Any government introducing tough new laws expects criticism. Still, jaws must have dropped among Britain’s ruling coalition last week, when recent changes to housing taxes were criticized by none other than the United Nations. Visiting Britain, U.N. special investigator Raquel Rolnik lambasted Prime Minister David Cameron’s so-called “bedroom tax,” a new levy on unoccupied space for welfare recipients.

Recommending that the law be scrapped, Rolnik told the Guardian that she “was very shocked to hear how people really feel abused in their human rights by this decision and why — being so vulnerable — they should pay for the cost of the economic downturn, which was brought about by the financial crisis. People in testimonies were crying, saying ‘I have nowhere to go,’ ‘I will commit suicide’.”

Rolnik’s response to the tax, introduced this past April, has clearly shocked the government. Britain isn’t alone in generally expecting the U.N. to deplore conditions in Syria rather than inside its own borders. The strong condemnation, building on an already embittered backlash within Britain, is even more unexpected given that, on a superficial reading, the law makes some sense. (Perhaps that explains why the pro-government press has already started assassinating Rolnik’s character?)

The essence of the bedroom tax is as follows: To keep homelessness down, 5 million Britons have their rent paid or subsidized through a welfare payment called housing benefit, which passes straight from state to landlord. While the majority of these people are unemployed, at least 18 percent (and probably more) have jobs but make wages too low to afford market prices.

Since April, though, any recipients with an extra bedroom — this includes separate bedrooms for young children — have had 14 percent of their housing benefit deducted. They lose 25 percent if they have two extra bedrooms. The idea is to encourage people to move into smaller dwellings, thus saving government cash and making potential abuse of the system harder.

But while in the abstract the law sounds reasonable, it ignores the realities of the British housing market. People aren’t being gently encouraged to downsize. They’re being pushed into homelessness, not least because the law is applied punitively and arbitrarily.

British unemployment benefit is at breadline level already, and many people have no hope of either finding the missing funds or somewhere smaller to live. Disabled people who have a specially adapted second room necessary for managing their conditions face eviction because they can’t afford make up the new rent gap. Many have lost their homes and some have reportedly been driven to suicide.

What’s more, many people simply have nowhere else to go. The supply of smaller flats and houses isn’t out there to be taken. Rather than moving, tenants are just building up unpayable debts that will ultimately lead to their eviction. If accommodation exists, it is often at rents that exceed new caps on what the state will pay in housing benefit. It’s perhaps no surprise then that since the bedroom tax was introduced, a quarter of Britain’s new homeless got that way because they couldn’t find anywhere affordable to live after their last rental contract ended.

Defenders of the law point to the fact that in some rare cases, the authorities pay huge amounts to house families in expensive areas. The British press has been peppered with cases of “benefit scroungers.” The reality is, however, that sometimes-high costs for housing benefit (which tenants themselves never touch) result not from luxury digs for the lazy but from Britain’s overheated property market. Overall, current problems don’t stem from abuse but from social housing changes made under the Thatcher Government in the 1980s.

Favoring the idea of a nation of owner-occupiers, late prime minister Margaret Thatcher accelerated an existing right-to-buy scheme for social housing tenants, allowing them to buy their homes at level far below market prices. Between 1979 and 1987, 1 million U.K. social housing properties were sold, an irresistible offer for many tenants who, under generous loan conditions, were able to buy and sell on homes at an excellent profit within a very short time.

Social housing stock was decimated, and local authorities could no longer guarantee they would keep hold of their properties. They lost the incentive to build more housing and as their old stock moved on to the private market, almost nothing replaced it. This created a situation where areas of high-quality social housing in high-demand areas like London became the preserve of the well-off.

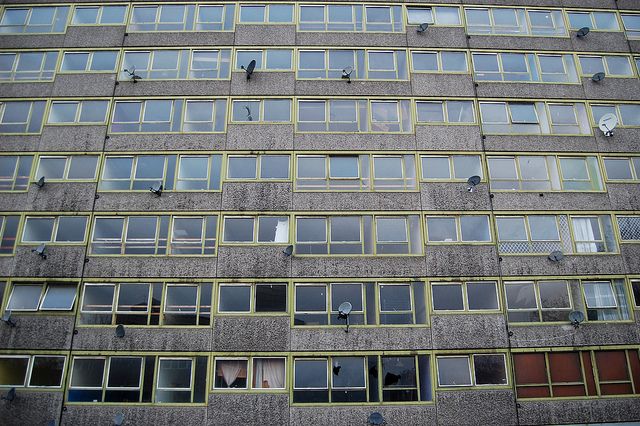

Independent, non-profit housing associations provided some counterbalance, but Britain still lost a huge chunk of its social housing. Mainly the poorest, least attractive stock remained in public hands, and living in such properties gained stigma it hadn’t suffered from before.

To plug this gap, successive governments from both of Britain’s major parties relied on housing benefit, paying cash directly to landlords to house people who would have previously lived in public housing. This kept many off the streets and in decent conditions. It also meant that, instead of plowing money into building more projects, governments just diverted funds directly to landlords. By providing owners with a captive, growing market, it further fueled a property speculation boom that pushed up rents and house prices, increasing the number of people who needed to claim housing benefit in the first place.

This messy, complicated situation needs more thought than the bedroom tax can offer. In fact, some suggest that it will actually cost more than it saves. While Britain is fixated on stories both of benefit abuse and of genuine need and desperation, something more is perhaps being missed. Beyond making cruelty institutional, the bedroom tax offers no ideas whatsoever about how to solve Britain’s affordable housing crisis.

Feargus O’Sullivan is a London-based writer on cities. He contributes regularly to Next City, CityLab and The Guardian.