Urban neighborhoods were hot spots for redevelopment before the economy collapsed, and some have continued to gentrify post-recession, according to a new report.

“During the housing boom, a number of large cities in the United States experienced redevelopment in their lower-income neighborhoods as higher-income residents moved in,” the authors of “Neighborhood Gentrification during the Boom and After” write in the intro. They were curious if gentrification trends continued after 2007, when lending standards tightened.

The short answer, by the report’s measurement, is yes — in some cities. Portland, Seattle, Denver, Minneapolis and Washington, D.C. continue to see incomes rise in their urban core. Atlanta, where city-center wealth spiked before the recession, has not continued to gentrify. And post-boom Cincinnati is witnessing a surprising surge in city-center income.

Daniel Hartley and Daniel Kolliner, of the Federal Reserve Bank of Cleveland, looked at 59 cities total, all with populations over 250,000. They compared cities with surrounding metro areas, using data from the 2000 Census, the 2005-2009 American Community Survey and the 2008-2012 American Community Survey, to reveal the wealth of city-center districts relative to their suburbs.

Each city’s mean was ranked as a percentile within its metro area. Here’s the report’s example:

For example, the average tract in the city of Virginia Beach was at the 66th percentile of all of the tracts in the Virginia Beach-Norfolk-Newport News metropolitan statistical area, while the average tract in the city of Newark was at the 18th percentile in the Newark, NJ-PA metropolitan division. This means that the average tract in Virginia Beach is higher income than the average suburban tract, while the opposite is true in Newark.

From 2000-2007, Atlanta rose a startling 8.7 percentile points, far and away the largest leap (it started out ranking around the 30th percentile for its metro area). For the same market-inflated time period, D.C. rose five points; Denver, Seattle and St. Louis rose about four; and Portland, Tampa, Buffalo, Minneapolis and Chicago rose about three. All of those cities started out at less than 50 percentile points; none was wealthier than its surroundings.

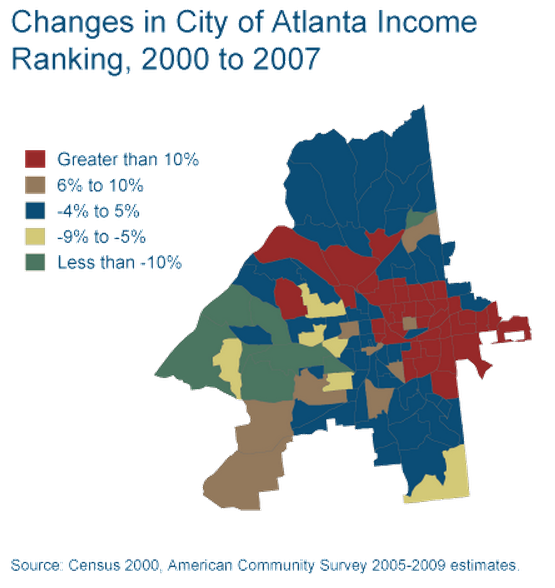

Atlanta saw the greatest income increases through its east-west corridors, as the image to the right illustrates.

Income levels fell in its southeast neighborhoods.In breaking down wealth around the housing bust, Hartley and Kolliner faced uneven numbers. Census tract-level data was only available from 2007 to 2010 — three years instead of the seven from 2000-2007. But the researchers did still notice incomes rising in the cities mentioned above. Portland, Minneapolis, Seattle, Denver and D.C. rose between two and three percentile points. Chicago rose less than one percentile point and Atlanta, a force of gentrification before 2007, actually decreased slightly from its pre-bust high.

The report points out that changes in income ranking over time were actually driven largely by poor neighborhoods that gained wealth, not wealthy neighborhoods that became even wealthier — a trend the report calls “consistent with gentrification.”

But while the notion of gentrification is often associated with higher-income people moving into poorer neighborhoods, the study doesn’t specify whether Hartley and Kolliner actually saw relocation. It’s possible that residents in lower-income neighborhoods simply moved up economically.

“The data we used for this article doesn’t allow us to differentiate,” Hartley writes in an email. “As you might be aware, there are many possible measures of gentrification. In my research I have looked at neighborhoods (usually Census tracts) that are in the main city within their metropolitan area, starting out low income, low housing price, low rent, or low college degree attainment and changing to be markedly higher on one of those measures.”

The researchers acknowledge that gentrification trends could vary based on industry.

“Since metropolitan areas specialize in different things, the effects of the crisis and bust played out in different ways across regions,” they write.

It would also be interesting to see how public transportation, schools, bike lanes, parks and the thousand other pieces that make up a city contributed to these neighborhoods’ upward mobility — or, conversely, how they were affected by it. And, as always with issues of gentrification, you have to wonder who, if anyone, was displaced and where they went.

But those questions, as Hartley writes, “are beyond the scope of this study.”

Rachel Dovey is an award-winning freelance writer and former USC Annenberg fellow living at the northern tip of California’s Bay Area. She writes about infrastructure, water and climate change and has been published by Bust, Wired, Paste, SF Weekly, the East Bay Express and the North Bay Bohemian

Follow Rachel .(JavaScript must be enabled to view this email address)