As rents continue to rise more quickly than incomes across the U.S., cities have become increasingly focused on affordable housing: How to pay for it, where to put it, and how to keep it from disappearing.

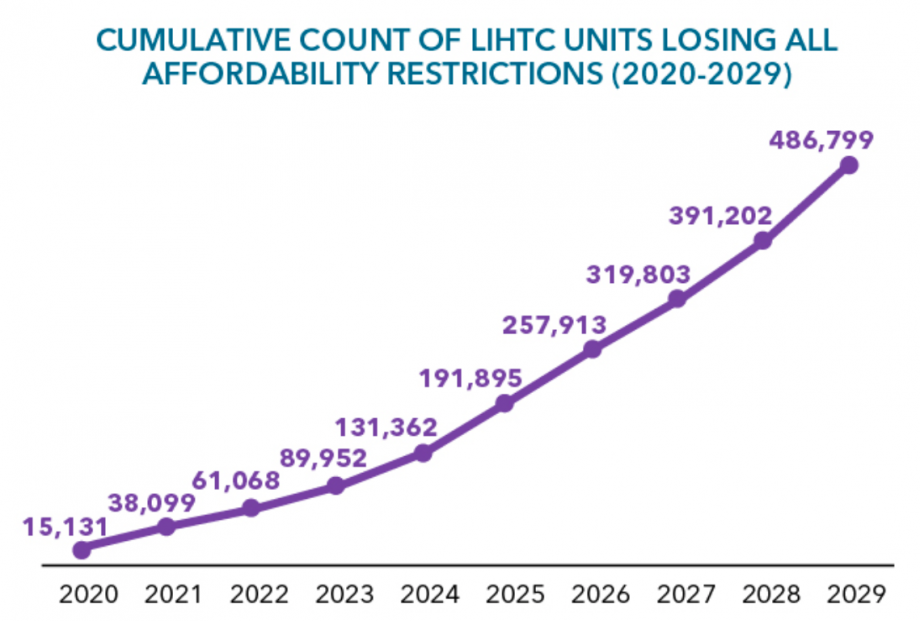

Hundreds of thousands of affordable units created under one of the biggest federal housing programs ever could start disappearing soon, in a manner of speaking. According to a new report from the National Low Income Housing Coalition and the Public and Affordable Housing Research Corporation, nearly half a million units created with Low Income Housing Tax Credits (LIHTCs) could be lost in the next ten years.

Most LIHTC (“ly-tek”) units are required to remain affordable for 30 years, the report notes. The LIHTC program was created in 1987, and the affordability requirements have started to expire on the first funded units. Between 2020 and 2029, more than 485,000 units will reach year 30, and could become unaffordable to low-income residents — including their existing tenants — without additional subsidy, the report says.

Some units in highly desirable neighborhoods could quickly be converted to market-rate rents, while many more units in neighborhoods with lower demand could start to physically deteriorate without additional capital for rehabilitation. The situation sets up a seemingly difficult choice, the report says: Reinvest in existing affordable housing to keep people housed or invest in new affordable housing to give low-income residents a chance to leave segregated, low-opportunity neighborhoods. But the choice is a false one, the authors say.

“Really, what we need is more resources for preservation,” says Andrew Aurand, vice president for research at the National Low Income Housing Coalition and a co-author of the report. “Short of that, we have to make these types of decisions about where it makes sense to invest for preservation and where it makes sense to invest for new development.”

“It’s not really a tradeoff,” adds Keely Stater, director of research and industry intelligence at the Public and Affordable Housing Research Corporation. “We can do both if we have the right resources.”

The authors of the report, called Balancing Priorities, ranked neighborhoods on spectrums of both desirability and opportunity. Owners of LIHTC units in highly desirable neighborhoods would have a greater incentive to convert them to market-rate rents, the report notes, while owners in the least desirable neighborhoods would have a harder time accessing money for improvements. The authors created an “opportunity index” that measures how well each neighborhood ranks in terms of “access to amenities thought to provide pathways for economic mobility.” That includes access to jobs, educational opportunities, transit, and a healthy environment.

The report shows that 42 percent of LIHTC units reaching year 30 in the next decade are located in neighborhoods that rank “very low” in terms of desirability, while 5 percent are in neighborhoods ranked “very high.” In terms of opportunity, 29 percent of expiring units are in neighborhoods ranked “very low,” with 12 percent in neighborhoods ranked “very high.”

“I think, at the very least, it’s going to require an extensive amount of planning and pulling together resources and communities working together to figure out their strategy for what to do when these units expire,” Stater says.

Cities are starting to develop affordable housing strategies that prioritize preservation as well as new production. In some cases, the work of protecting affordability for LIHTC units is already being done. For example, in 2016, Community Development Trust partnered with YES Housing Inc. of New Mexico to preserve 262 units of low-income housing in Albuquerque, Las Cruces and Roswell. Some of the units had been renovated using the LIHTC program in 2000, and the transaction allowed YES Housing to maintain ownership of the properties while providing capital for improvements.

Community Development Trust, based in New York City, is a rare combination of being both a federally-certified CDFI (community development financial institution) and a real estate investment trust, more commonly known as a REIT. While the Trust does make loans, as a REIT it can also take partial ownership stakes in properties in exchange for cash that can be used for renovations to preserve properties and maintain their status as affordable.

Brian Dowling, chief investment officer for the Community Development Trust, says the group tries to partner with other mission-driven groups when making investments in low-income and senior housing. In many cases, Dowling says, groups like his would have an easier time structuring deals to preserve housing if they could access relatively small subsidies from either state or local governments — something on the order of $10,000 to $30,000 per unit.

Local approaches are also in progress. In New York City, as Next City reported last year, a cadre of mission-driven, nonprofit affordable housing developers banded together to create the Joint-Ownership Entity, a new kind of nonprofit real estate trust but not quite a REIT, with preservation of existing LIHTC properties as one of its primary strategies.

In a section on recommendations for changes to the LIHTC program, the NLIHC/PAHRC report suggests that the program could require mission-driven nonprofits to be part of the ownership structure for LIHTC properties. It also suggests that new LIHTC production could be targeted in high-opportunity neighborhoods. And it recommends increasing investment in other programs, like housing vouchers, to give tenants access to more existing housing supply.

“Beyond LIHTC, we also need a fully-funded voucher program, because if we had that, it does a couple of things,” says Aurand. “First, it gives renters mobility. With a voucher, they could afford a rental unit in the private market up to a certain payment standard, so it gives them more mobility. Also, if vouchers are available, it provides tenants who are currently in a subsidized building some protection.”

Aurand and Stater both said they’ve been encouraged by attention to the housing crisis at the federal level, including proposals from senators Kamala Harris, Elizabeth Warren, and Cory Booker (though both stopped short of endorsing any particular proposal.) They hope that the report will lend some hard evidence to the growing national recognition of the issue.

“I definitely think cities and states are stepping up and trying to think about how to make the necessary investments,” Stater says. “It’s just that the problem is so huge. The scale of the problem really requires a huge federal investment.”

Jared Brey is Next City's housing correspondent, based in Philadelphia. He is a former staff writer at Philadelphia magazine and PlanPhilly, and his work has appeared in Columbia Journalism Review, Landscape Architecture Magazine, U.S. News & World Report, Philadelphia Weekly, and other publications.

Follow Jared .(JavaScript must be enabled to view this email address)