Property tax rates vary widely from city to city. But why? For the past five years, the Lincoln Institute of Land Policy and Minnesota Center for Fiscal Excellence have co-produced a report ranking effective property tax rates for residential, commercial and industrial properties in over 100 U.S. cities in all 50 states. This year’s report looks to the underlying causes of those differences for the first time, identifying four key factors that help explain the variance.

(From “50-State Property Tax Comparison Study For Taxes Paid in 2015,” by Lincoln Institute of Land Policy and Minnesota Center for Fiscal Excellence)

The two most crucial are a city’s property values and the extent to which cities rely on the property tax as opposed to other revenue sources. Municipalities with high sales or income taxes don’t need to raise as much in property taxes and tend to have lower rates. A city with lower property values would need a higher tax rate to raise as much revenue as a city with higher property values.

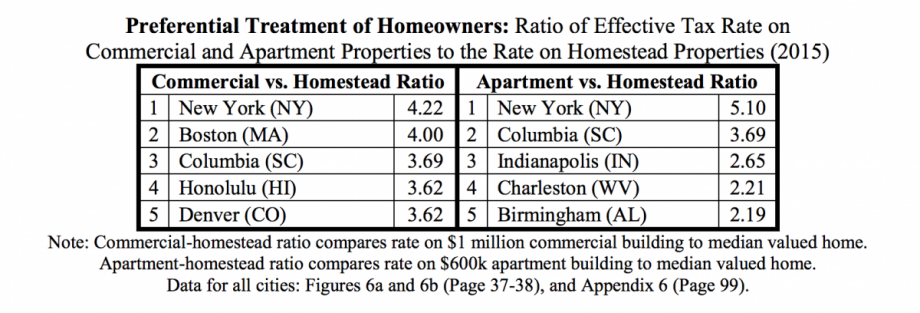

The rates of local government spending and the degree to which a city’s tax system favors certain forms of property ownership over others impact property tax rates to a lesser extent. In general, all else equal, cities with greater public expenditures will need higher property tax rates. When tax codes favor homeownership by offering lower tax rates than on commercial or non-owner-occupied properties — a process known as “classification” — homeowners may pay less but business and apartment owners will pay more.

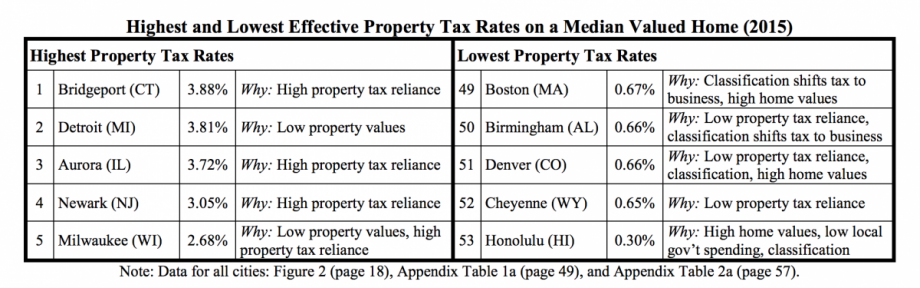

Understanding these four factors is crucial to explaining why a high property tax rate alone doesn’t necessarily translate to high taxes. The report compares Bridgeport, Connecticut, and Birmingham, Alabama. Among the large cities in the report, Bridgeport has the highest property tax reliance and the highest effective tax rate on a median valued home — that is, the highest tax bill as a percent of a property’s market value.

(From “50-State Property Tax Comparison Study For Taxes Paid in 2015,” by Lincoln Institute of Land Policy and Minnesota Center for Fiscal Excellence)

Birmingham on the other hand has the fifth-lowest effective tax rate but also the fourth-lowest reliance on the property tax. So while Bridgeport residents pay high property taxes, they pay comparatively little in other local taxes; it’s the other way around in Birmingham. As a result, total local taxes in Birmingham are much higher than in Bridgeport, despite lower property taxes — approximately $2,429 in Birmingham compared to $1,914 in Bridgeport, per capita.

The difference in property tax rates among cities with higher and lower property values is also stark. Take San Francisco and Detroit, for example, the cities with the highest and lowest median home values in the study: $848,8000 in S.F. compared to $41,900 in Detroit. The average property tax bill on a median valued home in the large cities studied is $3,093. To raise that amount from a median valued home in Detroit would require an effective tax rate more than 20 times higher than it would be in San Francisco: a rate of 7.25 percent versus a rate of .36 percent. In reality though, Detroit’s effective tax rate is less than four times higher than S.F.’s — 3.14 percent compared to 8.3 percent — meaning that San Francisco collects more than five times more in property taxes from a median valued home: $6,991 vs. $1,317.According to the report, this is typical: Higher property values tend to result in lower tax rates and more revenue for public services. Level of local government spending is another, though less impactful, factor determining effective property tax rates. A number of factors drive rates of local spending, including the number of school-age children in need of education and the crime rate, which could dictate greater police spending. Cities with a higher cost of living will need to pay higher wages to local government employees. All else equal, cities with higher spending will also need to have higher property tax rates.

The fourth factor, classification, explains how tax systems that give preferential treatment to different types of property ownership affect property tax rates. Under classified property tax systems, many cities and states offer lower effective tax rates to certain types of property, usually benefiting homeowners over business or apartment owners. In New York City, for example, commercial buildings and apartments are taxed at a much higher percentage of market value than owner-occupied residences. Hence New York’s tax rate on median valued homes is the seventh-lowest of all studied, but its apartment tax rate is the highest in the study and commercial properties the second highest.

In New York, as in other cities, this results in a property tax system that is relatively regressive. Renters don’t pay property tax directly, but they do pay indirectly as landlords pass the cost off in the form of higher rents. Because renters have on average lower incomes than homeowners, this can result in a much higher burden on renters.

(From “50-State Property Tax Comparison Study For Taxes Paid in 2015,” by Lincoln Institute of Land Policy and Minnesota Center for Fiscal Excellence)

Other factors include the amount of state and federal aid cities are receiving, and state government spending. But the effects of these factors are more ambiguous. Sometimes greater state spending will limit local spending; since cities need to raise less revenue on their own, property taxes are lower. But in other cases, like when state aid comes in the form of matching grants, greater state aid can encourage higher local spending, and may not reduce property taxes.

The report also analyzes the impact of property tax assessment limits, as implemented by California in the 1970s. These limits come in many forms, but typically restrict the growth of a property’s assessed value as opposed to its market value to limit growth in property taxes as property values increase. That value is reset when a property sells, meaning that a homeowner in Long Beach, California, whose property is worth $440,900 will pay 40 percent more in taxes if they recently purchased their home than if they’ve owned it for 14 years.

The report, which includes the full effective tax rate rankings for residential, commercial and industrial properties, is an update to a 2014 report. The data is drawn from the largest city in each state and D.C. plus Aurora, Illinois, and Buffalo, New York; the largest 50 cities in the country; and a rural municipality in each state.

Jen Kinney is a freelance writer and documentary photographer. Her work has also appeared in Philadelphia Magazine, High Country News online, and the Anchorage Press. She is currently a student of radio production at the Salt Institute of Documentary Studies. See her work at jakinney.com.

Follow Jen .(JavaScript must be enabled to view this email address)