Small businesses who adopt an “If you can’t beat them, join them” attitude toward operating hours might have an advantage when the next megaproject comes to town.

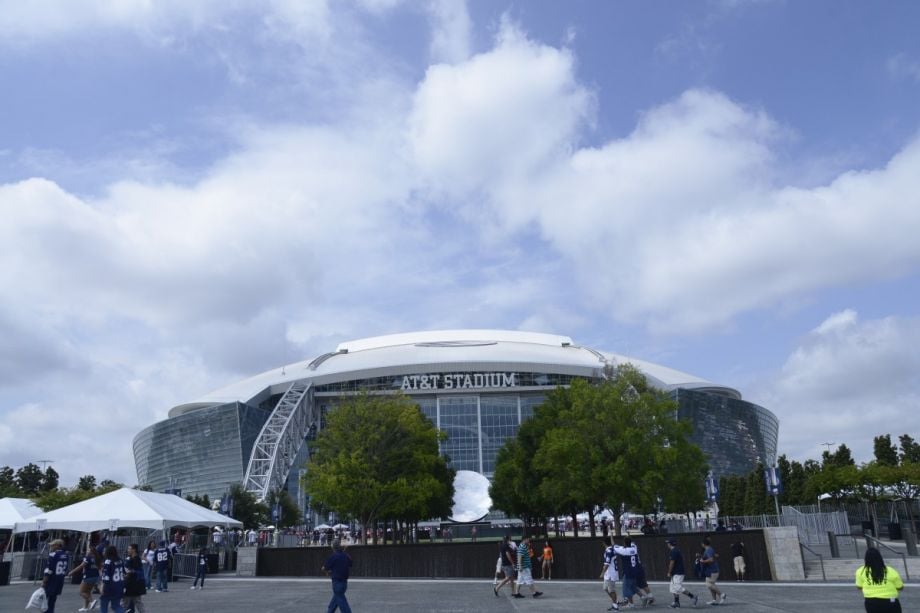

Management professors at the University of Texas at Arlington studied how business owners respond to environmental disruption by looking at the convenient local case study of AT&T Stadium, which opened in Arlington in 2009. Over a period of four years, they surveyed local businesses about their perceptions of the benefits or costs of the home of the Dallas Cowboys, and if the businesses planned to adopt new management strategies based on the presence of the stadium and local infrastructure improvements.

Responses reflected the obvious fact that the Cowboys were very popular from a fan perspective, but there were strong concerns about traffic congestion, increases in real estate prices and taxes, and “a strong passion against [Cowboys] owner Jerry Jones,” says Liliana Pérez-Nordtvedt, one of the co-authors of the report recently published in the Journal of Management Studies.

Instead of looking at the ways that businesses approach content changes (i.e., whether they painted their storefronts with blue and silver stars, or added a Dez Bryant-themed cocktail to their menu), the team looked at temporal adaptation, or changing daily or seasonal hours to dovetail with activities at the stadium.

They found that temporal adaptation did, in fact, correlate with performance. Businesses who changed their rhythms had more success than those who behaved as if Arlington was the same as before “Jerry’s World” moved to town.

They also discovered another intriguing takeaway: “If firms perceived the stadium to be a threat, they did nothing,” says Pérez-Nordtvedt. “If they perceived it as an opportunity, they were more likely to try to adapt.” In other words, accepting change and hoping for the best had an impact on whether businesses thrived in the new environment.

Whether or not the businesses accommodated the change had a geographical component too. “Among business owners who saw the shock as an opportunity, those who were physically closer to it were more likely than those who were far away from it to exploit it — by deciding to pursue [temporal adaptation],” writes the report’s authors.

So when projects promising to draw crowds come to the neighborhood, businesses might have to invest less than they think to capitalize. “One of our takeaways was that temporal adaptations might be less costly [than content changes] for small businesses,” says Pérez-Nordtvedt.

The Equity Factor is made possible with the support of the Surdna Foundation.

Alexis Stephens was Next City’s 2014-2015 equitable cities fellow. She’s written about housing, pop culture, global music subcultures, and more for publications like Shelterforce, Rolling Stone, SPIN, and MTV Iggy. She has a B.A. in urban studies from Barnard College and an M.S. in historic preservation from the University of Pennsylvania.