Are You A Vanguard? Applications Now Open

AP Photo/David Zalubowski, file

This is your first of three free stories this month. Become a free or sustaining member to read unlimited articles, webinars and ebooks.

Become A MemberIsmene Speliotis sent her staff deep into New York’s outer boroughs on an investigative mission in 2015. Their target: a few dozen homes with severely delinquent mortgages.

Speliotis is executive director of the Mutual Housing Association of New York, which was part of a City Council-backed coalition that was trying to figure out how much they would have to pay to purchase the distressed mortgages that had reached the last step before foreclosure.

“You go in the morning, you go in the evening, are the lights on, is the grass cut, is the snow shoveled,” she says, explaining the process. Their survey took them to Southeast Queens, Eastern Brooklyn, the Bronx and the North Shore of Staten Island, but from Cleveland and Detroit to Baltimore, Atlanta and beyond, blight — decaying properties, many left vacant due to recession-era foreclosures — has cost U.S. cities and their residents millions of dollars by many estimates.

They drove by, took photos and assessed the condition of each property. They knew roughly how much in principal was owed on the mortgages for each of the properties, and they had an idea of their market value.

One thing they didn’t do: Knock on doors.

When it comes to purchasing severely delinquent mortgages through the federal Distressed Asset Stabilization Program (DASP), which they intended to do, potential buyers aren’t allowed to speak with current occupants of a property (if there are even any home). The controversial U.S. Department of Housing and Urban Development program has seen thousands of troubled federally insured mortgages sold off to investors — mainly private equity firms that have seized an opportunity to amass real estate relatively cheaply.

Well before DASP, nonprofits focused on community development had concerns about the influence of for-profit companies amid the mortgage crisis.

“After the crisis, we had this idea. Banks were turning around and selling these notes at auction for very cheap. We had this very naive idea way at the beginning that, well, it would be very good if the banks would actually sell them to the nonprofit development community so that we could really do the right thing by the homeowners and the neighborhood. The answer was no, no, no, no,” Speliotis says.

With DASP, formally started in 2012, HUD started dangling a yes.

Last June, the Council-backed coalition including MHANY managed to successfully purchase 24 distressed mortgages, in a direct sale from HUD. It marked the first time a major city helped purchase loans under DASP. The coalition hopes the move will be the first of many for NYC and other cities to support neighborhood stabilization as well as struggling homeowners. However, nonprofits and city halls that want to follow their example face stiff competition from Wall Street, as well as uncertainty about how HUD may handle auctioning off these mortgages under President Donald Trump and new Secretary Ben Carson.

Thousands of homeowners lined up in June 2011 outside the Shrine Auditorium in Los Angeles, at an event offering free help with loan modifications. (AP Photo/Nick Ut)

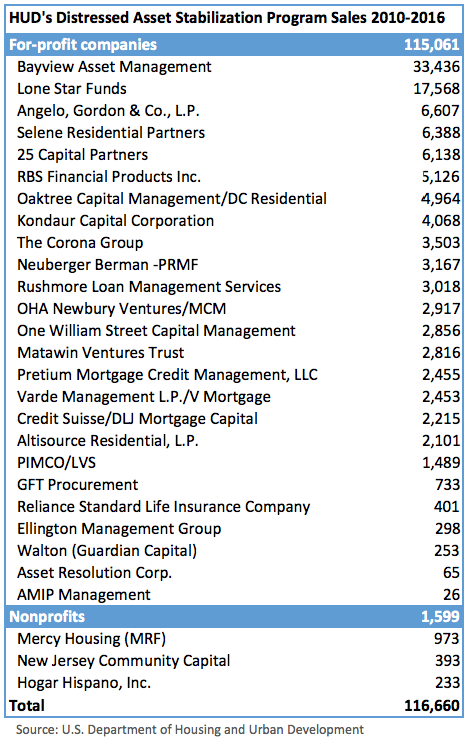

HUD started selling distressed single-family home mortgages at auction in 2010. Of the 116,660 sold since, the agency has faced withering criticism over the past few years over the fact that for-profit, typically private equity-backed firms have purchased 99 percent of those mortgages. (The department started auctioning off single-family loans in an experimental program in 2010, which became known as DASP in 2012.)

On the one hand, it’s true that all of those loans were a step away from foreclosure, so any prevention of those foreclosures is a net gain for all those homeowners. On the other hand, it’s become a huge cash machine for private equity firms. They buy the debt at a deep discount, typically between 30 and 50 cents on the dollar, can write down some principal or reduce interest rates in negotiation with homeowners, and still make a ton of money by collecting the payments or selling the modified loans to a bank. Or they can foreclose and sell back into a real estate market that is no longer in shambles — often the case since a large percentage of the underlying properties had long been vacant, according to HUD.

The New York Times reported in 2015 that homeowners complained that one of those private equity firms, Lone Star Funds, pushed them into foreclosure even after they’d submitted all the necessary paperwork to apply for a loan modification to keep their homes. (A rep for the Lone Star subsidiary involved told the Times, the firm “had one of the highest loan modification rates in the industry.”) Private equity firm Blackstone became the nation’s largest landlord by purchasing foreclosed homes and foreclosing on many of the DASP mortgages it bought through affiliates like Bayview Asset Management.

In April 2016, several nonprofits launched the “Stop Selling Our Neighborhoods to Wall Street” campaign, pushing for HUD to sell the mortgages to nonprofit or mission-driven organizations.

Last year’s direct sale to NYC was part of a series of changes HUD began making to the program in 2012, with the intent of producing more favorable outcomes for homeowners and neighborhoods. That was the first year that nonprofits were able to purchase loans as a result of those changes. Out of 5,899 loans HUD sold via DASP in 2012, nonprofits purchased 483.

But when HUD sold 30,839 loans via DASP in 2013, only 751 went to nonprofit buyers. In 2014, when HUD sold 54,764 loans via DASP, zero went to nonprofit buyers.

In 2015, nonprofits purchased only three of 5,253 loans sold via DASP.

After the latest round of reforms, nonprofits purchased 362 out of 16,518 loans sold at the two DASP auctions in 2016 — still far below HUD’s own goal of 10 percent of DASP loans going to nonprofits or municipal governments.

These numbers are low for many reasons, including the nature of the auctions, the nature of nonprofit buyers versus for-profit buyers, and HUD’s underlying impetus for the sales themselves.

On the nature of the sales, “nonprofits are generally not equipped to engage in the kind of transactions these note sales have turned into,” says Julia Gordon, executive vice president of the National Community Stabilization Trust (NCST).

The vast majority of the note sales, another term for selling the debt on a property as opposed to selling the property itself, see HUD auctioning off pools containing dozens, hundreds, sometimes thousands of loans spread out all over the U.S. or large regions of the county. A single auction has 15, 20, sometimes closer to 30 of these pools up for sale. Interested buyers must pre-qualify with HUD, and when an auction is announced, they get access to essentially giant spreadsheets with information on each of the mortgages in the pools, such as addresses, unpaid balance amounts, broker estimates of market value for each property, date of last payment, and more. Buyers then typically have 22 days to perform their due diligence before submitting bids. Crucially, buyers have to put in a bid for each individual distressed mortgage in any given pool it wishes to bid on, and the winner is whoever has the highest aggregate bid for any given pool.

“Most nonprofits work with a smaller area, equipped to deal with only a few properties at a time,” Gordon says. It almost goes without saying, municipalities aren’t exactly willing to bid on loans outside their own boundaries.

Some of the early changes HUD made in 2012 included offering pools that were geographically targeted to areas that were particularly hard-hit by the foreclosure crisis. That year featured seven targeted pools, two in Chicago; two in Newark, New Jersey; one in Phoenix; and two in Tampa. Two nonprofits bid successfully: Mercy Housing won a Chicago pool with 324 loans, and New Jersey Community Capital (NJCC) won a Newark and a Tampa pool with 150 and 249 loans, respectively.

“We like geographic density in our pools so that when we get a pool we can maximize our outreach to homeowners, which is done by local nonprofits, local HUD counseling agencies,” says Scott Fergus, who previously spearheaded NJCC’s efforts to purchase distressed mortgages from HUD as well as Fannie Mae and Freddie Mac, which have their own distressed mortgage sale programs. “Even if we can’t find the homeowners and have to foreclose, it’s in a geographic area that we can manage and do something with.”

In addition to its New Jersey focus, NJCC decided to also target Florida, given the concentration of distressed mortgages in that state. Florida and New Jersey are Nos. 1 and 2 in terms of distressed mortgages sold at DASP auctions.

While geographically targeted pools made it easier for nonprofits to get involved, it didn’t exactly level the playing field. Nonprofits still had to bid against for-profit buyers. In that same 2012 auction, Blackstone-affiliated Bayview Acquisitions won a Chicago-targeted pool with 1,430 loans. Since 2012, nonprofit buyers have purchased only 6 percent of 27,808 distressed mortgages purchased via these geographically targeted DASP auction pools.

As part of HUD’s reforms, these geographically targeted pools also came with more explicit directives to push all buyers, for-profit or nonprofit, toward foreclosure-prevention outcomes. Such outcomes include re-performance, or in other words, the borrower is making on-time payments again, typically after a loan modification to reduce principal or interest and monthly payment amount; rental to a borrower; sale to an owner occupant; gift to a land bank; sale to a Neighborhood Stabilization Program grantee (NSP) or a nonprofit organization, or a loan payoff. For this reason, HUD labeled these geographically targeted pools as “Neighborhood Stabilization Outcome” or NSO pools.

HUD required NSO pool buyers to reach foreclosure-prevention outcomes in at least 50 percent of resolved mortgages. But it has barely made a difference. Foreclosure rates overall for both NSO and national pools tend to hover between 50 and 60 percent. For-profit buyers still have at least some incentive to modify loans and get homeowners back on track making payments. As things have panned out, it has basically been a coin toss as to whether buyers can make as much money modifying and reselling loans to a bank as they can foreclosing and reselling properties on the market. Some, like Blackstone, have turned foreclosed properties into rentals.

As of 2015, national pool buyers had foreclosed on 23,291 out of 52,767 resolved loans, with 26,023 loans still unresolved. NSO buyers meanwhile had foreclosed on 7,246 out of 15,424 resolved loans, with 5,613 loans still unresolved.

Even if nonprofits can get their hands on more distressed mortgages, the challenge of reaching out to homeowners and working them through the loan modification process remains a huge burden. Loan modifications are the most favorable outcome, keeping the homeowner in place while reducing the principal owed and often the interest rate, resulting in a lower monthly payment the homeowner can truly afford.

It’s a process — working with a HUD-approved housing counseling agency such as MHANY, homeowners receive a temporary “trial modification,” based on third-party assurance from the agency that the homeowner is working on a plan to boost their income to be able to afford the modification before moving up to a permanent, 30- to 40-year fixed-rate modified loan. MHANY estimates it has about 200 homeowners in foreclosure prevention counseling at any given time, with 30 to 40 a year moving into a non-foreclosure outcome.

But DASP mortgage homeowners are weary, many having been through the process multiple times with banks only to have loan modifications denied for reasons that may or may not be made clear to the homeowners.

“They may go through a lot of different servicers, and at the end of the day, they don’t trust anybody,” says Cecilia Joza, who directs the housing counseling program at MHANY. “A lot of times they’ve never worked with an agency before. It took a long time to get these homeowners engaged. It’s continuous knocking on the doors, calls, building trust. Even as they provide the documentation, they’re still hesitant. It’s personal information.”

People gathered in Chicago to protest the financial industry expos in the city in October 2011. (AP Photo/Paul Beaty)

So far, in its ongoing role as the HUD-approved housing counseling agency within the NYC Council-backed coalition, MHANY has successfully contacted 23 of the 24 homeowners with distressed mortgages they purchased. It’s an unusual position for the organization. “We’re not just on the homeowners’ side, hammering the banks like usual,” says Speliotis.

At least five of the homeowners have achieved a trial modification at this point, and the rest of those contacted are progressing toward the same or another favorable outcome. The coalition has set its own goal of 100 percent foreclosure prevention outcomes for the loans it has purchased.

One of their homeowners is a senior couple from Guyana, who have been living in Brooklyn since 1999. According to MHANY, they had been years behind on their mortgage, and had tried multiple times to apply for loan modifications, to no avail.

“At first it was difficult to get them to trust us. It took us a while,” says Joza. “[Eventually] they understood that the only way to get a modification was to work with a housing counseling agency.”

According to Fergus, NJCC is anticipating it will end up with successful loan modifications on 30 to 35 percent of the distressed mortgages it has purchased so far. That would be far above the current rates. Under DASP, homeowners have achieved loan modifications on 15 percent of resolved NSO pool mortgages and 12 percent of resolved national pool mortgages.

In 2016, HUD began offering select NSO pools exclusively to nonprofits and municipal or state government: Hogar Hispano, an affiliate of the National Council of La Raza, has purchased 230 distressed mortgages, and NJCC has purchased 132.

Part of HUD’s willingness to set aside special auction pools for nonprofits or local government, or to do direct sales instead of auctions as it did last summer, has been the ability of groups like NJCC, Hogar Hispano and the NYC Council-backed coalition to line up capital partners that can provide the cash necessary to meet HUD’s needs with DASP sales.

The original purpose of the DASP sales was to reduce claims on Federal Housing Administration (FHA) insurance and even replenish the FHA’s mutual mortgage insurance fund with proceeds from the sales. Each pool has a minimum bid price, called a reserve price, that reflects what HUD thinks it needs to justify selling the loans instead of going through the standard FHA insurance claim and foreclosure process.

The FHA was created in 1934 to provide insurance to lenders making single-family home loans across the country. It was meant to give lenders assurance as they essentially embarked on a totally new market of single-family home lending in the U.S. without credit ratings or credit histories of any kind. (For decades those loans only went to white households, a practice known as redlining, which contributed greatly to the current racial wealth gap.) In the aftermath of subprime crisis and ensuing recession in the 2000s, HUD, which administers the FHA, built up a backlog of distressed mortgages that were eligible for claims from the FHA’s mutual mortgage insurance fund.

President Donald Trump and HUD Secretary Ben Carson (AP Photo/Evan Vucci)

The mutual mortgage insurance fund’s net worth quickly fell into the red, as there were more claims on it than there were cash reserves in the fund itself. HUD was backed into a corner. So in 2010, as an experiment, instead of paying out insurance claims, taking ownership of properties and foreclosing, HUD came up with the idea to auction off distressed mortgages. That was the origin of what is now DASP.

For each pool of loans at a DASP auction, HUD estimates the net return of paying out FHA insurance claims to banks, taking ownership of properties, going through the foreclosure process, making any repairs or maintenance as needed to properties, and eventually selling the properties back into the market. The foreclosure and resale process can take years, and there was already a backlog of distressed mortgages at the front end. So with DASP, bids need to be worth more than what HUD forecasts it would net from paying out FHA insurance claims and going through that process.

In the September 2016 DASP auction, there were actually five NSO pools limited to nonprofit, municipal or state buyers. Hogar Hispano and NJCC each won one, but the other three, targeting Baltimore, New York state and New York City, were not awarded to anyone. The NYC Council-backed coalition submitted a bid on the NYC pool, but it did not exceed HUD’s minimum price. A New York state bid led by a different coalition also failed to win its bid for the New York state pool. Speliotis heard that there were other nonprofits that also put in failed bids for these loans.

“That was very disappointing,” Speliotis says. “We said OK, let’s go back to negotiating a direct sale with HUD, since the auction did not work. Of course then everything just screeched to a halt [after the election].”

There is no law that says HUD must always maximize its return on DASP sales. It’s a regulatory decision. HUD’s fiduciary obligation is to protect and maintain the FHA mutual mortgage insurance fund. That fund has been back in the black for three years running, and is now worth $27.6 billion. From 2012-2016, HUD estimates that DASP sales have saved the fund $2.2 billion dollars from what it would have cost to put properties through foreclosure.

The open question remaining is whether HUD can be convinced it no longer needs to use DASP auctions to replenish the fund, perhaps opting instead to sell distressed mortgages exclusively to nonprofits or local government, as long as those entities can pay more than the net return of paying out FHA insurance claims and going through the foreclosure process.

For some indication of the administration’s position on the FHA insurance fund consider their decision to rescind President Barack Obama’s last-minute FHA insurance premium cut, one of the first decisions made after inauguration. That move was justified in part as necessary to continue boosting the value of the insurance fund. Continuing to sell mortgages to Wall Street would fall in line with the same reasoning.

Ultimately, the FHA commissioner — a politically appointed position requiring Senate confirmation — will answer the questions regarding DASP. There are some people reportedly in contention for the job in the Trump administration, but no nominee yet. Without an FHA commissioner currently in place, HUD declined to comment on the potential future of the DASP program. It could not even confirm whether or not DASP will continue at all, or whether recent measures taken, such as offering direct sales to municipalities, would remain available under DASP.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)

20th Anniversary Solutions of the Year magazine