Over the past few years, Baltimore small businesses are attracting more capital than you might expect, but the nature and sources of that capital have some profound implications for the future of those businesses. That’s according to “Financing Baltimore’s Growth: Measuring Small Companies’ Access to Capital,” a new report from Johns Hopkins University’s 21st Century Cities Initiative.

The report looks at 34,982 public and private transactions from 2011 to 2015 that totaled $2.7 billion in small business investment. The most recent of those years was an above average year, with $603 million in Baltimore small business investment in 2015.

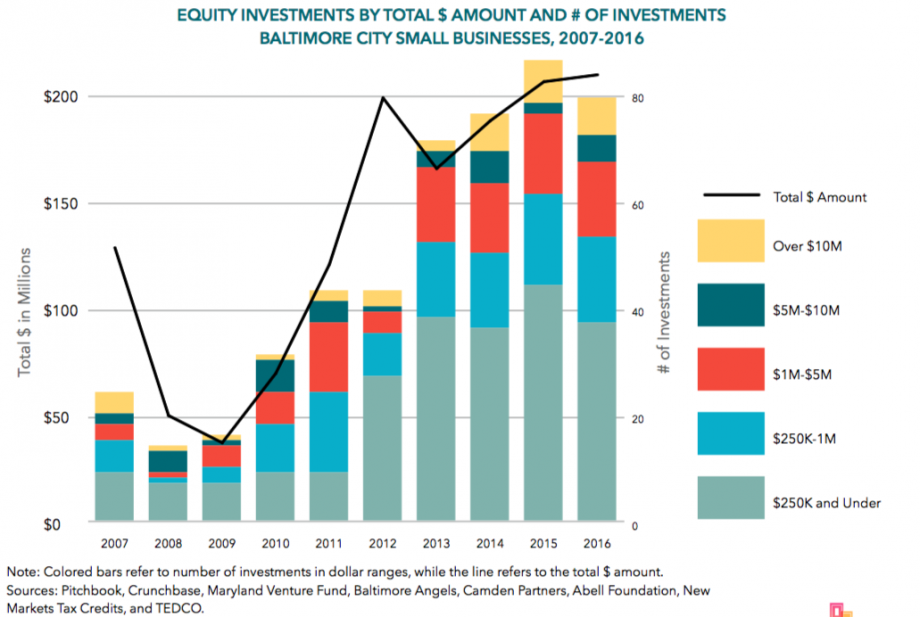

Equity investments are up in Baltimore, from $50 million a year nine years ago to over $200 million a year in 2015 and 2016. (There was more recent data available for equity investments.) These are important investments for growing small businesses, as they can be more patient investments, requiring no interest payments, and allowing for time and resources to support management, networking, or other efforts that might not bring in direct revenue but do help with overall growth.

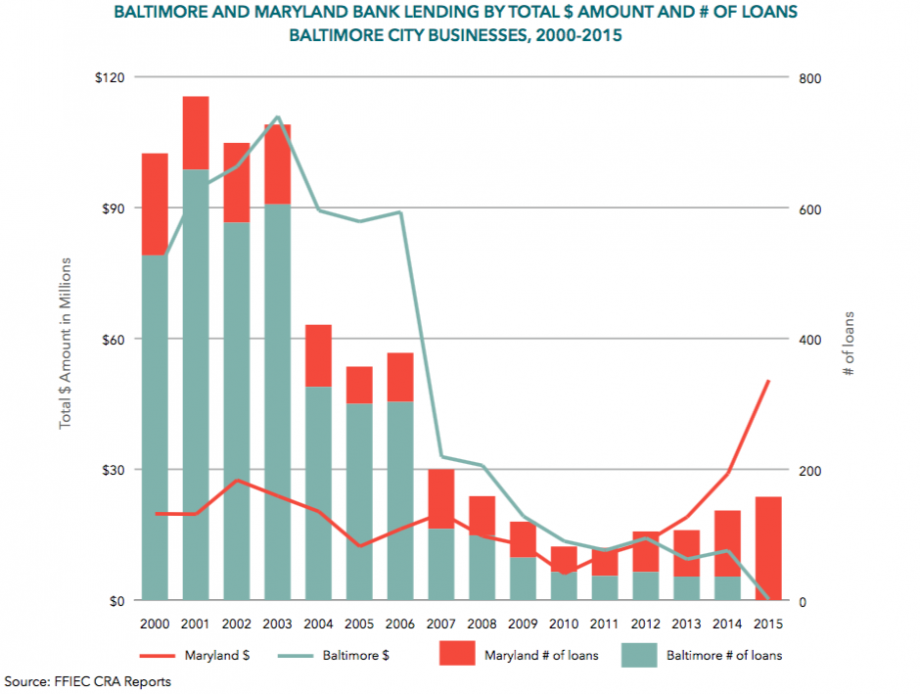

Meanwhile, bank lending is down in Baltimore. A decade ago, banks made over $400 million per year in small business loans to Baltimore small businesses. Bank lending to small businesses plummeted during the recession, and has never recovered, and is still below $300 million per year as of 2015. The drop-off gets more stark when you look local: Banks based in Baltimore were lending more than $90 million a year to Baltimore small businesses in the early 2000s; today they are lending next to nothing. Maryland-based banks have picked up some of the slack, but it’s still far below what it was.

The report cites consolidation within the banking sector as a primary driver behind that shift:

“Local banks with significant small business lending portfolios, such as Allfirst, Mercantile, and Provident, were acquired in the early and mid-2000s by national banks, such as M&T and PNC … while the banks that took over these local banks, such as M&T and PNC, have developed strong local relationships and are a key capital resource for Baltimore’s small businesses, the total current small business lending activity of the consolidated banking system does not equal the sum of the parts from the early 2000s.”

The effect of losing local banks and branches on small business lending can be profound. Unlike the home mortgage market, which is much more driven by algorithms and credit scores, small business lending is much more relationship driven. Small business loan officers and entrepreneurs need to trust each other on a more personal level than home lending officers and borrowers. A merger or branch closure can disrupt those relationships. According to one study from a researcher at the University of Maryland’s Robert H. Smith School of Business, within an 8-mile radius of a recently closed branch, the number of new small business loans was 13 percent lower for several years, and the decline persisted even after the entry of new banks and after a resumption of home lending in the same area.

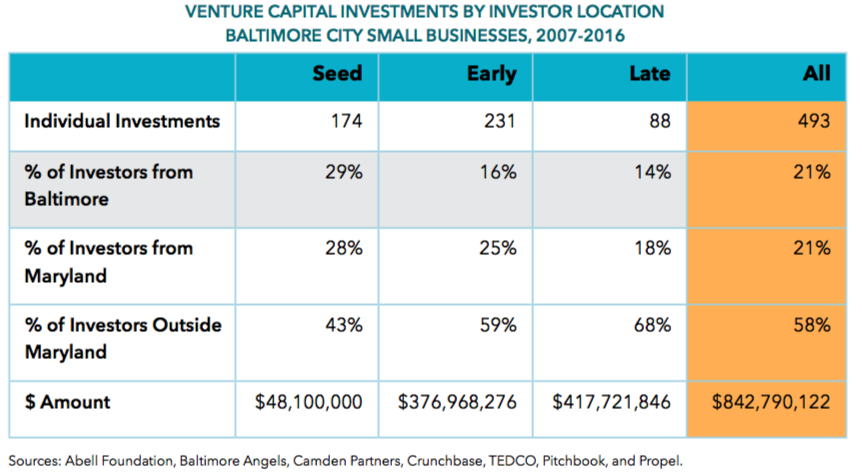

Meanwhile, the shift to capital sources outside of Baltimore is also reflected in the mix of equity investors. Only 21 percent of Baltimore equity investors are from Baltimore, such as Maryland’s TEDCO, which focuses on minority- and women-owned small businesses (and which I covered previously). Sixty percent of Baltimore equity investors are from outside Baltimore, and they are heavily tilted toward later stages of equity investment.

With so much capital coming from outside Baltimore, particularly at later stages of investment, the report notes that it makes growing businesses more likely to leave Baltimore on the advice of those investors. If those growing businesses also don’t have relationships with local banks, there is even less reason for growing businesses to stay in Baltimore. As noted in the report:

Through interviews with experts and stakeholders, we learned that investors making large investments in businesses often prefer close oversight of their investment, and will make an investment contingent on a company’s willingness to be located near the investor. Given that more than half of venture capital investors in Baltimore startups and small businesses are from outside Baltimore and Maryland, the following question arises: are growing companies pressured to leave Baltimore to access capital?”

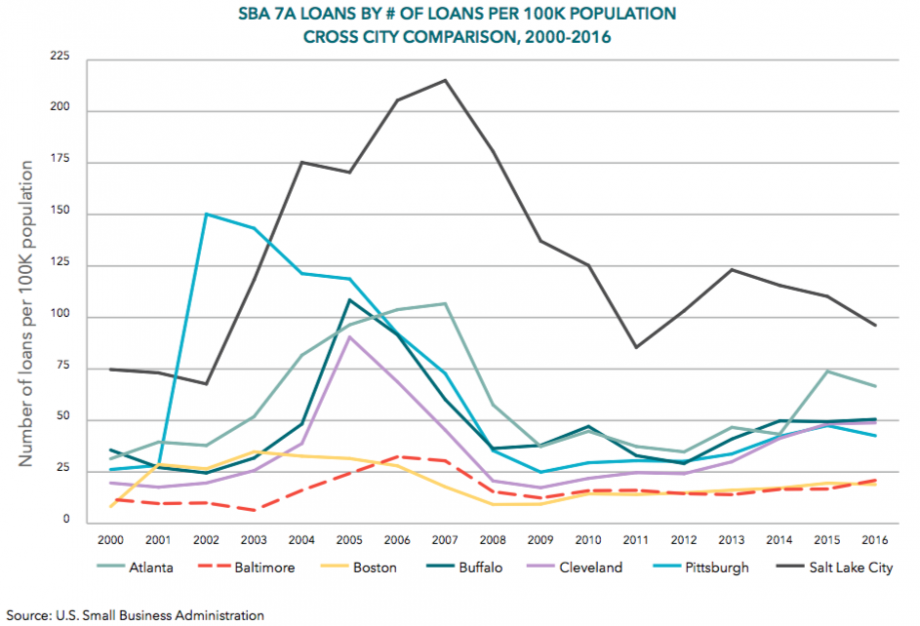

The study found even more reason for concern when looking deeper into the subset of small business loans guaranteed by the federal government, specifically the Small Business Administration’s flagship 7(a) loan guarantee program. The program is supposed to encourage banks and other lenders to make loans to borrowers who don’t qualify for conventional small business loans. Comparing a mix of cities, the report measured 7(a) lending per 100,000 people, to account for differences in population. Baltimore was at the bottom of the mix.

The report includes a series of recommendations to increase the volume of small business investment, especially from local sources, such as a regular convening for equity investors from Baltimore, use of new technology platforms to connect more Baltimore small businesses and investors, and increasing capacity of Baltimore small business lenders to take advantage of the SBA’s 7(a) program.

“We need to rebuild the art and practice of small business lending in Baltimore,” the report reads.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)