In June 2018, a fence went up around Arrowhead Mobile Home Park in Flagstaff, Arizona. By that time, any remaining mobile homes were empty. Some of them were still adorned with the faces of their past residents, murals painted by local artists as a final protest. The residents themselves had lost their years-long fight to remain in their homes.

Many of the families at Arrowhead had immigrated to the United States from Mexico decades before. They had carved out lives in Flagstaff, working jobs in the service industry — at hotels and restaurants and stores — that were critical to the town’s tourism-driven economy. As Jorge Garza, a master’s student at Northern Arizona University at that time, observed, these residents had formed a tight-knit community at Arrowhead. It was common to leave doors unlocked and for residents to rely on each other for repairs and child care. Kids played together and went to school together. For many, it was the only home they’d ever known.

Eviction shattered these families’ lives. As Garza wrote, “Residents continually spoke of losing sleep, fits of anger, family discord, illness, anxiety, and feelings of weakness throughout the experience of displacement.”

More than four years later, many are dispersed across Flagstaff while others have left the area entirely. Some who’d come to the United States seeking greater stability and freedom have returned to Mexico. The land that once held this community remains a vacant lot.

The former Arrowhead residents, like a growing number of people across the country, don’t need to be told that housing is being auctioned off at a global scale. They don’t need to be told that local residents looking for housing options are being pitted against people from metropolitan areas with far higher income pools. They are already forced to spend more of their income to simply pay for a roof overhead. They know that this means less to spend on savings, education, starting a business, spending in the community, or any other pursuits because they are experiencing all this firsthand. All these residents want to know how we got into this mess. And how we get out.

But many people have come to very different conclusions about the current situation. They may see the rise in short-term rentals, second homes, and general growth as part of a larger pattern. They don’t dispute the rampant construction of luxury-priced housing or the notion that housing has become dominated by people who see it as nothing more than a way to turn a profit. They may even acknowledge that this focus on maximizing return on investment instead of producing stable homes is undermining our communities. But rather than asking how we can change any of this, they ask why they should care. Or more pointedly, if they have the money, why shouldn’t they go out and buy a second home in one of these places right now?

In tourism towns, it’s often said half-jokingly that people “either have a second home or a second job.” It seems we’re all in that town now.

Beyond Boom and Bust

We are taught to think in binaries. The market is booming or busting. The world is made up of haves and have-nots. We are profiting or losing. But COVID further revealed the cracks in this simplistic thinking, and nowhere was this clearer than the housing market.

The housing boom that began in 2020 would seem to benefit a lot of people. City and state governments, buoyed by a huge flow of federal assistance and an influx of high-income, high-spending residents, would be obvious beneficiaries. Except that a December 2020 report from the Brookings Institute noted city and state governments across the country had continued cutting large numbers of jobs. Those buying a home, who gained the security of homeownership and could someday make a windfall from reselling their new house, would also seem to gain. Except that July 2021 calculations from the Center for Housing and Policy at the Federal Reserve Bank of Atlanta show the typical median-income homebuyer was paying a thirteen-year high of 32.1% of income on housing. In other words, new homebuyers have been increasingly likely to meet HUD’s definition of housing cost-burdened.

Of course, real estate companies would have appreciated the boom, until the number of people buying houses dropped in 2022. And those selling their homes benefited immensely, just as long as they could find somewhere else to live. For the vast majority looking to remain in a place, however, faced with rising rents or home prices or property taxes, losing the identity they’d long-attached to their home, there is no question of what to call it. This is a bust.

They face a dwindling and increasingly desperate set of choices. In order to cover the ballooning property tax, a retired couple on a fixed income forgo badly needed medical check-ups and prescriptions. Unable to afford housing elsewhere, a young mother stays in an abusive relationship. Seeking a way out of expensive and unstable rentals in a dangerous neighborhood, a couple with two kids puts half their monthly income toward a mortgage. With the walls closing in, a resident who’s called the town home for years or decades or generations — who plays in a local band, who volunteers at the food bank, who is planning to start a family — moves to a new city.

The pattern repeats across the country. The housing system becomes increasingly oriented around profit, with those who benefit — or believe that they will benefit — critiquing those who suffer. Those who benefit from the boom become more skilled at obscuring their role in the concurrent bust. Government officials claim their hands are tied by the state or by the market or by voters. Besides, aren’t they doing enough on housing already? Investors, developers, and landlords are just following the market. Wouldn’t they be fools to not extract every possible dollar out of a house? Homeowners who will someday reap the benefit of staggering price increases worked hard to afford their investment. Why shouldn’t they get what’s rightfully theirs?

The beneficiaries of housing booms cling to these justifications as their communities flail. As government officials defend their market-oriented fixes to the growing unaffordability of housing, evictions rise. As real estate agents revel in the windfall of growing market demand, the unsheltered population grows. As homeowners vote down funding for affordable housing projects — or any multiunit housing projects — the city sprawls further outward.

Eventually, the lead server at the neighborhood café leaves town. Then a beloved teacher. Then the best local handyman. As powerful voices across the city shout their allegiance to the market, many of those who once felt insulated from the unaffordability of housing have seen store prices go up. They’ve felt their neighborhoods growing fragile, hollow, static. As they listen to the stories of a friend or daughter or employee struggling to make ends meet, they start to question whether the rising tide of economic growth actually lifts all boats and fortunes. They start to wonder if this logic is actually just causing more people to drown.

This article is part of Backyard, a newsletter exploring scalable solutions to make housing fairer, more affordable and more environmentally sustainable. Subscribe to our weekly Backyard newsletter.

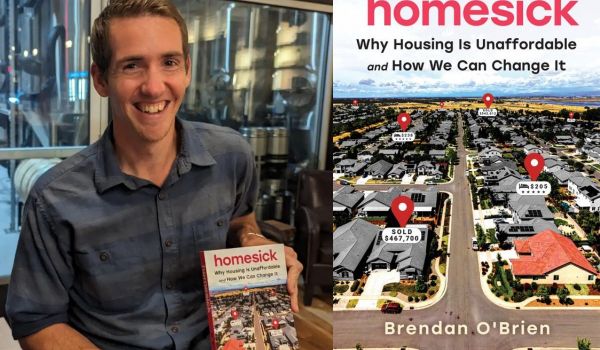

Brendan O’Brien is a guide and writer in Flagstaff, Arizona. He has a master’s in geography in Northern Arizona University. Homesick: Why Housing is Unaffordable and How We Change It is his first published book.