On July 6, St. Anthony, Minnesota, police officer Jeronimo Yanez shot and killed Philando Castile in front of his girlfriend and her daughter. The story of a senseless killing of a Black person at the hands of police is an all-too-familiar one.

In the days and weeks that followed we learned heart-wrenching details about the death of this school cafeteria worker beloved by family and friends. We also learned details about Castile’s life, and his recurring interactions with local law enforcement in the Minneapolis-St. Paul region. Between his first traffic stop in July 2002 and his final traffic stop on July 6, Philando had been pulled over by police at least 49 times, an average of about once every three months. During those fourteen years he accrued more than $6,000 in fines, often for minor violations.

According to the Brennan Center for Justice, an estimated 10 million people owe more than $50 billion in debt resulting from their involvement in the criminal justice system. Over 60 percent of that total is owed by Blacks and Latinos, with an average total amount of over $7,000. More and more, municipalities are explicitly extracting large sums of money from their most vulnerable residents.

Castile’s long parade of traffic stops didn’t escape the notice of Minnesota NAACP president Nekima Levy-Pounds, who at a rally denounced the St. Anthony Police Department for its “money-making scheme.” City Manager Mark Casey had no choice but to acknowledge that his town, like others, faced the challenge of racial inequality “in terms of arrests, citations, and incarceration.” Yet, as NPR’s Cheryl Corley and Eyder Peralta pointed out, Casey didn’t provide any particulars on how St. Anthony would address the challenge.

While we recount and respond with outrage to the senseless killing of Philando Castile, we also should recognize the “taxation by citation” scheme of which he was a victim for much of his life. While the actions of individual police officers must be addressed, so too should the predatory system devised and facilitated by those officers’ bosses, and their bosses, and so on—the entire leadership of a town or city, and specifically its approach to generating municipal revenue.

Predatory revenues are the fines and fees (also known as legal financial obligations, or LFOs) that municipalities across the nation are using to fill their coffers on the backs of communities of color and the poor. Perhaps the only case study we really need is Ferguson, Missouri, where predatory revenues have helped bring the town to the brink of bankruptcy. The shooting of Michael Brown lit a powder keg fueled largely by rampant and excessive LFOs.

Journalist Jack Hitt reports that in 2014, the year of the shooting, 75 percent of all Ferguson residents—yes, three-quarters of the city’s population—had active outstanding arrest warrants. The fines and fees attached to those warrants and other citations helped to pay for 20 percent of the city’s total municipal budget.

After an extensive investigation, in March 2015 the Department of Justice (DOJ) released a report declaring that the Ferguson Police Department routinely violated the constitutional rights of Black residents, and that police and court officials, in response to budgetary pressures, were prioritizing revenue from fines over public safety. Attorney General Eric Holder stated that “the city relies on the police force to serve, essentially, as a collection agency for the municipal court …” The DOJ recognized that this practice wasn’t unique to Ferguson, and the numbers support that claim: even within St. Louis County, Ferguson isn’t an outlier. Some towns can derive 40 percent or more of their annual revenue from fines and fees.

Ferguson’s fallout didn’t end with the DOJ findings. In late 2015, Moody’s Investor Service downgraded Ferguson’s credit rating status twice, first to “junk status” and then deeper into junk. Key factors in the assessment included rising costs of ongoing litigation and coverage for legal settlements related to civil rights cases stemming from the unrest. The city recognized that if it failed to halt the current trajectory, it could face “insolvency sometime in fiscal 2017.”

The town’s descent into “junk status” is very revealing in light of the nation’s increasing predatory revenues. This is an unusual occurrence in a $3.7 trillion municipal bond market that’s traditionally presumed to be safe and stable (although Ferguson suggests otherwise). Part of the instability stems from the fact that predatory municipal revenues are short-term and non-recurring, creating a layer of risk exposure that may lead to significant mispricing in the market. It’s a phenomenon that most investors aren’t currently discussing.

Municipal bonds, one of several types of fixed income investments, are a cornerstone of nearly every balanced investment portfolio. Yet, examining fines and fees in one’s municipal bond portfolio is also a rare point of focus for investors, even for socially responsible ones, who have historically viewed all investments in municipal bonds as inherently good and socially beneficial.

Granted, some investors are beginning to explore municipal bonds in terms of their ability to pay for social service initiatives through social impact bonds or how green bonds can fund environmentally beneficial projects.

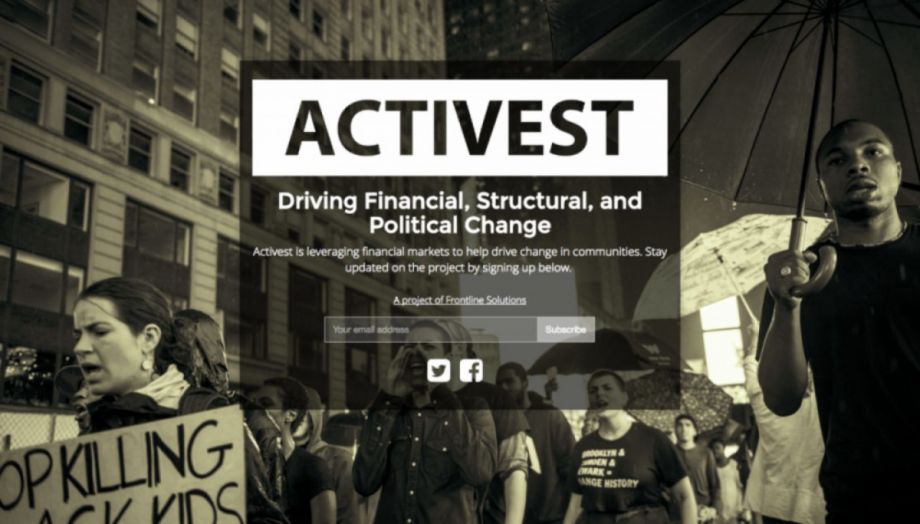

But Activest, the national initiative we are launching, takes a more aggressive posture toward municipal finance by asking the question, “How do our cities’ practices, policies, and budgets align with our values?” If we’re all somehow or another investing in municipal bonds, don’t we owe it to ourselves and our communities to divest of cities that continually get it wrong, and invest in those cities that are trying to take steps to do right?

That’s why our campaign seeks to bring transparency and accountability to the laws, decisions, and budget priorities over which cities have discretion. This all starts with our work on fines and fees. We’ll be calling out the worst offending cities in this area and exposing the heavy risks their predatory revenues pose to investors and the public. We’ll also seek to influence the rating agencies to use smarter metrics for evaluating the riskiness of municipal bonds—indicators such as unsustainable financial strategies and the likelihood of lawsuits and social unrest.

Activest will seek to facilitate greater coordination among socially responsible investors, criminal debt legal scholars, municipal finance experts, and grassroots activists. (This includes aligning with the Black Lives Matter coalition, which this week released a policy agenda that includes among its demands an end to money bail, fines and fees, and related charges.) This represents a possible new addition to the advocates’ toolbox: those who have consistently used a hammer to tear down an apparatus built on over policing and fines and fees now have a “crowbar” in the form of data-informed investor activism—a tool of leverage in the collective effort to end discriminatory municipal practices.

The overuse of fines and fees is not only morally wrong and in some cases unconstitutional, but also fiscally inefficient and reckless. We, collectively, must reckon with the injustice and instability that our democratically elected governments create, and that we indirectly fund through our investment. Join us as we push for the kind of changes that will serve all of us.

Ryan Bowers, Melissa DeShields, Micah Gilmer and Marcus Littles are Partners of Frontline Solutions, a national consulting firm that offers clients in the nonprofit sector a full range of services to enhance their impact. Frontline Solutions is helping change happen by expanding opportunity for all through a critical understanding of race, place, class, and gender.

_600_350_80_s_c1.jpg)