Commercial rents went up 12 percent in Milwaukee last year — part of a nationwide trend, compelling cities and small business advocates to call for measures to protect commercial tenants. For nonprofits, losing a space can be a big headache, but it can also be devastating. The more an organization struggles to find an affordable headquarters, or pay increases in office rent, the fewer resources there are for the mission — whether that’s job training and placement or affordable housing or childcare services.

IFF, a Chicago-based loan fund and community development financial institution (CDFI), specializes in helping Midwest nonprofits with that struggle. Just before Thanksgiving, it closed a $14.6 million note sale to investors, bringing total note sales for the year to $46.4 million. Since they started note sales in 2004, they’ve raised $241.8 million this way.

That means $241.8 million in long-term financing for nonprofits to acquire and build out their own properties, providing them crucial stability in a time of growing instability. It’s meant a world of difference. Just ask the Wisconsin Regional Training Partnership.

By 2006, WRTP had been changing offices for years, renting one place after another in Milwaukee.

“We bounced around a few different locations around the city, instead of one site where everybody knows where you are and you can build it out to do what you wanted to do,” says Matthew Waltz, director of administration.

Eventually they found a home, in a former chemical company building that was headquarters for a tractor company before that. The 90-year-old building needed a ton of work, including new HVAC and new electrical almost everywhere. But WRTP finally had the opportunity to build out the space they needed, with classrooms, hands-on training areas, offices, filing rooms and more. IFF provided long-term financing for the project.

WRTP now serves about 3,000 people a year with career and skills development programs, as the Milwaukee region’s largest workforce development organization. In 2015, it helped place 621 workers into new jobs, taking them from an average wage of $9.22 an hour to $18.59 an hour upon completion of training programs. Eighty percent of those placements went to minorities.

“Even now, 10 years later, I don’t know what we would have done without this space,” says Waltz.

Financing for such a buildout can be tough for a nonprofit, especially one in workforce development, where public sector grants can come from local, state and federal sources, which are chronically subject to payment delays due to politics or sometimes just paperwork. A patchwork of private sector funding, from corporate and industry partners or philanthropy, often keeps things going, but it doesn’t look good on a loan application. Part of WRTP’s collateral for the IFF financing included pledged donations. “I don’t think any other lender would have done that,” says Waltz.

IFF’s note sales are its primary source of long-term capital.

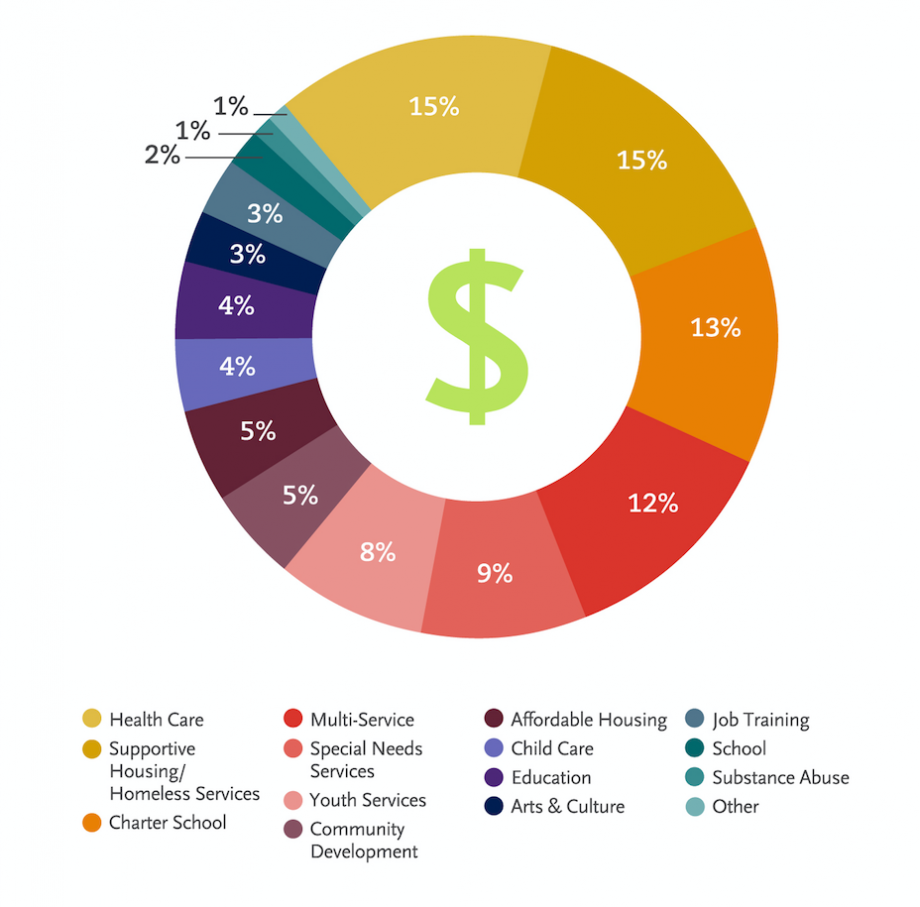

IFF cumulative note sales loans by sector (Credit: IFF)

Initially, banks were hesitant to lend to nonprofits, particularly those working in historically marginalized neighborhoods, where property values are artificially depressed from the days of redlining.

“Lending on appraised value [in these neighborhoods] is a quick way to no,” says IFF CEO Joe Neri.

So IFF’s founder, Trinita Logue, created a nonprofit loan fund that would specialize in long-term lending to the nonprofit sector, serving borrowers who had a wide variety of revenue sources. The CDFI has made $640 million in loans so far, and the loan delinquency rate has historically stayed under 2 percent; most years it’s less than 1 percent.

As IFF established its track record, meeting demand for loans became a challenge.

“As we grew, we knew we needed to match our exposure to the lending we were creating,” says Neri.

When you make a 15-year loan, you could wait 15 years to have it paid back with interest. Now make a bunch of those loans. Instead of waiting, in 2004, IFF started its note sales to investors. In exchange for part of the interest on the long-term loans, IFF gets capital from investors to continue making loans.

Twenty-eight investors are now part of IFF’s investor consortium, which participates in the note sales on a regular basis. Four new banks joined in the most recent sale. There have been no investor losses to date for IFF’s note sales.

Banks are the biggest investors, motivated by obligations under the Community Reinvestment Act. In some ways these are loans that banks might make themselves, Neri says, but they simply don’t have the expertise and relationships necessary to underwrite loans to these nonprofits. IFF helps solve a problem for them: They need credit for lending in low- and moderate-income communities, and not just home loans but also loans to support broader community development. Buying IFF notes can be like a one-stop shop for banks to support community development lending in multiple states at a time.

IFF note sales have supported loans to borrowers in eight states for far, in a wide variety of sectors.

The Equity Factor is made possible with the support of the Surdna Foundation.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)