As 2013 speeds to an end, we’re thinking back on the year’s most defining urban trends. Below, our columnists weigh in on what the year has meant for transportation, urban economies, water infrastructure and the rising, tech-empowered culture of collaboration.

The Works

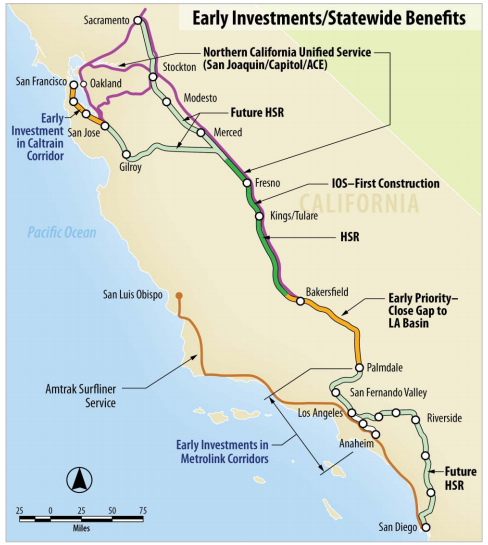

Proposed routes in from the California high-speed rail business plan Credit: Wikimedia Commons

Infrastructure in the U.S. is a long game with few huge news stories and sudden shifts, but one that keeps coming back in one way or another is the privatization of mass transit. The trend is very incipient — the vast majority of public transportation is, in fact, public, with no interest in what nowadays is always a money-losing proposition.

But there are some green shoots. All Aboard Florida, the Florida East Coast’s passenger rail project operating on freight tracks between Miami and Orlando, is heading toward a 2016 opening. The company has acquired nearly all the land it will need, buying sites for stations in Miami, Ft. Lauderdale and West Palm Beach, and a right-of-way to the Orlando International Airport. All Aboard Florida has staffed up, and appears ready to ask for a loan of $632 million from the feds, a relative pittance in aid for something like a multibillion-dollar intercity rail project.

Meanwhile JR Central, the private Japanese railroad that owns the country’s flagship bullet train between Tokyo and Osaka, is quietly moving ahead with plans for a high-speed rail line in Texas, between the Dallas-Fort Worth Metroplex and Houston. The railroad will decide on the most important aspect, route alignment, early next year, and wants to see the line up and running with 200-mph service in seven years.

(As a sidenote, JR Central is building a maglev, or magnetic levitating, relief line between Tokyo and Osaka, which will reach 314 miles per hour. The line is unique in that it will be almost completely unsubsidized, and if completed will become the world’s most impressive railway.)

While private capital can build great transit projects, it has no mercy for the weak. The California High-Speed Rail Authority’s project continues to flounder. With two unfavorable court rulings last month, both state and federal money has been put in jeopardy. The authority spurned one early offer of private investment from French national rail operator SNCF, and has pursued circuitous and challenging route alignments that could make attracting a private investor and operator difficult. Private capital will likely require a realignment that avoids areas outside the big moneymakers of San Diego, Los Angeles, San Francisco and Sacramento, which should prove politically challenging given how much sway cities like Palmdale, Fresno and San Jose hold in the process.

While private capital is shunning the California High-Speed Rail Authority because of poor decisions on an otherwise viable route, some executions by market forces are more thoroughly deserved. Consider the two ill-conceived plots to connect, by rail, Las Vegas with Los Angeles (actually Palmdale, Victorville and Fullerton — a big reason why the projects weren’t viable). RIP, XpressWest and X Train.

- Stephen J. Smith

Watermark

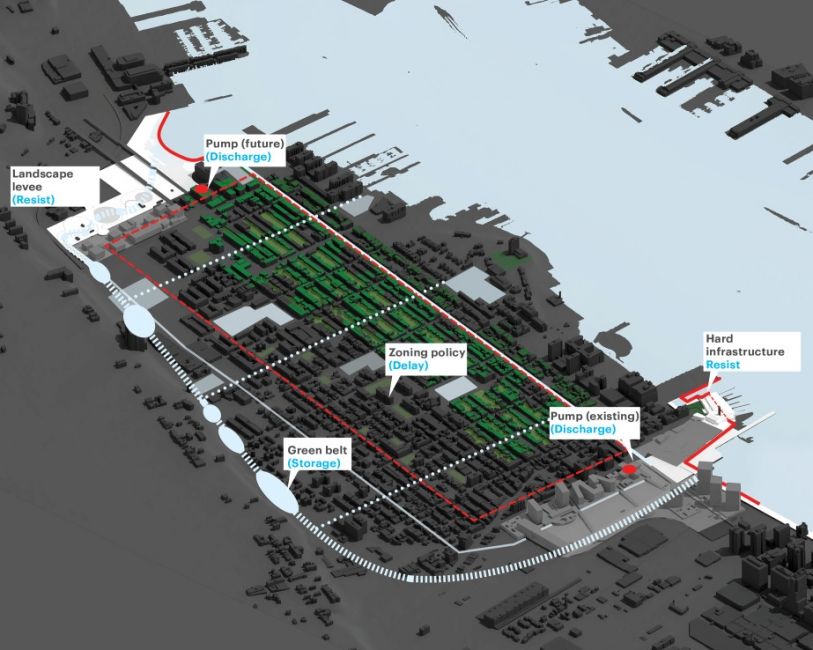

One of OMA’s design proposals submitted to the RebuildbyDesign competition

Much of the western United States continued to grapple with a historic drought in 2013. But in many other parts of the country, particularly east of the Mississippi, this was a year in which urban leaders rolled up their sleeves to tackle a very different problem: Too much water. The Dutch approach to the challenge, known as “living with water,” has been steadily gaining acceptance as a model.

Here’s the Dutch philosophy, in a nutshell: While big, expensive hard infrastructure projects such as pumping systems, seawalls and levees can provide one important line of defense against storm water and rising sea levels, they can’t do it all. Sometimes, you have to let the water take its course. To cope, you should build and manage the landscape accordingly — restoring wetlands, designing parks and parking lots to hold floodwaters safely, and creating “green infrastructure” like bioswales, rain gardens and pervious pavement that filter water and absorb it slowly rather than allowing it to sheet off, as do asphalt and concrete. This also reduces the costs of water treatment, as runoff doesn’t enter the treatment system, and cuts down on pollution entering natural bodies of water.

The green infrastructure model is catching on in places around the U.S. In Seattle, Philadelphia, New Orleans, Indianapolis, New York and dozens of other cities, innovative models are being piloted and incorporated into routine practice. The hope is that as such measures become more pervasive, they will provide a cumulative positive effect on the environment, economy and long-term viability of cities facing increased flooding risk due to climate change and other factors.

The “living with water” ethos is a prime influence in post-Hurricane Sandy rebuilding efforts in the New York-New Jersey area, especially in the Rebuild by Design competition. It also figures prominently in the Greater New Orleans Water Plan, unveiled this fall.

In 2012, Renée Jones-Bos, former ambassador from the Netherlands to the U.S., gave a speech to the American Planning Association about why “living with water” is so important for nations around the globe. “The new paradigm means …that we can’t always fight the water. Instead, we need to accommodate water, and give it room,” she said. “Climate change, oddly enough, is reminding us of both the beauty and resiliency of nature, and the benefits of sustainable design.” - Sarah Goodyear

Equity Factor

Watson Street in Detroit. Credit: Bill Bradley

This July, if you haven’t heard by now, Detroit declared bankruptcy. Sure, Stockton, Calif. and Central Falls, R.I. had filed for Chapter 9 before. But this was Detroit. The Arsenal Of Democracy! The American Dream! It’s the biggest municipal bankruptcy in American history.

Is this the future of American cities? people asked. Is this where capitalism begins its fall? Pundits and armchair columnists quickly fashioned themselves into municipal finance experts as they descended on Detroit.

As the bankruptcy hearings played out — Judge Steven Rhodes declared the city eligible for Chapter 9 earlier this month — one of Detroit’s largest debts, its pension obligations, turned into the crux of the story.

It turns out Detroit isn’t the only city staring down massive pension liabilities, and when the Motor City filed for bankruptcy the dull, complicated world of ballooning pension debt suddenly had its poster child.

Chicago, for instance, can’t kick the can down the road any longer. If Mayor Rahm Emanuel doesn’t sort out the city’s pensions before November 2015, it will have to increase its annual contributions to $1.4 billion. As I wrote this September, “Chicago’s adjusted net pension liability exceeds 600 percent the size of its operating revenue. No other city in the country comes close.”

Just this month the state of Illinois, with its pension fund burdened by a $100 billion shortfall, passed a deal to reform its pension system. The unions are readying a lawsuit to fight back. Reform is on its way, or municipalities will have to pay the price.

Now, not every city faces pension debt that will leave it teetering on the edge of bankruptcy. Detroit is a special case. But from California to Chicago, from New York to Detroit, pension debt is the biggest municipal liability of the future. As we turn to the New Year and Detroit enters bankruptcy court, you can bet many cities will pay close attention to how the story plays out. - Bill Bradley

Shared City

At Code for America’s 2013 Summit. Credit: Code for America’s Facebook

If you’re looking for the moment the idea blossomed that modern, networked technologies like the Internet could remake the relationship between citizen and community, it’s probably best to go all the way back to Howard Dean’s 2004 campaign for president. But 2013 is, arguably, when that notion went both mainstream and local at the same time. The non-profit Code for America, to pick an example, has been around for handful of years, exploring the idea that committed technologists could, given a yearlong fellowship, upgrade the way cities work. But it was this year that Code’s founder was brought to the White House as a deputy chief technology officer, with the goal of seeing if the lessons about civic innovation learned in Los Angeles, Louisville, London and beyond deserve to spread all over.

Twenty-thirteen was, too, a year of growing awareness that the open, collaborative city was more than just a movement. It could mean business. BlightStatus, started as a Code for America project in New Orleans, became the city-serving start-up CivicInsight. These new stakes mean big questions for policymakers. In Dallas, an apologetic mayor announced that city officials erred when, in seeming cahoots with the taxi industry, they cracked down on Uber, the app-powered car service. While ride sharing services like BlaBlaCar have taken off in Europe, U.S. cities have wrestled with concerns about safety and competition. California regulators this year largely gave companies like Lyft and Sidecar their blessing. In New York, the attorney general has asked Airbnb for records of every person in the state who rented out a room through its site. (Airbnb has refused.) As the year wraps, the case is being closely watched for what will say about where the rise of Internet-enabled-yet-offline action meets the law.

There’s a picture coming together. The multiplication of kitchen incubators and food trucks has something to do with things like open government data and apps like OpenCounter, built to streamline getting a business license. It’s inchoate, but there’s a growing consensus around two things: There’s a there there, and the dominant term of art, “the sharing economy,” isn’t capturing it. Roles and possibilities are different now. It’s newly easy to engage directly with your peers, one of whom is City Hall. Indeed, this year a group called Peers sprung up to capture that momentum — it now claims a quarter-million members. What works and what doesn’t is an unsettled question. This year saw 3rd Ward, Brooklyn’s for-artists-by-artists shared workspace, close down after seven years, while the giant developer Forest City reinvigorated a project to create a new kind of mixed-use and shared creative community in one of the most troubled corners of San Francisco.

Twenty-thirteen was the year these ideas took root; 2014 will be about watching what happens next.

- Nancy Scola

Cassie Owens is a regular contributor to Next City. Her writing has also appeared at CNN.com, Philadelphia City Paper and other publications.

Follow Cassie .(JavaScript must be enabled to view this email address)