Despite all the talk and headlines about the tens of thousands of jobs promised by big tech companies such as Amazon coming to a new city, residents of low-income, high-poverty neighborhoods know that it’s the small businesses that provide most of the jobs in their cities, and especially in their neighborhoods.

In Detroit, businesses with 250 or fewer employees accounted for 53 percent of all jobs within city limits and 64 percent of jobs in low-income, high-poverty neighborhoods, according to the Institute for a Competitive Inner City. In Chicago, businesses of that size accounted for 58 percent of all jobs and 70 percent of jobs in Chicago’s low-income, high-poverty neighborhoods. In D.C., 62 and 74 percent; in Los Angeles, 74 and 77 percent.

So it is with great interest every year that the Federal Reserve system puts out its Small Business Credit Survey, as it did yesterday.

Expectations for growth among small businesses are at their highest levels since 2015, according to the survey results, compiled over the last six months of 2017. Some 66 percent of firms anticipate revenue growth in 2018, while 44 percent expect to hire new employees. Meanwhile, 40 percent of firms said they applied for financing in 2017, a drop from 45 percent in 2016. Of those who applied for financing, 59 percent applied for the purpose of expanding their business, while the rest applied to smooth out cash flows or refinance previous debt.

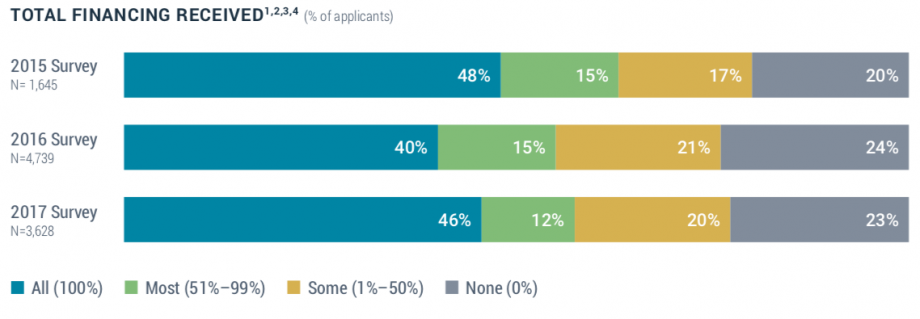

Small businesses most frequently sought financing at large banks (48 percent), small banks (47 percent) and online lenders (24 percent). A notable share (18 percent) turned to other lenders, including auto/equipment dealers, farm lending institutions, friends/family, nonprofits, private investors, and government entities. There was an uptick in successful applications receiving the full amount requested, 46 percent in 2017, compared with 40 percent in 2016.

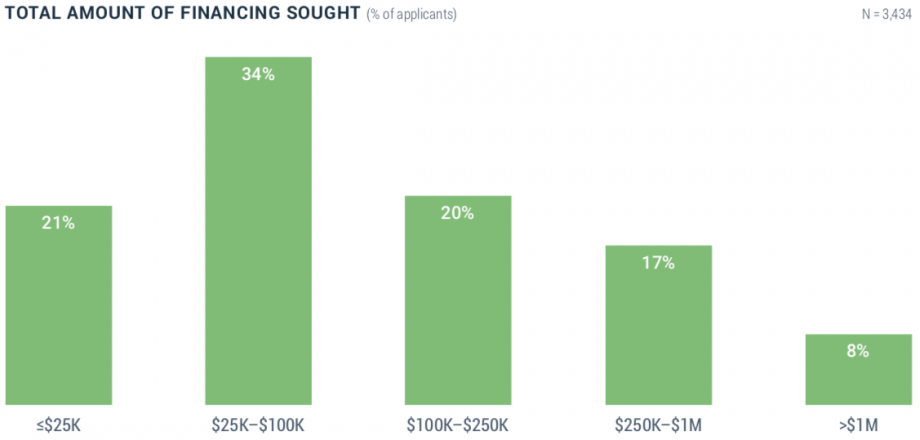

A majority of businesses sought financing amounts between $25,000 and $250,000.

But only 46 percent of businesses that sought financing got all of the capital they needed — a figure on par with previous years.

Taking a slightly broader scope of small businesses than the Institute for a Competitive Inner City, the Federal Reserve study defines small businesses as those having up to 500 employees. The survey garnered 8,169 responses, grouping them into seven categories: professional services and real estate; non-manufacturing goods production and associated services; retail; healthcare and education; leisure and hospitality; and other.

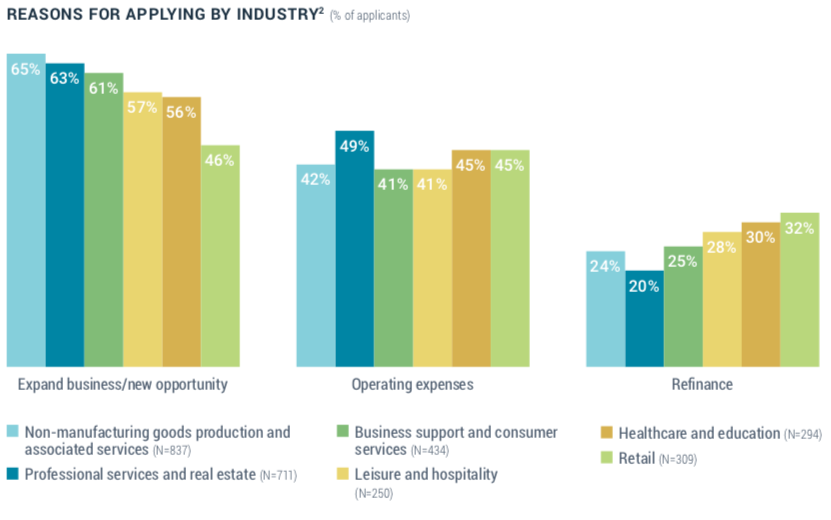

While there was some variance across the different industry categories, expansion or new business opportunities was the top reason for businesses applying for finance across each group.

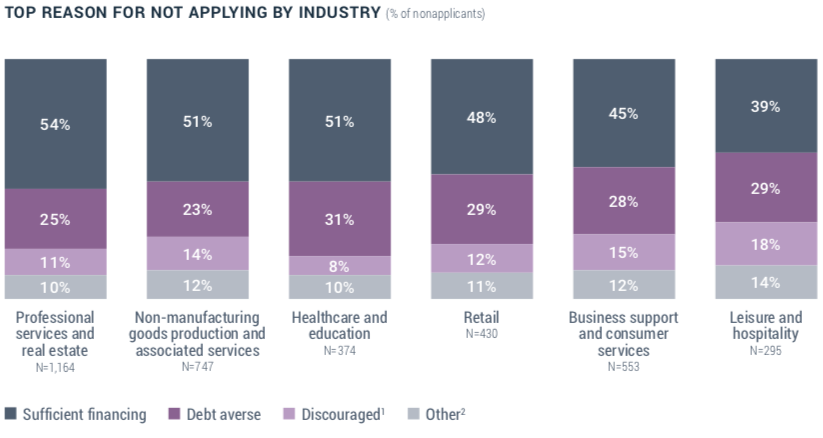

A large proportion of firms across all industry groups reported having enough cash on hand or an aversion to taking on debt as the reason for not seeking credit.

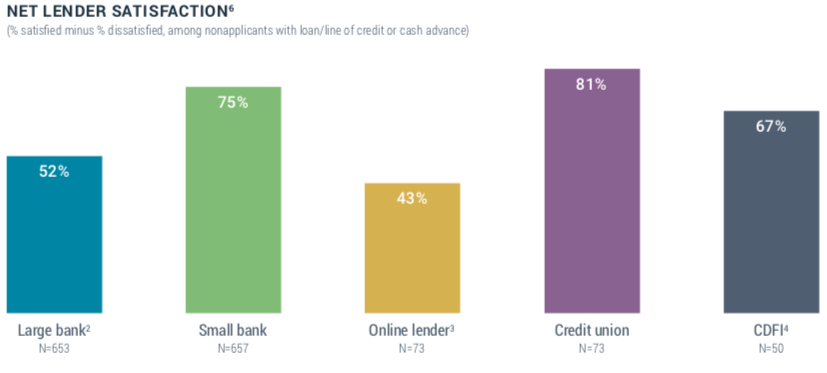

Small businesses reported the highest satisfaction with credit unions and small banks, followed by community development financial institutions (although some small banks and credit unions are also certified as community development financial institutions, they do not count as such in this study).

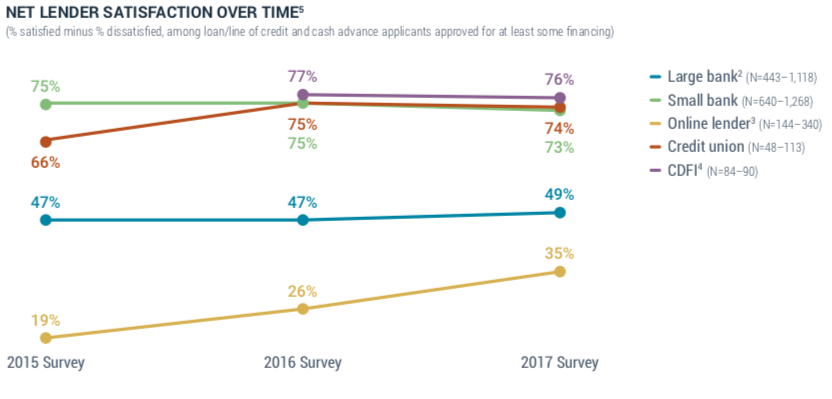

Over time, online lenders have been at the bottom of client satisfaction, but have also shown the most improvement since 2015.

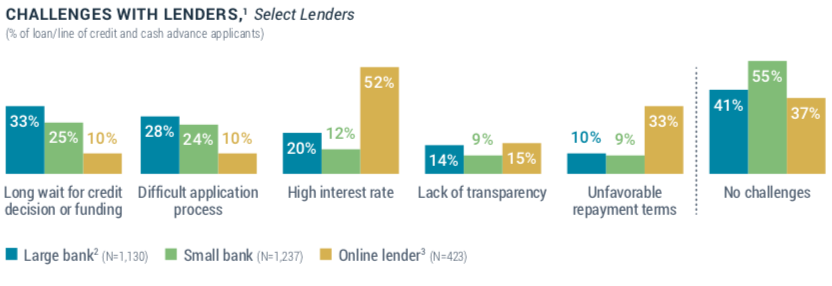

The reasons for dissatisfaction varied, but for among online lenders, the big reason for dissatisfaction was high interest rates.

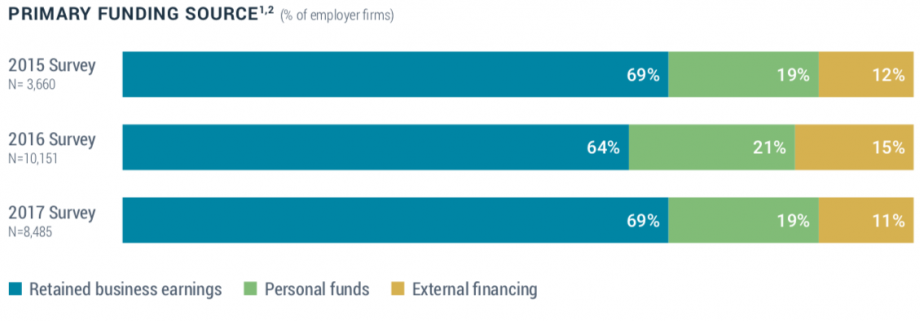

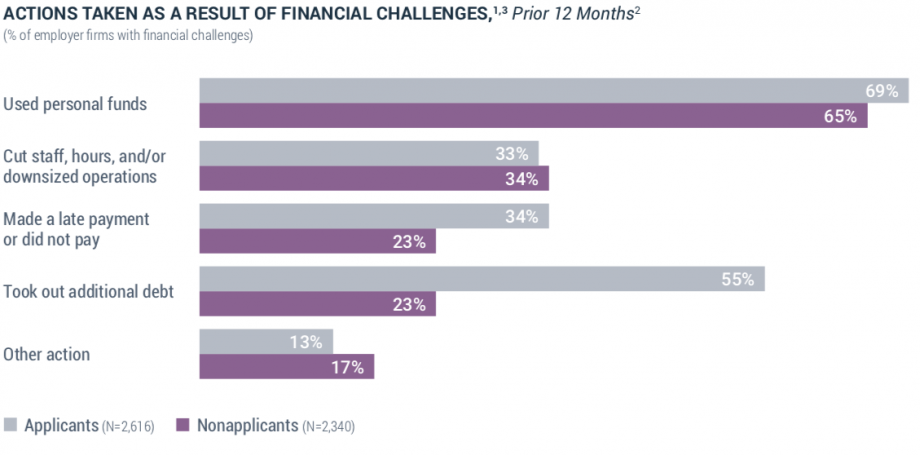

But in the grand scheme of things, the main source of funding for small business growth or expansion has been and continues to be the businesses themselves. And in instances where small businesses have needed external capital, personal finances remains a major source of funding — putting entrepreneurs of color at a constant, inherent disadvantage to white entrepreneurs owing to the racial wealth gap created by the long history of race-based discrimination in lending and housing policies in the United States.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)

_600_350_80_s_c1.jpeg)