Philadelphia’s soda tax is safe — for now. The Pennsylvania Supreme Court last week upheld the city’s controversial tax with a 4-2 majority, the Philadelphia Inquirer reports.

Opponents of the tax saw it as an example of “double taxation” — a violation of a Depression-era state law called the Sterling Act forbidding cities from taxing anything already taxed by the state.

The court disagreed.

“The legal incidences of the Philadelphia tax and the commonwealth’s sales and use tax are different and, accordingly, Sterling Act preemption does not apply,” Chief Justice Thomas G. Saylor wrote in the majority opinion, as reported by the Inquirer.

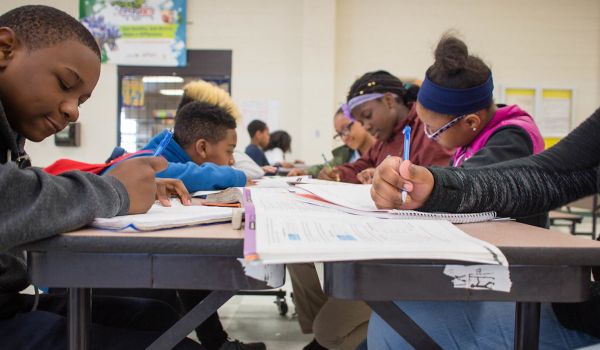

Philadelphia became the first big U.S. city to pass a soda tax in 2016, following in the footsteps of the smaller Berkeley, Calif., which passed a similar tax in 2014. At the time, Philadelphia’s tax — a key piece of legislation for Mayor Jim Kenney — was expected to raise $91 million a year to fund preschools, create community schools and improve recreation centers and libraries. (It’s raised less than initially projected, however, causing the city to lower its estimates by about 15 percent and downsize plans for those education-focused programs, according to the Inquirer.)

With the case completed the city can spend some of the funds that have been raised — Kenney said last week that the city would give the go-ahead for an estimated $56 million that had been reserved, the paper reports.

The court decision likely won’t mean smooth sailing ahead for the tax, however. The American Beverage Association has spent millions of dollars fighting it — along with other taxes in cities like Santa Fe, N.M., and Boulder, Colo. Pepsi last year registered its displeasure with the tax by ceasing distribution of certain items within city limits. A bill that would preempt and eliminate the tax is pending in the Pennsylvania House (a similar bill was recently passed in Arizona). And Kenny’s role in passing the legislation will likely be amplified in the next mayoral election, according to the Inquirer.

The mayor has stood behind the tax, however, and has advised other cities to craft their messaging around the funds created by a beverage tax, rather than the health impacts of sugar, as Next City has covered.

His statement last week reflected that messaging.

“These programs, funded by the beverage tax, will fuel the aspirations and dreams of those who have waited too long for investments in their communities,” he said, according to the Inquirer. “The City of Philadelphia will now proceed expeditiously with our original plans — delayed in whole or part by nearly two years of litigation — to fully ramp up these programs, now that the legal challenge has been resolved.”

Rachel Dovey is an award-winning freelance writer and former USC Annenberg fellow living at the northern tip of California’s Bay Area. She writes about infrastructure, water and climate change and has been published by Bust, Wired, Paste, SF Weekly, the East Bay Express and the North Bay Bohemian

Follow Rachel .(JavaScript must be enabled to view this email address)