This weekend’s New York Times Magazine has a good piece detailing how taking on some debt can actually help the poor. It seems counterintuitive: How can owing more money help people who struggle to make ends meet in the first place? But as writer Shaila Dewan details, a smart approach to debt is one way to give low-income Americans a better shot at not only finding an affordable apartment or car, but some long-term security as well.

Many of the nation’s poor have found themselves in a nasty catch-22: You have bad credit, so you can’t get a credit card to build your credit. A community development group called the Local Initiatives Support Corporation is trying to change that by giving low-income earners the chance to take out small loans and, if they make their monthly payments, increase their very modest nest egg. (One man who spoke with the Times took out a $300 loan, which then doubled to $600 at the end of the year.)

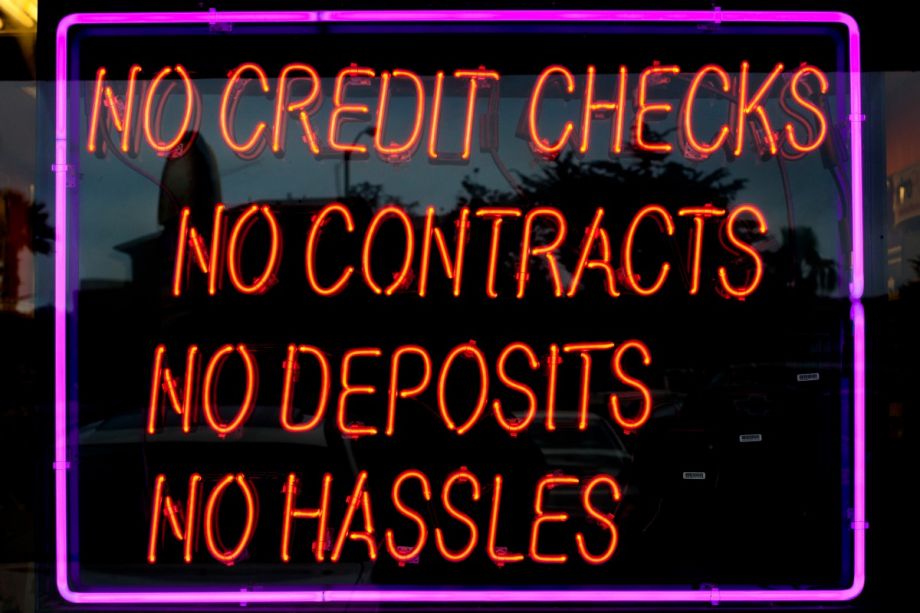

More importantly, this allows people to build credit where the opportunity to do so would not exist otherwise. For one, it can raise your credit score to a more palatable number for credit card companies. Beyond that, it can be a great help when it comes to buying cars (used or new), renting apartments (which requires extensive credit checks), and finding work.

The latter has become an increasingly large problem in cities, which suffer from large pockets of concentrated poverty. Last October I explored how credit checks from employers make it difficult for people who need a job to actually find one. I spoke with Christian Weller, a senior fellow at the Center for American Progress, who had this to say:

Credit checks create a vicious cycle — with an inequitable outcome — between being stuck in unstable, low-wage jobs and not having enough assets while having constantly to borrow at high-cost and high-risk debt. It creates a feedback loop because these communities of color are saddled with that high-risk debt I mentioned, which then feeds back into their job search if employers regularly check on credit for employment.

The Local Initiatives Support Corporation hopes to reverse that cycle by giving low-income earners the chance to boost their credit score. Raising that credit near the national average of 689 can do everything from making available lower-interest car loans to ensuring a job opportunity is not lost.

The Equity Factor is made possible with the support of the Surdna Foundation.

Bill Bradley is a writer and reporter living in Brooklyn. His work has appeared in Deadspin, GQ, and Vanity Fair, among others.