There are upwards of $60 billion in impact investments under management as of 2015. They span the globe, financing everything from solar power to sanitation to smallholder farming and more.

Meanwhile, just in the U.S., banks made nearly $75 billion in community development loans in 2014. Some of that went to organizations that in turn provide capital to neighborhoods and populations that banks continue to leave behind, like in Baltimore where banks lent twice as many mortgages to whites than blacks in 2014, despite the city’s black population being twice as large as its white population.

What might attract more jet-setting impact investors to putting their money into places in their own backyards? That’s the question at the heart of a recent report, “Scaling U.S. Community Investing: The Investor-Product Interface,” from the Global Impact Investor Network (GIIN) and the University of New Hampshire’s Carsey School of Public Policy. (Ford Foundation and MacArthur Foundation funded the report, and both are also Next City supporters.)

“Through discussions with members over the years, we received a lot of feedback that there’s a need to conduct research on U.S. community investing sector, in particular the challenges of how to scale community investments,” says Abhilash Mudaliar, research manager at the GIIN.

The report bases its definition for community investing on that from U.S. SIF, a trade organization of social investors: a focus on marginalized areas or communities that conventional market activity does not reach; a focus on enabling the delivery of explicit social benefits (affordable housing, economic development, provision of needed goods and services at affordable rates, healthier outcomes) to those areas or communities; and a financial product available for investment that can be managed in terms of risk and return.

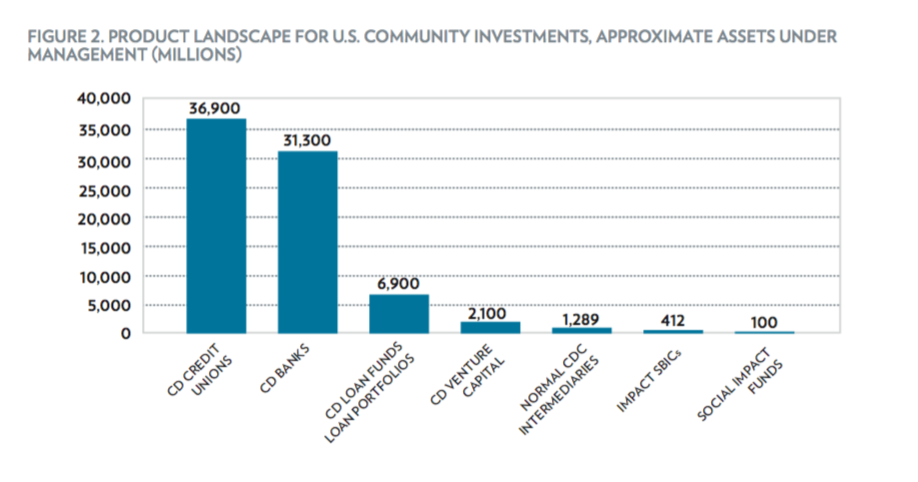

The meat of the report maps out a landscape of community investment opportunities (largely CDFIs) and community investors, current and potential. The authors also identify seven key themes around the gaps and opportunities to scale up community investment as part of the impact investing field.

(Credit: GIIN)

“Despite the fact that there are a wide range of actors in play, there are several factors that constrain scale in the industry,” Mudaliar says.

The biggest factor? Liquidity.

“We talked to a whole bunch of investment advisers and managers, and they find community investment so hard to do. It’s all one-off deals, every one is different, they can’t be bought and sold. They do them because their investors want there to be some,” says Michael Swack, who co-authored the report with Eric Hangen. Swack is faculty director at the Center on Social Innovation and Finance at the Carsey School of Public Policy. Hangen is with I Squared Community Development Consulting.

Specifically, Swack and Hangen conducted 34 in-depth interviews for the report, half with investment managers and advisers (such as banks, foundations, pension funds, investment advisers to high-net-worth individuals, family offices, and other professionals facilitating investment in community development funds) and half with product managers (private equity funds, community development banks and credit unions, and CDFI loan funds). They also conducted a less intense survey of 33 investors.

In the environmental space, Swack says, impact investors can find a healthy menu of investments in standardized forms, notes, bonds and shares. They look and feel like a more typical investment. Most importantly, they’re liquid.

Historically, liquidity hasn’t been an issue for attracting capital into the community development space. The current community investment field began to take hold in the 1980s, after the 1977 passing of the Community Reinvestment Act, a landmark legislation that drove huge volumes of bank lending to community development organizations (without having to subsidize it with tax incentives). But times have changed.

“Thirty years ago, it made sense to say ‘we’re different,‘” Swack says. “Being able to talk more of the Wall Street talk doesn’t mean we aren’t fulfilling our mission, it means we’re maturing in terms of our ability to access more capital to do that.”

For community investment managers who can get past the history of being “different,” the next challenge then becomes marketing. As Mudaliar says, “The field needs coordinated and comprehensive marketing and communication efforts to educate players about what community investing is, and what its benefits are.”

The disconnect between the social/impact investing world and the community investing world can be quite frustrating.

“At a recent impact investing conference I attended, hardly anyone there had heard of CDFIs. We’ve got a marketing issue here,” Swack says.

To further illustrate, Swack mentions TIAA-CREF’s social investment options for retirement plans. When he filled out his plan investment form at University of New Hampshire, he picked the one social investment option he saw. He later got a chance to look at the prospectus.

“If you read it, you wouldn’t know it was a social investment fund,” Swack says.

The top five holdings in TIAA-CREF’s Social Choice Account, a $13.7 billion family of funds that claims to give “special consideration to certain social criteria”? Google, Johnson & Johnson, Berkshire Hathaway, Procter & Gamble and Disney.

“A tiny bit of it is in CDFIs,” Swack says.

Given the utter lack of marketing and awareness for community investment, he adds, “What that $13.7 billion tells us is, among other things, there is actually a huge appetite for community investments. If people knew about it and could do it easily, they will do it.”

The Equity Factor is made possible with the support of the Surdna Foundation.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)