NYC Could Lose 10K Airbnb Listings Via New Short-Term Rental Regulations

The New York Daily News reports that Mayor Eric Adams’ new short-term rental registration policies could affect thousands of active Airbnb listings once they take effect in January.

The policy will require Airbnb hosts to provide the office with full names of all short-term rental residents. They must also provide proof that the hosts reside there, and that the rental adheres to local zoning and safety regulations and building codes.

“Approximately 10,000 active listings offering illegal occupancy will either be shut down or come into compliance,” Christian Klossner, executive director of Mayor Adams’ Office of Special Enforcement, told the outlet. That’s about a quarter of the listings currently active in the city.

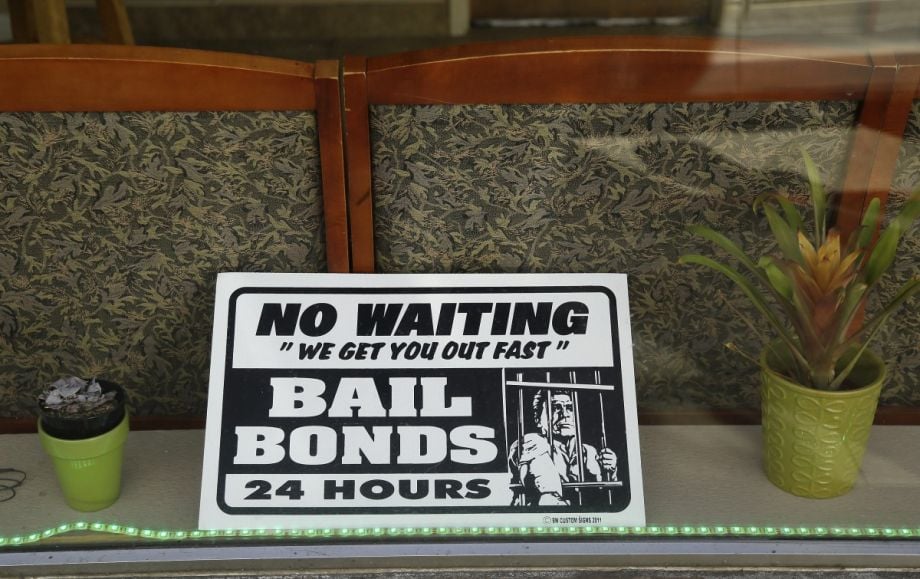

Cash Bail System Ends in Illinois Beginning January

On Jan. 1, Illinois will become the first U.S. state to completely eliminate the cash bail system. Instead, the state’s criminal justice system will require judges to “more carefully weigh who among the accused should be held in custody before trial without using money as a factor,” The Chicago Tribune reports.

But this week, a Kankakee County judge ruled that the pretrial reforms signed into law by Gov. J.B. Pritzker were unconstitutional. While Cook County officials say they intend to follow the new pretrial-detention process, the 60 counties involved in the litigation may hold off.

For more, read WBEZ’s look at how other states and municipalities have implemented different forms of bail reform, from Washington, D.C. to Alaska.

The Missed Opportunity Of CDFIs In The Bronx

Almost half of the Bronx households have limited or no banking access, The City writes. Now, a new report from The Center for an Urban Future think tank concludes that government support for the borough’s existing nonprofit Community Development Financial Institutions (CDFIs) could transform banking in the Bronx.

“When thousands of minority- and immigrant-owned businesses in New York were unable to access the federal Paycheck Protection Program via traditional banks or take advantage of the city’s emergency grant program for small businesses, CDFIs filled the void, providing a financial lifeline to many at-risk firms,” the report says. “The problem is that CDFIs serve only a tiny fraction of the businesses and aspiring entrepreneurs who could benefit from affordable loans and business advising services.”

This article is part of The Bottom Line, a series exploring scalable solutions for problems related to affordability, inclusive economic growth and access to capital. Click here to subscribe to our Bottom Line newsletter.

Aysha Khan is the managing editor at Next City.

Follow Aysha .(JavaScript must be enabled to view this email address)