Cities across the U.S. are embracing worker cooperatives. Cleveland, Rochester, Madison, Oakland, Austin and New York City, to name a few. Worker cooperative development is included in the Boston 2030 draft plan.

These businesses, which are owned and democratically controlled by workers, often provide economic opportunity for the formerly incarcerated, the long-term unemployed and immigrants. In certain industries like commercial cleaning or taxi service, worker-ownership can prevent exploitative or hostile work environments. The benefits of worker co-ops are on less solid ground when it comes to financial security and wealth building, however. A recent survey of 67 worker-owners from 10 worker cooperatives in New York City saw 53 percent agree or strongly agree with the statement, “I’m worried about my finances.”

“Just because a worker cooperative is created, it doesn’t always translate into wealth or assets or financial independence for worker-owners,” says Debra-Ellen Glickstein, executive director of the Office of Financial Empowerment (OFE) at NYC’s Department of Consumer Affairs.

OFE recently released a report, Leveraging Financial Empowerment to Support Employee-Owned Businesses, which distilled the lessons from a yearlong pilot that focused on ways to weave education about money into the process of setting up a worker co-op. It also included the results from that survey of NYC worker-owners. (Eighty-six percent were Latino, and 65 percent were women. Eighty percent had been in the U.S. for more than 10 years. Survey respondents were given the option to remain anonymous.)

While, as worker-owners, those surveyed are likely earning three to four times what they might be earning doing the same work for a conventional business competitor, 65 percent had less than $1,000 in savings, and 56 percent had no health insurance. Seventy-two percent did not know their credit score. So even with better pay and shared ownership of their business, they are just as susceptible to economic anxiety as everyone else.

The OFE pilot, conducted through Make the Road New York (MRNY), tested ways to change those numbers. MRNY is an NYC metro-area community organizing group and community service provider that works primarily with Latino and other working-class families of color. The group operates one of OFE’s more than 20 financial empowerment centers, scattered across all five boroughs of NYC, which focus on providing one-on-one personal financial counseling.

Throughout the year, 42 members from two worker cooperatives that MRNY has incubated (including Pa’Lante Cleaning Cooperative) participated in financial empowerment activities, and about half of those received one-on-one counseling.

Citi Community Development provided financial support to fund the pilot project, research and a forthcoming toolkit. Citi had pre-existing relationships with both MRNY and OFE, particularly as a major funder of OFE’s financial empowerment centers.

“As a national company, we saw that worker co-ops were popping up across the country as a strategy for wealth building,” says Eileen Auld, Citi Community Development’s director for the NYC tri-state area. “But we realized a lot of the worker-owners were still struggling with their personal financial situation.”

The worker cooperative development setting has some conducive elements to personal financial empowerment, as highlighted in the report.

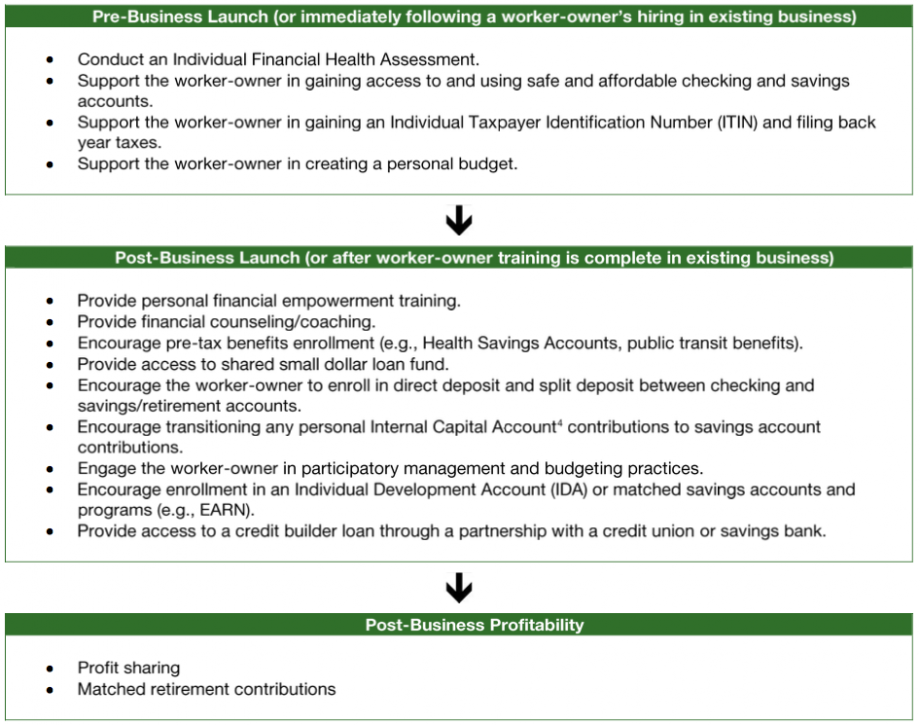

The setting up of a new co-op can be a natural time to discuss bank accounts and direct deposit for worker-owners. The survey found that 34 percent of worker-owners did not have a bank account. Sessions about participatory management of a cooperative business transition naturally into discussions about weekly or monthly household budgeting. When it’s time to discuss profit sharing, it’s a relatively easy segue into planning for long-term saving or expenses. Worker cooperative developers are also likely to discuss setting up benefits packages, including retirement plans.

Opportunities for financial empowerment education at each stage of developing a worker-cooperative (Credit: OFE)

The pilot included training of worker cooperative developers to do financial empowerment work. These workshops were based on OFE’s existing financial counselor training course, customized for the program by Joyce Moy of the City University of New York, MRNY, and David Hammer, president and CEO of The ICA Group, which supports worker-ownership and workforce development across the country.

“There is a real interest in this among most cooperative developers,” says Hammer. “It comes from a place where it’s about getting people to understand the intersection of their own personal finances and the business’s finances.”

In addition to the soon to be released toolkit, OFE is also considering how to train its existing network of financial empowerment centers to understand how to serve the needs of worker-owners.

“In this context, financial empowerment is about a transformative process to give people more agency over their finances, their job, their career and their business,” adds Hammer. “That sort of broad notion is pretty unusual and exciting.”

The Equity Factor is made possible with the support of the Surdna Foundation.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)