For decades, the south and west sides of Chicago have belonged to a group of low-income, urban areas that major retailers have regarded as a black hole. Dating back to the mid-1990s, economists like Harvard’s Michael Porter noted many of the nation’s largest grocers, department stores, and pharmacies avoided these communities, viewing them as unprofitable and unsustainable markets.

On the other hand, there’s south side restaurant Majani, owned by Chefs Tsadakeeyah and Nasya Emmanuel. The vegan eatery is a hit among locals and serves as an example for what can be possible in an area that has historically suffered from insufficient retail food options.

“Majani’s has a constant flow of traffic” says Erica King, vice president of lending at CNI Micro Finance Group, which provided seed capital to Majani. “People are standing outside waiting to come in to order because there are no seats. They are just that busy.”

According to King, Majani is up to almost half a million in revenue in their first year. “Their margins are really good for a restaurant. They are doing well,” she adds.

A new study backs up the notion that prevailing assumptions about areas like the south and west sides of Chicago may be incorrect. The Commercial Vibrancy of Chicago Neighborhoods 2016, from the JPMorgan Chase Institute, found that residents on the south and west sides of Chicago travel significantly further on average than residents in other parts of the city to purchase goods and services.

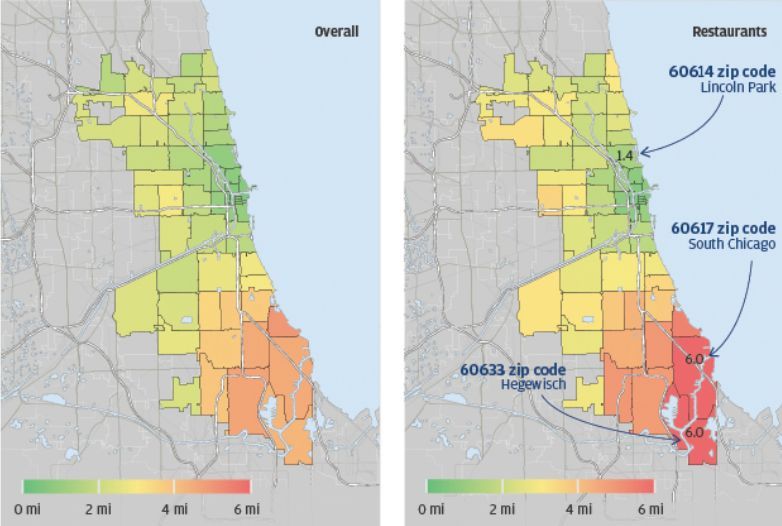

Using anonymized credit and debit card transaction data, the study found that a south side resident on average traveled over four miles away from their home to make a purchase, while residents of the north side of Chicago on average traveled less than two miles.

Average distance traveled by Chicago residents to make any purchase (left) or to make a purchase at a restaurant (right). (Credit: JPMorgan Chase)

Accion Chicago CEO Brad McConnell says the pattern suggests there is large untapped demand in these neighborhoods.

“People mistakenly think there isn’t enough income in these neighborhoods to support retail, but there is. However, because of underdevelopment, that income travels” says McConnell. “They go somewhere else because the demand is not being met by an adequate supply of high-quality stuff in their own neighborhood.”

Accion Chicago works with entrepreneurs in the city’s distressed communities to help fill those gaps, providing micro-loans (small business loans up to $5,000), larger business loans up to $100,000, and technical assistance to help new or expanding businesses. In McConnell’s experience, shoppers on the south and west sides of the city respond best to the differentiated and personalized retail environment that has become popular in recent years.

“Shoppers want an experience,” McConnell says. “They want something that feels higher end.”

Calvin L. Holmes, president of Chicago Community Loan Fund, which also helped finance Majani, said that he has witnessed similar results with the development of the south side’s Englewood Square retail center. The 5-acre shopping center in the south side Englewood community is anchored by a 20,000 square foot, full-service Whole Foods grocery store, and also features a Chipotle and Starbucks.

“It’s really exciting,” Holmes says. “You have got one of the lowest income communities, with the highest crime rates and every negative social indicator you can imagine, and low and behold, it turns out that it is a profitable area.”

Holmes says the Whole Foods is outperforming other locations in the region and that the other storefronts on the lot have been selling at record prices.

The success of these retail ventures on the south side and the data from the new JP Morgan report join a growing body of research and anecdotes that suggest major retailers are regularly overlooking the viability of urban, minority neighborhoods.

A 2012 study by researchers at the University of Illinois found retailers missed opportunities in the economically robust Chicago suburb of Olympia Fields. Another2013 study published in the Journal of Urban Health found retailers like bookstores, pharmacies, and shoe stores failed to capitalize on opportunities in moderate-income, minority neighborhoods in central Brooklyn. And a comprehensive study by the Initiative for a Competitive Inner City found that nationwide retailers have failed to service low-income urban areas, leaving a $40 billion retail gap across the country.

“One of the challenges, for the national brands in particular, and some entrepreneurs, is that there’s just a lot of misinformation about the strength of business corridors in low-income communities,” says Holmes. “Even if the education level is lower than what they typically stipulate, even if the per capita income in a community is lower than what they typically require, there are other variables that offset that, like density.”

UPDATE: We’ve clarified language this article to reflect Accion Chicago’s full breadth of loan products offered.

Aaron Ross Coleman is a Next City Equitable Cities Fellow for 2018-2019. A freelance writer from Atlanta, Aaron’s writing focuses on the intersection of economics and racial inequality. Based in New York, he is a Marjorie Deane Fellow at New York University’s Graduate School of Journalism. Aaron has his B.A. in Political Science from Fort Valley State University. His work has appeared in CNBC, Rewire News, The Huffington Post, and other publications.