New Orleans is poised to break new ground in Louisiana legislative history. Mayor LaToya Cantrell and the city’s state representatives pushed hard for a pair of bills, Senate Bills 79 and 80, that would provide tax relief to low-income homeowners and, in a twist, also to landlords of multi-family dwellings with up to 15 units. The goal is to lower housing costs for both homeowners and renters in a city where housing costs spiked in the wake of Hurricane Katrina.

One issue that has complicated the situation for New Orleans, however, is that the city doesn’t have the legal power to authorize tax abatements. Such a change has to be passed by a state constitutional amendment. On June 2, the Louisiana state legislature approved putting the measure on the October ballot. If passed, this would be the first time the constitution would be amended to provide local tax relief.

Recent research found that families that earn 75 percent less than the median-area income have housing costs only 25 percent lower than the median. At the same time, New Orleans has seen income inequality surge by 44 percent.

“We found that income inequality grew faster in New Orleans than in any other large metro over the past decade,” Igor Popov, the chief economist at real-estate site Apartment List, said in an interview with The Louisiana Weekly.

Advocates believe that SB 79 and 80 would help ameliorate some of that inequality.

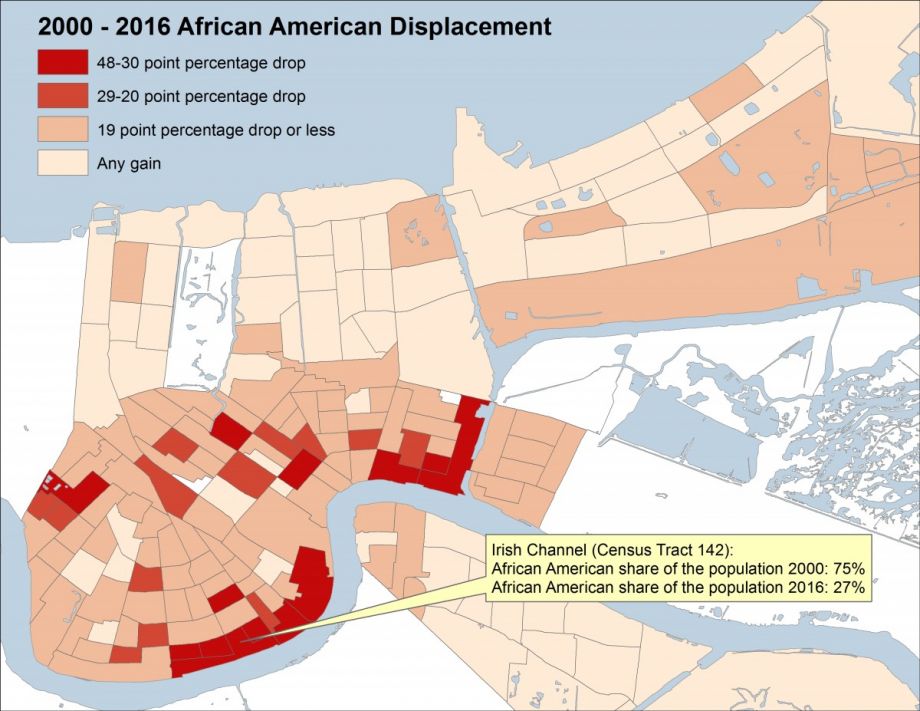

“The bills would really complement our work around stopping displacement,” says Cashauna Hill, Executive Director of the Greater New Orleans Fair Housing Action Center. A February report from New Orleans’ Data Center shows that blacks as a percentage of the population dropped from 67 percent in 2000 to 59 percent in 2017. New Orleans’ median household income also dropped as has the number of households with children under 18. For Hill, the proposed tax abatement powers would enable the city “to provide tax relief and to cap property taxes on long-term homeowners in gentrifying neighborhoods. This is a fair-housing issue in New Orleans in particular because the neighborhoods that are rapidly gentrifying have been black communities.”

Yet the bills are unique because they include a solution for renters as well as homeowners. HIll says that rents have increased by more than 40 percent since Hurricane Katrina while incomes have stagnated. “Half of New Orleanians are cost burdened,” Hill says. “Almost 40 percent of the renters are paying more than half of their monthly income towards housing costs. We know that that is not sustainable.”

By providing an incentive to landlords of smaller, multi-family properties, the city aims to add to the number of affordable rental units available. “This could prevent families from being pushed out of their homes and their neighborhoods,” says Hill.

A map showing how the racial makeup of New Orleans has changed over the last half-decade (Map by Greater New Orleans Fair Housing Action Center)

AirBnB has been part of the city’s landscape of increasing rents. A 2016 study estimated that there were between 2500 and 4000 illegal short-term rentals operating in the city. Nearly half of these were controlled by a small group of people. Landlords were able to get rates as high as $500 per night, a dramatic jump from ordinary rents. To counteract the tight market for renters, New Orleans City Council passed a measure in 2018 mandating that the online giant share data about its hosts, banning rentals in the French Quarter, and limiting the number of days a homeowner can rent a full house or apartment.

Megan Braden-Perry is one person who stands to benefit, if voters approve the constitutional amendment later this year. Braden-Perry inherited her home when she was a teenager and her parents passed away. Now 34, Braden-Perry has a five-year-old son and works as a freelance writer and part-time teacher. Before giving birth, she worked as a staff reporter for NOLA.com, the Times-Picayune’s web publication. But she says that when she returned from maternity leave, her job didn’t exist anymore.

“There ain’t no jobs in journalism anymore, and the minimum wage isn’t going up,” Braden-Perry says. “Waitresses, that’s the backbone of the city, people who make $2.35 an hour plus tips.”

Braden-Perry had owned her home outright, but she says she allowed her now-ex-husband to convince her to take out a mortgage to make improvements. She says has negotiated a lower monthly payment with her bank, but it’s still a struggle every month. “As of right now, technically, black and white, no, I can’t afford it.”

Braden-Perry recently won a fellowship to support her while she writes a novel, but it doesn’t stop the anxiety. “I’m always kind of afraid,” she says, describing her worries about covering her mortgage and tax bills.

Monika Gerhart handles relations with the state for the City of New Orleans. She sees the amendment as a tool that will allow New Orleans to “layer” policies on top of each other to try to address the city’s housing needs.

The amendment, Gerhart says, will allow the city both to prevent displacement and encourage new, affordable construction. “New construction of affordable housing has traditionally relied on federal HUD funds and housing tax credits and other funding sources, including private financing, and as those wells have dried up a little bit, this is a way for us to innovate our way to some solutions.”

Gerhart says that New Orleans has pushed hard to be able to administer its own four-percent, low-income housing tax credits, which it hopes to launch in the next year. At the same time, it has passed a new inclusionary zoning policy.

“So, the idea for new construction is that you are potentially getting a little bit of benefit in inclusionary zoning policy,” Gerhart says. “You’re taking advantage of local four-percent low-income housing tax credits. And then, if you have a potential tax abatement, and then combined with potential federal funds for let’s say soft development costs. That’s a ball game, right? You’re layering four solutions onto a single property in order to really maximize what we can do at the policy level.”

The amendments would allow the city to provide tax relief to landlords of existing buildings as well as to new constructions, Gerhart says. “When housing advocates talk about affordable housing, they mean housing that has a subsidy attached,” she says. “We’re talking about working with landlords to incentivize keeping rents low.” The city didn’t offer details, however, on how it would enforce the deal.

New Orleans, Gerhart says, is entering into a Cooperative Endeavor Agreement (CEA) with the State of Louisiana to be able to administer its four-percent tax credits. The IRS offers both nine- and four-percent tax credits, and Gerhart says. “While the nine percents are very competitive, typically the state of Louisiana gets nowhere near its volume cap for four percents. In other words, it has all of these tax credits that it’s not using because the four percent tax credits on their own aren’t worth a ton.” Yet leveraging those credits locally, she says, will enable the city to pilot a model that Gerhart believes to be unique in the nation.

For Hill, the tax abatement represents a tool the city can wield against inequality.

“It’s clear, based on census data, that the city of New Orleans has become more segregated post-Katrina than it was before and that’s due to a variety of different factors,” Hill says. “But we can certainly understand that without some policies put in place that are designed to address that increased segregation, and frankly designed to fix it, neighborhoods in New Orleans will continue to become more wealthy and more exclusive and segregated patterns will continue to grow.”

Zoe Sullivan is a multimedia journalist and visual artist with experience on the U.S. Gulf Coast, Argentina, Brazil, and Kenya. Her radio work has appeared on outlets such as BBC, Marketplace, Radio France International, Free Speech Radio News and DW. Her writing has appeared on outlets such as The Guardian, Al Jazeera America and The Crisis.

Follow Zoe .(JavaScript must be enabled to view this email address)