Coronavirus Has Wiped Out Every Job Created Since the 2008 Financial Crisis

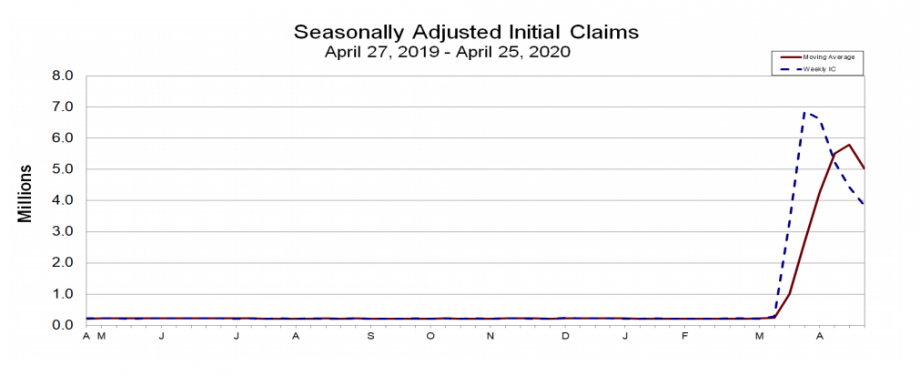

Another 3.8 million people applied for unemployment last week, bringing the total number of people who have applied for benefits in the past six weeks to 30.3 million, the Washington Post reports.

Economists estimate that the national unemployment rate is between 15 to 20 percent. At the peak of the Great Depression, in 1933, the unemployment rate was 25 percent.

The number of unemployed people could be even higher than the numbers reflect. Research by the left-leaning Economic Policy Institute found that from March 15 to April 18, another 8.9 to 13.9 million more people would have applied for unemployment if the process had been easier or if labor agency phone lines and websites had not been perpetually tied up. It’s unclear how many of those millions have managed since April 18 to successfully apply for benefits.

Meanwhile, states that have moved toward reopening — mostly red states, it should be noted — are pushing workers to return to their old jobs or risk losing their unemployment benefits, a position the federal Labor Department has affirmed, the Post reports. In general, workers receiving offers of “suitable employment,” which generally means wages and duties comparable to their recent jobs, must accept them or could jeopardize their benefits. But Michele Evermore, a senior policy analyst at the National Employment Law Project, told the Post, “I would argue having to go back to wait tables during a pandemic might not count as similar working conditions.”

Trump Appointee Manipulated Research on Payday Loans, Per Ex-CFPB Economist

The New York Times has obtained a memo sent by a Consumer Financial Protection Bureau on his last day of work claiming that Trump appointees manipulated agency research and acted in bad faith in order to weaken a rule on payday lending.

The original rule, which had been set to take effect in 2019 before Trump appointees proposed undoing most of it, would have limited lenders to making loans up to $500 but only for borrowers with no other outstanding payday loans, the Times wrote at the time. For larger loans, lenders would have to ensure that borrowers had the ability to repay the loan before making it.

In 2018, the CFPB began re-researching the rule, directed by Mick Mulvaney to do so; the Times reports that the memo said economists were directed to only research Mulvaney’s “preferred changes” without analyzing other alternatives.

Further, for any rule change, the agency was required to analyze how the proposed changes would affect consumers. But Brian Johnson, at the time Mick Mulvaney’s deputy, said that since the rule had not yet taken effect, abolishing it would have no effect on consumers. Staffers argued that this method was “frowned on by federal rule-making bodies,” the Times said, but were overruled.

Fed Tweaks Main Street Lending Program

A day after Next City published this story on the Federal Reserve’s Main Street Lending program, which is supplying capital to small businesses through loan participations, the Fed expanded the scope and eligibility of the program. Per a press release, bigger businesses (who have up to 15,000 employees and make up to $5 billion in annual revenue) are now eligible; the program tweaks also lower the minimum loan size from $1 million to $500,000 to “offer more options to a wider set of eligible small and medium-size businesses.”

This article is part of The Bottom Line, a series exploring scalable solutions for problems related to affordability, inclusive economic growth and access to capital. Click here to subscribe to our Bottom Line newsletter.