In the recently released book Evicted: Poverty and Profit in the American City, Matthew Desmond chronicles the lives of people in two Milwaukee communities who are at constant risk of eviction from their homes. Desmond, a sociologist at Harvard University, shows that evictions are not a consequence of poverty, but a driver of it, adding to the national conversation on how housing connects families to opportunity.

Desmond’s book highlights evictions, an important but often ignored issue facing thousands of families across the United States. But evictions are an outgrowth of larger challenges around housing affordability.

Over the past three years, we have analyzed the consequences of the affordability crisis as part of the Housing Assistance Matters Initiative. Let’s take a closer look at what we’ve learned about housing affordability in the Milwaukee area.

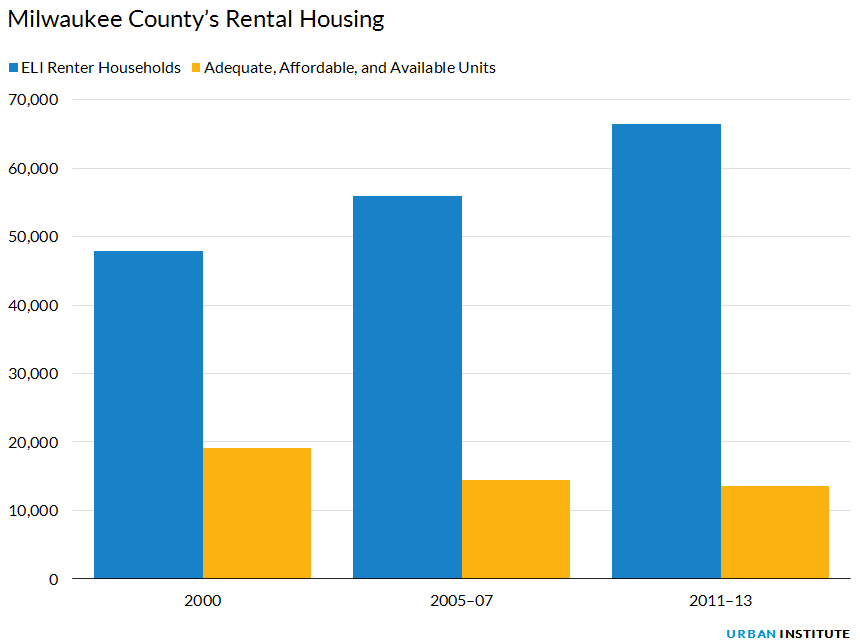

In 2000, Milwaukee County had about 48,000 extremely low-income (ELI) renters — households making less than 30 percent of the area’s median income — but only about 19,200 housing units that were adequate, affordable, and available to these renters. This large affordability gap grew between 2000 and 2013 as the number of ELI renters increased by nearly 40 percent to 66,400. At the same time, the number of affordable units decreased to 13,600. This means that 80 percent of ELI renter households in Milwaukee County (about 53,000) cannot obtain affordable housing and are likely making sacrifices on food, healthcare, transportation and other necessities.

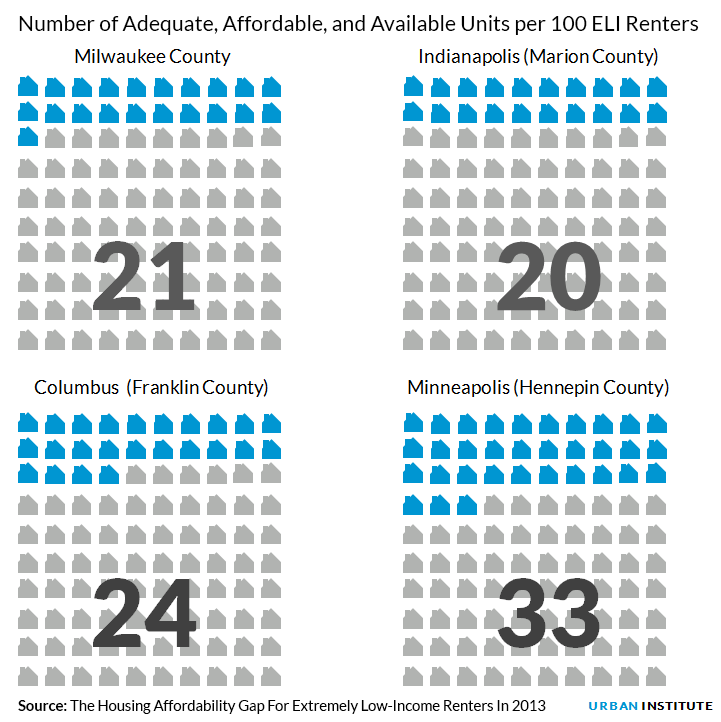

Put differently, in Milwaukee County there are only 21 units of adequate, available and affordable housing per 100 ELI renters. The results of the gap are clear in Desmond’s book: Families are both renting at unaffordable levels — sometimes paying over 70 percent of their income — and living in inadequate (e.g. poor plumbing, broken doors and windows) units.

But what is happening in Milwaukee is not unique. Indianapolis (Marion County) has 20 units of adequate and affordable housing for every 100 ELI renters, and Columbus (Franklin County) has 24. Even Minneapolis, one of the Midwest regions with the smallest gap for ELI households, still only has about 33 units per 100 renters. This dearth of affordable housing contributes to eviction and other damaging effects of housing instability.

How do we deal with this growing problem?

The market alone does not supply enough housing that is affordable to renters with these incomes. Nationwide, without public subsidy, there would be only five units of affordable housing for every 100 ELI households. Rental assistance helps make housing affordable to families with the lowest incomes, but there is not enough of it to meet the growing need. At current funding levels, housing assistance serves only one out of every four eligible households.

In order to address eviction, Desmond’s main recommendation is to expand housing assistance, namely the Housing Choice Voucher program, the largest rental assistance program in the United States. Vouchers put assistance directly in the hands of low-income families and facilitate housing choice and mobility. Increased federal funding for vouchers and other housing assistance is critical to closing the housing affordability gap, but current congressional approval of increased funding is unlikely.

Even if expanding the voucher program were a political reality, there are other impediments to the widespread use of vouchers. Voucher holders are not protected under the Fair Housing Act, which makes discriminatory housing practices based on race, color, national origin, religion, sex, disability or familial status illegal. Local studies have found that many landlords discriminate against voucher holders, further limiting housing options for low-income families. We have new tools from federal agencies to help communities meet the long-standing obligations of the Fair Housing Act, but to help voucher holders, we should also look to the local level. State and local governments could provide protections for voucher holders by adding source of income as a protected class in housing or human rights ordinances.

Expanding federal housing assistance and enhancing state and local protections against housing discrimination are powerful tools for improving access to affordable housing and helping families avoid the damage of eviction, which Desmond’s book poignantly illustrates.

This post originally appeared on Urban Wire. It is part of the Housing Assistance Matters Initiative, which educates Americans about the vital role of housing assistance. The initiative is a project of the Urban Institute, made possible with support from Housing Authority Insurance, Inc. (HAI, Inc.). The Urban Institute is a nonprofit, nonpartisan research organization and retains independent and exclusive control over substance and quality of any Housing Assistance Matters Initiative products. The views expressed in this product are those of the authors and should not be attributed to the Urban Institute or HAI, Inc.

Reed Jordan is a research assistant with the Metropolitan Housing and Communities Policy Center, and Emily Blumenthal is a research associate with the Policy Advisory Group, at the Urban Institute.