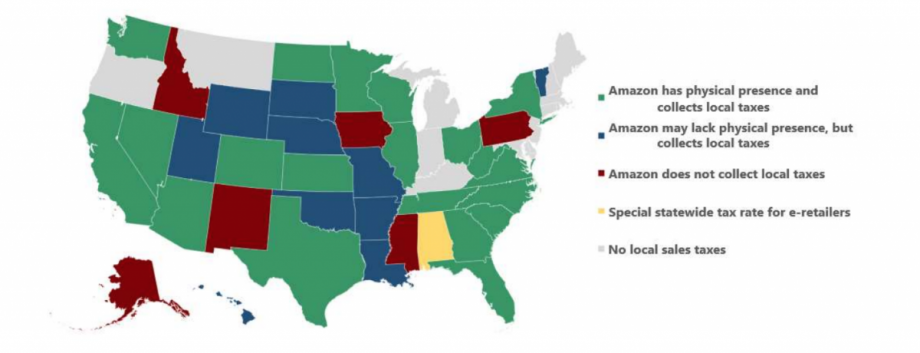

Last year, Amazon began collecting state-level sales tax on its direct sales. But it’s still not collecting city taxes in a number of states — while taking advantage of city services like roads and police forces — according to a new report from the Institute on Taxation and Economic Policy (ITEP).

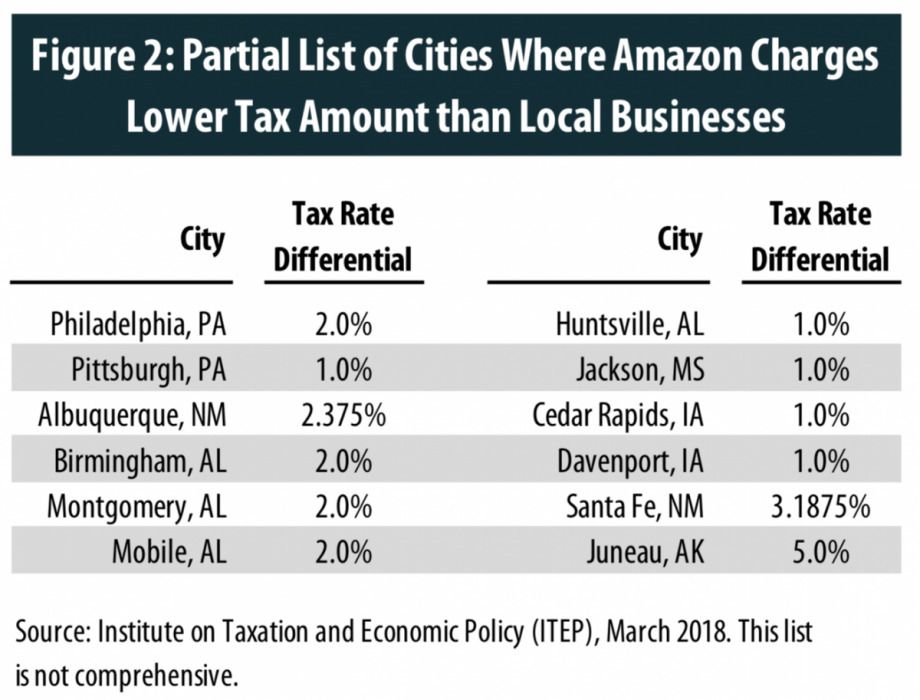

The e-commerce giant, which has been criticized for paying little in federal income taxes and asking cities to incentivize its HQ2, is either collecting a lower amount or not collecting local tax at all in seven of the 37 states with local-level sales taxes, the report from the left-leaning think tank states. Amazon charges less tax than local retailers in Philadelphia, Pittsburgh, Albuquerque, Santa Fe, and Birmingham, among other cities in the seven states, which include Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico and Pennsylvania. The gap between what Amazon collects and what local retailers collect “can be as high as 7.5 percent of an item’s pre-tax purchase price (in Homer, Alaska), but it is more commonly in the range of 1 to 3 percentage points,” the report states.

“This collection gap is harming local governments’ ability to fund vital programs, and it is contributing to an unlevel playing field for local businesses because millions of shoppers are able to pay less tax if they choose to buy products from out-of-state companies over the Internet rather than at local stores,” according to ITEP.

The gap can’t be blamed solely on Amazon — and is often the fault of state legislation, the report points out. In a recent article on the research, the New York Times detailed several of those laws.

(Credit: ITEP)

“Sales tax rules based on the location of the seller may be impossible to enforce if the company has no physical presence in that jurisdiction,” according to the paper. “And smaller online retailers can escape collecting sales taxes in more places than Amazon does — even when they use Amazon to sell their products.”

What’s more, a “hodgepodge of state laws” govern tax collection, according to the paper, so there’s no one simple solution for municipalities that are being undercut. The report offers several suggestions for cities left out under state law, including “destination-sourcing,” where the location of the buyer (rather than the seller) determines the tax amount collected, and the implementation of local “use taxes” at the state level to apply to interstate sales.

According to the Times, Albuquerque relies on sales tax for about two-thirds of its general fund revenue, which added up to about $500 million last year. The city has estimated that it lost roughly $5 million in tax revenue on Amazon purchases in 2016.

“The loser in that arrangement is cities,” Albuquerque Mayor Tim Keller told the paper. “Cities are really being left to themselves.”

Rachel Dovey is an award-winning freelance writer and former USC Annenberg fellow living at the northern tip of California’s Bay Area. She writes about infrastructure, water and climate change and has been published by Bust, Wired, Paste, SF Weekly, the East Bay Express and the North Bay Bohemian

Follow Rachel .(JavaScript must be enabled to view this email address)