The amount of affordable housing available for extremely low-income people in the Philly metro area and much of Pennsylvania shrank between 2005 and 2010, leading to a shortage of more than a quarter-million units, according to a report released today by the Federal Reserve Bank of Philadelphia.

Taking a look at what’s officially called the Third Federal Reserve District — an area comprising eastern Pennsylvania, southern New Jersey and Delaware — the FRB examined 1.4 million rental units and found that more people are spending more of their money on rent. This ratio of rent to income was highest for extremely low-income (ELI) households, defined as making 30 percent or less of the area’s median family income. (In Pennsylvania, the median household income is about $50,000, according to Census numbers. In Philadelphia, it’s $36,000.)

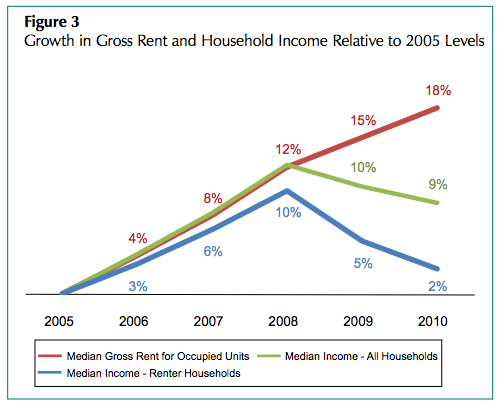

Part of the reason, according to the report, was a rise in rents and slowdown in earnings. As the chart above shows, rents have continued to increase since 2005 even as the growth rate for household incomes, especially among renters, took a steep turn downward following the 2008 financial crisis.

This all means that housing in the region got more expensive while yearly incomes haven’t kept up. Whereas in 2005 there were 40 affordable units for every 100 ELI households, in 2010 there were only 34 for every 100. The report concludes that theoretically, the appearance 266,000 new affordable rental units could address the shortfall. (Any developers out there wanna take that project on? Anyone?)

It bears mentioning that nationwide, the rental market during this period grew by more than 4 million households while the rate of homeownership mostly stayed the same. In the Third District, meanwhile, the number of ELI renter households grew at nearly three times the rate of overall renter households.

The report also found that about three-quarters of ELI renters spent more than half of their income on rent and utilities. Experts consider this a “severe housing cost burden” — a term that could apply to nearly 30 percent of renters in the region