In a blow to beverage industry giants, four U.S. cities passed controversial “soda taxes” Tuesday. San Francisco and Oakland became the largest cities in the country to approve such measures. Along with Albany, California, the Bay Area cities approved a penny-per-ounce tax on distributors of sugary drinks. In Boulder, Colorado, voters said yes to a 2-cent-per-ounce excise tax on distributors.

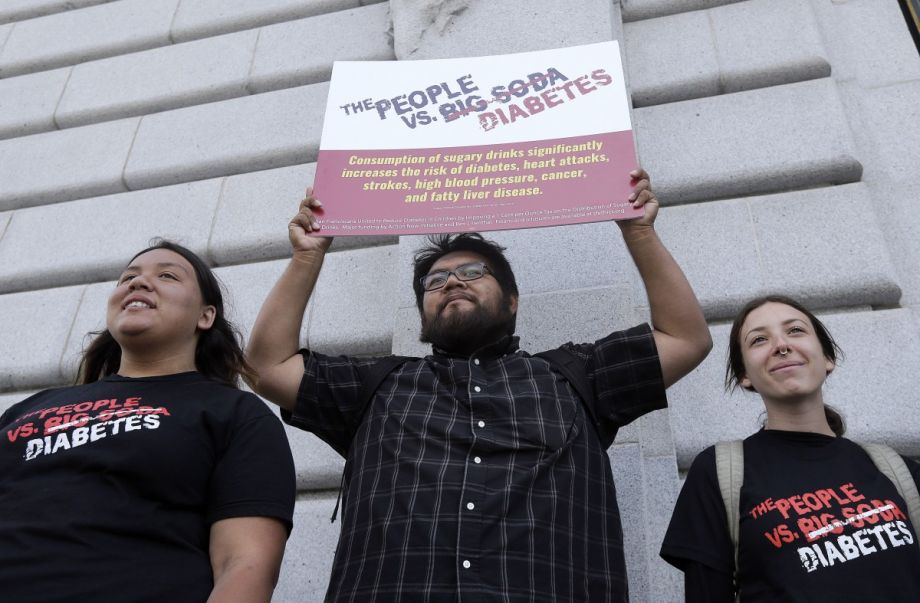

All four measures — aimed at fighting back against the rising tide of obesity and diabetes — passed in landslide victories. In San Francisco and Oakland soda tax measures passed with 62 percent support, in Albany, with 71 percent, and in Boulder, with 55 percent.

The four join Berkeley, the first U.S. city to pass a tax on sugary drinks in 2014, and Philadelphia, which approved a levy of 1.5 cents per ounce on sweetened beverages in June.

The taxes had a number of big-name supporters, including former New York City Mayor Michael Bloomberg who invested millions in campaigns in favor of the taxes. The taxes were mainly opposed by the soda industry, which has seen slumping sales in recent years.

This has been an expensive fight for those on both sides of the issue. In 2016, Bloomberg alone invested more than $9 million on lobbying for the taxes, while Coca-Cola and the American Beverage Association invested $4.7 million and $30.8 million respectively fighting the taxes, according to the Action Now Initiative.

Some opponents have dubbed the measure a “grocery tax” and say it disproportionately affects low-income Americans. While the taxes are levied on distributors, they could increase prices by 20 percent or more if fully passed along to consumers, according the Wall Street Journal.

Joe Arellano, a spokesman for the campaign against the measures, told the East Bay Times that opponents “remain concerned that any revenue raised will go to the general funds where the cities can spend it however they choose. Unfortunately, low-income and hardworking families are struggling in San Francisco.”

While the taxes received broad support from the public health community, it isn’t yet clear how much the taxes will impact health, mainly because not enough cities have passed similar taxes to gather data from. In Berkeley, at least, leaders say the tax has reduced soda consumption. A UC Berkeley poll found a 21 percent reduction in consumption of sugary beverages by low-income residents, and the tax is on track to collect about $1.5 million a year.

Lynn Silver, a senior adviser at the Public Health Institute in Oakland, called the Bay Area measures “a tremendous victory” for public health. “Having big cities like Oakland and San Francisco approve a soda tax will make it easier and more likely to be successful in other jurisdictions across the country,” she said.

That could prove true later this week in Chicago, where Cook County residents will vote Thursday on a penny-per-ounce tax on beverages with added sweeteners.

Kelsey E. Thomas is a writer and editor based in the most upper-left corner of the country. She writes about urban policy, equitable development and the outdoors (but also about nearly everything else) with a focus on solutions-oriented journalism. She is a former associate editor and current contributing editor at Next City.