The U.S. Treasury Department announced last week that it had received 230 applications for this year’s round of New Markets Tax Credit (NMTC) allocations. Add up what those applicants are seeking to support community development in low-income areas, and you get $16.2 billion — more than four times the $3.5 billion in NMTCs available.

Through the first 13 rounds of the program, Treasury’s CDFI Fund has made 1,032 awards totaling $50.5 billion in “tax credit allocation authority.” (Tax credit allocation authority simply translates to the tax credits a community development enterprise (CDE) can offer to investors in order to raise capital that will go toward supporting everything from job training to affordable housing.) In the last round, out of $7 billion in New Markets Tax Credits, $4.1 billion went to urban areas, and $870 million went to minority-owned or -controlled organizations.

The announcement came on the heels of a new compliance review of the NMTC Program, commissioned by the Treasury Department and conducted by a third party. It examined whether the recipients of NMTC allocations have complied with program requirements, and whether the recipients’ investment activities have aligned with the objectives of the program — broadly speaking, to stimulate investment and economic development in the most economically distressed areas, both urban and rural. According to the department, the review was prompted by its own questions as well as questions from the Government Accountability Office (GAO) and others.

More than 4,500 NMTC projects have closed since the program’s inception in 2000. The review divided them into 12 categories based on investment size, purpose (real estate development, business lending, mixed), metro versus rural, and whether or not a CDFI (community development financial institution) was involved. Projects were chosen randomly within each category, and 53 projects were analyzed.

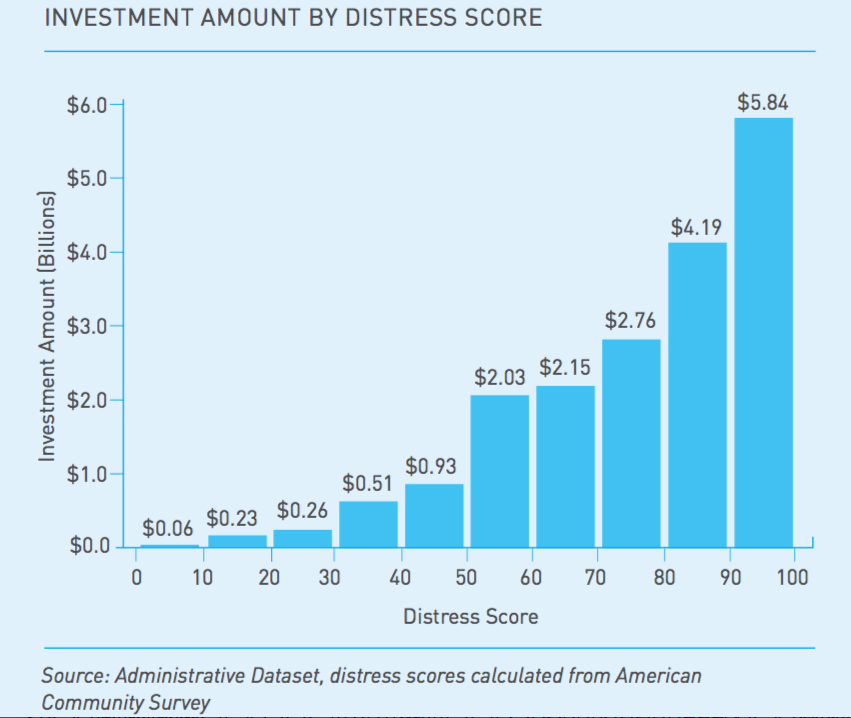

Among the key findings, the review found that the more distressed the area, the more NMTC investment it received.

The firm that conducted the review, Summit Consulting, created its own measure of economic distress based on poverty rate, unemployment rate, median family income, educational attainment and housing vacancy, resulting in a score between 0 and 100. Each score corresponds to a census tract’s percentile of distress; a census tract with a distress score of 60 is more distressed than 60 percent of the country.

(Credit: U.S. Treasury/Summit Consulting)

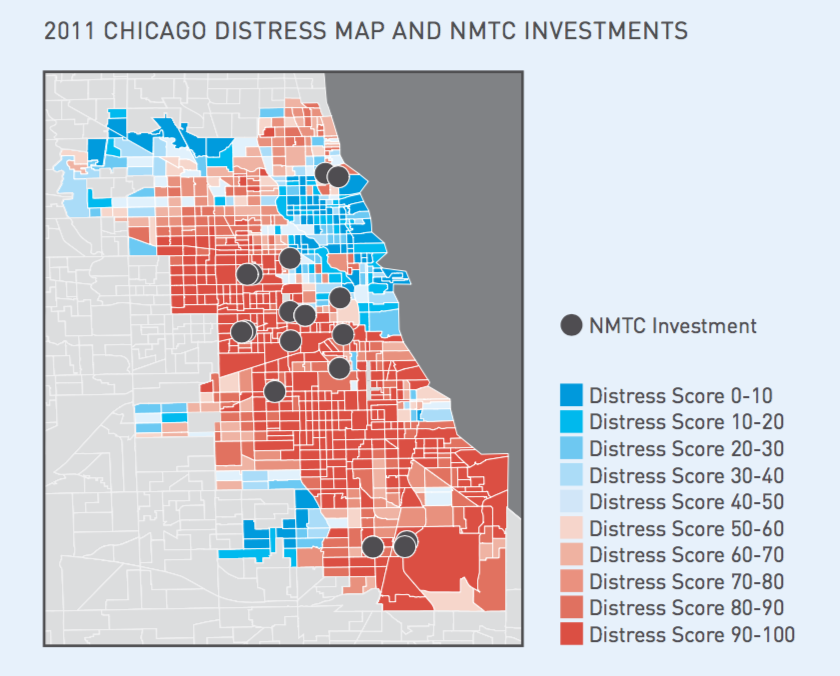

Summit also conducted a spatial analysis, addressing the question of whether NMTC investments tend to go to locations that are adjacent to wealthier areas. Their review found no evidence that NMTC investments are concentrated in areas adjacent to affluent areas; it found the opposite was true, that NMTC investments tend to go into census tracts surrounded by other distressed tracts.

(Credit: U.S. Treasury/Summit Consulting)

One of the reasons that NMTC projects may be targeted to the most distressed areas may be the prevailing “but-for” analysis used by most NMTC program participants. Exact approaches vary by organization, but the general idea is to get a sense of whether any other tool (community development block grants, philanthropic sources) might be available to obtain all necessary financing for a particular project, and if so, to use those tools instead.

The scarcity of NMTCs, combined with the program’s onerous (and expensive) compliance and reporting requirements, seem to be driving participants to make certain they aren’t wasting NMTC allocations on projects that could find other financing without NMTCs. Interestingly, the but-for analysis has never formally been a requirement of the program. Summit’s compliance review recommends that the Treasury Department consider making it so, while also providing templates and technical assistance to share best practices for doing a but-for analysis.

Besides targeting a highly distressed area and an eligible project (NMTCs cannot finance projects that derive more than 80 percent of their income from rental housing, for example), in order to be in compliance with the program, NMTC transactions must offer some kind of flexible loan feature for the project or borrower. Longer-than-standard interest-only payment periods, for example, can give a business time to benefit from moving to a new, larger space or a new piece of equipment or new marketing staff. Higher-than-standard loan-to-value ratios can allow a project in a highly distressed area to attract more capital than the property is currently worth, but not to an irresponsible or speculative investment amount.

Summit’s analysis found that the most popular flexible features offered, in order of most common to least common, were: below-market interest rates, longer-than-standard interest-only payment periods, lower-than-standard origination fees, higher-than-standard loan-to-value ratio, and longer-than-standard amortization period.

Another key question for the review was how much other public funding might be going into NMTC transactions. The Treasury Department frequently touts the 8-to-1 ratio of private-to-public funding that the NMTC program generates, but if other public dollars are injected into projects that involve NMTC allocations, it can lower the true ratio. Of the 53 NMTC projects Summit analyzed, 26 received other public funding in addition to NMTC allocations.

The review also examined the fees charged to projects or borrowers under the NMTC program, noting concern with the administrative costs of NMTC financing, in particular legal and accounting costs. In Summit’s program sample, fees averaged 8.7 percent of the NMTC transaction amount. Fees ranged from 0 percent to 15.9 percent. Summit found that the fees were typically on the application for the project or borrower receiving the NMTC investment dollars, providing a degree of transparency. (The fees can certainly add up, but they can often be a major windfall for smaller CDFIs, giving them access to a stream of unrestricted income — a rarity for most nonprofits.)

The compliance review did not examine the sectors of NMTC projects — manufacturing, healthcare, education or mixed use. Charter school opponents have criticized the program for getting involved in financing charter school construction. Over the life of the program, NMTCs have financed the creation or construction of an estimated 200 schools (not all of them charter schools), according to the latest progress report from the NMTC Coalition, which lobbies for the NMTC program. Manufacturing now accounts for the largest share of NMTC projects, according to the coalition report. As Johnny Magdaleno reported for Next City last fall, NMTCs are being used to create community hubs of a sort that include small-scale manufacturers.

As for those 230 applications that the Treasury Department announced last week, it plans to announce the next round of NMTC allocations this fall.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)