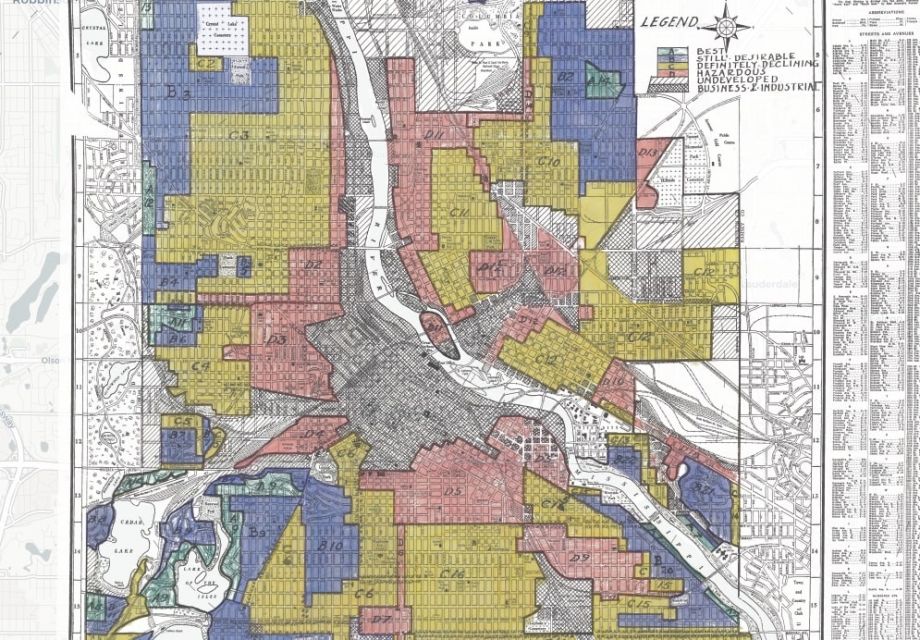

New Minneapolis Mayor Jacob Frey acknowledges that much of the city’s housing market is still influenced by intentionally segregationist, racist policies of the past. Market forces and zoning policies continue to bolster those patterns today.

His new office recently proposed a $50 million housing plan to provide housing choices that seeks to undo some of those patterns and create a more racially and economically integrated city.

“I’m fully aware of the political pushback that will inevitably come to bear, but I’m willing to stake my career on this …” says Frey. “I believe we should have affordable housing in every neighborhood of this city, including the wealthy ones.”

Frey put housing at the center of his winning campaign agenda last year. The plan, which was developed by a task force that began working almost as soon as Frey took office, would put those funds toward production and preservation of affordable rental units, down-payment assistance for homeowners and various supports for low-income renters.

“We have an affordable housing crisis in Minneapolis,” says Frey. “Values are going up. Rents are skyrocketing out of control. People are being displaced from the neighborhoods they’ve made wonderful to begin with.”

A 2016 report from the Minnesota Housing Partnership showed that the housing market in Minneapolis was increasingly putting renters at risk of displacement — the risk was especially high in racially diverse neighborhoods. According to the Minneapolis Health Department, there is a high correlation between the concentration of poverty, cost-burdened households and residents of color in the city’s neighborhoods.

The affordable housing task force held a community forum in February, along with a series of roundtables with business leaders and other stakeholders to discuss affordable homeownership, housing stability, and the production and preservation of affordable rental housing. Strategies in the group’s recommendations include increasing funding to support affordable housing production, incentivizing preservation of “naturally-occurring affordable housing” units (those that are currently affordable without any rent-restriction applied to them and usually without any public subsidy), strengthening protection of tenants through just-cause eviction legislation and additional legal representation, providing down-payment assistance for low-income homeowners, and producing an annual report outlining who benefits from the city’s housing investments.

The report also suggests establishing mandatory inclusionary zoning for projects that take advantage of tax increment financing and other city subsidies, an opportunity that the report notes may be fading quickly as the current construction boom reaches its later phases.

Some efforts to address housing affordability are already underway. In April, the city council approved a pilot program called “4d” that reduces property taxes on certain apartment buildings where at least 20 percent of the units are kept affordable for renters earning up to 60 percent of Area Median Income. Frey has come out in support of zoning changes to allow “fourplexes,” or conversions of single-family homes to allow up to four units. The Greater Minnesota Housing Fund has launched a “NOAH Impact Fund” to help preserve naturally occurring affordable housing that’s at risk of becoming more expensive.

The task force recommendations would bolster those efforts with a proposed quadrupling of the city’s current $11 million to $12 million annually invested in affordable housing.

“This feels like a historic moment,” says Anne Mavity, executive director of the Minnesota Housing Partnership and a co-chair of the mayor’s task force. “Local elected officials and [business] leaders and faith leaders are focusing on affordable housing in a way that I haven’t seen in decades in my career. I think it provides an opportunity to act in ways that will significantly impact and improve our ability to address this affordable housing challenge, and we need to take advantage of this moment.”

Mavity says that her group’s research shows that addressing affordable housing challenges in the Twin Cities region would require an investment of at least $1.1 billion in public funds. Of that, she says, 30 percent is needed for housing preservation and production, and 70 percent is needed for direct subsidies to low-income renters.

“Traditionally, this had been the role that [the federal government] has played, but they have, of late, failed at that role,” Mavity says. “We have spent a lot of time insisting that they do this. Three out of every 4 households that are eligible for these Housing Choice Vouchers do not get them.”

The additional dedicated funding will have to be negotiated with the city council after Frey presents a budget proposal later this year.

“We will be allocating a record amount of funding to affordable housing,” Frey says. “… If we end up with $40 million worth of affordable housing funds, that’s still nearly three times the previous record.”

The task force report acknowledges that housing affordability is a problem for the entire Twin Cities region, and that local funding alone can’t fix it. According to a 2017 report from the Minnesota Housing Partnership, some 42 percent of renters in Minneapolis are cost-burdened. For renters earning less than $20,000 a year, the rate rises to 84 percent. And while development is booming, according to a report last summer in the Star-Tribune, the vacancy rate was just 2.4 percent, with rents rising across the metro area.

“Minneapolis is obviously not unique in these circumstances,” Frey says. “But we want to be on the very forefront of progress.”

Jared Brey is Next City's housing correspondent, based in Philadelphia. He is a former staff writer at Philadelphia magazine and PlanPhilly, and his work has appeared in Columbia Journalism Review, Landscape Architecture Magazine, U.S. News & World Report, Philadelphia Weekly, and other publications.

Follow Jared .(JavaScript must be enabled to view this email address)