President Obama’s 2015 budget proposal calls for hikes to the Earned Income Tax Credit (EITC). Under Obama’s plan, the EITC — a refundable tax credit for the working poor which, we believe, could help cities break out of wage stagnation — would be extended to childless workers, whom the current tax code overlooks.

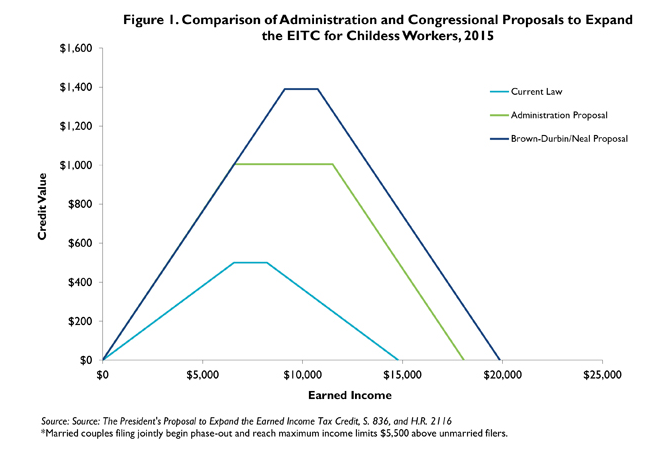

Today, the Brookings Institution released a report examining the potential impact of an expanded EITC, which would change the age parameters (it is currently available to working parents between the ages 25 of 65) and increase the maximum credit. As the graphic below shows, you can see how much the credit would spike from the president’s proposal as well as from similar legislation on the table in Washington: Rep. Richard Neal’s Earned Income Tax Credit Improvement and Simplification Act of 2013, and the Working Families Tax Relief Act of 2013 introduced by senators Sherrod Brown and Richard Durbin. The White House’s proposal would double the maximum credit to about $1,000 annually, while the Brown-Durbin/Neal legislation would cap it at $1,400.

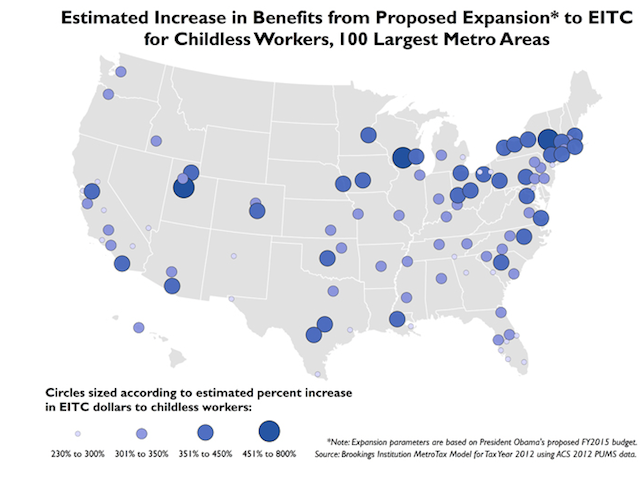

What sort of impact would this have across the country? Expanding the credit — remember, the entire tax credit is designed for the working poor — would not only help childless workers, but also buoy those who already receive it. At least 15 states would double the number of fliers eligible for the childless worker credit, according to Brookings. And, as the map below shows, metro areas across the country would have thousands of workers seeing an uptick in their income from the credit.

From the report:

Within the 100 largest metro areas, both expansions would boost benefits for nearly 4.7 million filers who are currently eligible for the credit. At the same time, the administration proposal would expand eligibility to an additional 3.9 million filers, while the Brown-Durbin/Neal proposals would increase the eligible population by 4.6 million.

The Equity Factor is made possible with the support of the Surdna Foundation.

Bill Bradley is a writer and reporter living in Brooklyn. His work has appeared in Deadspin, GQ, and Vanity Fair, among others.