Are You A Vanguard? Applications Now Open

This is your first of three free stories this month. Become a free or sustaining member to read unlimited articles, webinars and ebooks.

Become A MemberOn a bright November morning in Manhattan, several hundred luxury goods executives filed into the basement auditorium of the Morgan Library expecting to hear Paul Romer speak about China and innovation. Courtly, earnest and reserved, Romer is an academic economist by training, and it shows. Before the crowd’s caffeine could kick in, he offered a modest proposal: Rather than start the next Louis Vuitton, we should knock off Hong Kong. Cities can be startups too, he said. “We can build new ones much faster than people think.”

That’s what China’s paramount leader Deng Xiaoping thought in 1979 when he designated Shenzhen as the country’s first special economic zone. In less than 30 years, Romer explained, the fishing village across the border from Hong Kong had become a capitalist enclave larger and more populous than New York. Shenzhen, in turn, kicked off China’s transformation from a rural backwater to an export-driven powerhouse. Hong Kong and its copies, Romer likes to say, have done more to eliminate poverty than all the foreign aid put together, and he may be right. China lifted 660 million of its citizens out of absolute poverty between 1981 and 2008 — more than the rest of the world combined.

Romer’s appearance that morning was a favor to the hosts, his new colleagues at New York University’s Stern School of Business. A year ago, Stern lured the eminent economist back to academia with a $10 million gift for the Urbanization Project, a personal think tank devoted to creating new “charter” cities and massively expanding existing ones, thus planting the school’s flag in what dean Peter Henry believes will be a $20 trillion market in financing urbanization — and the next line of work for Stern graduates.

“We will do more urbanization in this century than we’ve done in all of history,” Romer said from the stage. “Whatever we do will establish the pattern that will last forever.” Expecting a day of social media tips and fireside chats with CEOs, the audience sat stunned — who decides that what the world needs now are mega-cities built from scratch in the its poorest places?

If Romer had logged a career at the World Bank, that would be one thing, but he made his name 20 years ago by proving how technology and innovation underlie economic growth. After another decade spent expounding on his theory at Stanford University, he put it into practice, starting his own online education company in 2000, just as the market for online education was shaping up. A few years later he uttered the catchphrase Rahm Emanuel would make famous during the early days of the Obama administration — “a crisis is a terrible thing to waste.” These days, the crisis Romer obsesses over is an urban one: How do you absorb another 3.5 billion residents in the coming decades without consigning them to slums?

The tale of two cities Romer told his audience that sunny morning in November is a cautionary one. Colonial Hong Kong was carved from China at gunpoint following the first Opium War, while its modern shape and form was defined by being an island both literally and figuratively — as a refuge for millions fleeing Mao Zedong. Later, Shenzhen grew so fast it absorbed hundreds of villages where they stood, along with an illegal “floating” population of rural migrants who man the most dangerous factories.

Romer acknowledges their origins of blood and sweat, and argues we could do better if we designed a city from the bottom up. “The opportunity is to create a number of cities,” he told the audience, “startups like Shenzhen.” These startups, which he calls charter cities, are new enclaves granted their own laws, immigrants and investors. They’re laboratories for testing competing forms of governance, erected on what in theory are clean urban slates. He went public with the idea in 2009 with a TED talk that quickly went viral in the international aid community while puzzling urban planners — because Romer isn’t one himself.

In fact, his lack of urban experience — let alone in designing cities ex nihilo — is seen by allies as a plus. “It was a big idea — a really, really big idea,” said Peter Henry. “There’s a joke that the really hard part of institutional development is the first couple of centuries — after that, it’s a piece of cake. The idea is, can you leapfrog some of these steps? Do countries really have to wait 200 years?”

Romer’s biggest idea is the importance of “rules.” Rules are, he, believes, the core DNA of any successful city — not sidewalks, not small blocks, not the width or layout of city streets. New ideas don’t need old buildings; they need strong patent and bankruptcy laws. Good rules explain why Nogales, Ariz., is roughly three times as rich as its sister city across the Mexican border. Instead of over-thinking urban form through rigid codes and top-down planning — the approach favored by modernists and New Urbanists alike — Romer and his partners refuse to plan at all, preferring to search for a minimum set of rules from which order can emerge. But what does it mean to build cities from scratch when the city itself is an afterthought?

That Romer should be the one picking up where Deng Xiaoping left off makes little sense unless you stop to consider how cities have been the proof of his theories all along. In 1985, economist Robert Lucas asked why they exist at all. “If we postulate only the usual list of economic forces, cities should fly apart,” he said in a now-famous speech at Cambridge University. “A city is simply a collection of factors of production — capital, people, and land — and land is always far cheaper outside cities than inside.” So how do you explain sky-high Manhattan rents?

Lucas looked to Jane Jacobs for the answer. In her book The Economy of Cities, Jacobs defined cities as places where “new work” is added to the old, and where new ideas combine to create (and destroy) industries. We can see the value of ideas reflected in those rents, Lucas said — smart people pay to live and work near other smart people.

But it would fall to Romer, in a landmark paper published five years later, to define “ideas” as the fourth and perhaps most powerful factor of production. Unlike the others, ideas can be shared, and the more they are, the more potent they become — the effect known as increasing returns to scale. Cities, as Jacobs would tell you, are where scaling happens. Romer’s insights underpin such bestsellers as Edward Glaeser’s Triumph of the City and Jonah Lehrer’s Imagine: How Creativity Works, explaining why dense cities get better as they grow bigger, as documented by the physicist Geoffrey West.

Romer didn’t think about cities for years, however, until after he had left academia to start and then sell an online education startup named Aplia, which pioneered putting college coursework online. By then his focus had changed from technology to rules. In the absence of good rules, he points out, “when you teach a man to fish, you destroy an aquatic ecosystem.” Laws and institutions turn out to influence growth as much as innovation — and without them, the latter doesn’t happen. How else to explain the stark divergence of North and South Korea? Before the war, the North was the more technologically advanced of the two.

Now — and this is where Romer diverges from his peers — if rules are ideas, and ideas can freely be shared, then tax codes, anti-trust laws and independent judges should be shareable as well. And if cities are the places where new ideas take root and grow to scale, well, we should be building more Hong Kongs — and we should be able to build them anywhere. By transplanting rules from well-run nations to poorly governed ones, we can close the development gap between them, just as China has done. That, in a nutshell, is the rationale for charter cities.

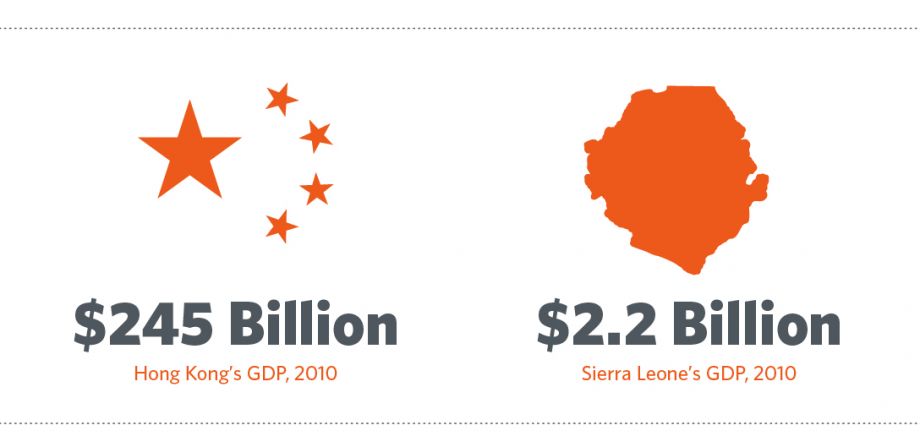

“We understand very well what it would take to make Sierra Leone a rich country. What we don’t know is how to turn it into South Korea.”

At heart, they are a development scheme, an attempt to lure private investors to replace foreign aid, which study after study suggests does as much harm to developing countries as good. But investors are understandably reluctant to pay for infrastructure and relocate factories to basket-case nations making only a token effort at upholding the rule of law. What Romer is ultimately selling is trust — trust in the rules and regulations of a wildly successful entrepot such as Hong Kong, and trust in the idea that the personality of a Hong Kong can be grafted onto another place.

If only it were that easy, say his critics. James Robinson, a professor of government at Harvard and co-author of Why Nations Fail, agrees that rules and institutions determine cities’ success or failure. But he dismisses the idea Hong Kong could be the model for a charter city outside China, or that social norms can be transplanted wholesale to other cultures. “We understand very well what it would take to make Sierra Leone a rich country,” he says. “What we don’t know is how to turn it into South Korea.” In other words, culture still matters — and it can often be the enemy of progress.

Romer discovered this for himself when he began crisscrossing Africa and buttonholing government officials. At one point, Madagascar’s president was prepared to give him not one city, but two — but was overthrown before he could put it in writing. Another coup, this time in Central America, would provide Romer with an opening.

On the morning of June 28, 2009, Honduran president Manuel Zelaya was awoken by soldiers, stashed on a plane and deposited in Costa Rica still wearing his pajamas. The coup had been a long time coming, practically since his election three years before, when he proved to be more of a reformer than his backers in Congress had bargained for. The army accused Zelaya of plotting to rewrite the Constitution to pave the way for his re-election; Zelaya decried the plot as illegal. A truth and reconciliation commission would later decide they were both wrong, but by then Zelaya wasn’t getting his old job back, and it’s fair to ask whether anyone would want a second term.

Honduras has the world’s highest murder rate, with more homicides per year than all 27 nations of the European Union combined. San Pedro Sula, its second-largest city and the center of the garment trade, is more violent than Ciudad Juarez, home to Mexico’s drug cartels. This isn’t a coincidence: Mexico’s literal war on drugs has driven the cartels south into Central America, with increasingly lawless consequences. Killers are rarely brought to justice — even when they’re the police.

When the son of a university rector was murdered in October, police officials admitted the suspects were fellow officers but failed to detain them. A former police commissioner who subsequently charged that their ranks were riddled with drug traffickers was assassinated in December. In the face of such institutional dysfunction, it’s tempting to imagine how a clean slate could provide the country with a much-needed opportunity to reinvent itself.

A year after the coup, Honduras still found itself an international pariah, cut off from foreign aid while investors streamed toward the exits. Aides to the new president Porfirio Lobo were brainstorming ways to lure them back when a friend sent them the link to Romer’s charter cities TED talk.

Lobo, his chief of staff Octavio Sanchez and Juan Orlando Hernandez, president of the Honduran Congress, flew to Miami in November 2010 to hear Romer’s pitch. Impressed, Lobo invited him to the Honduran capital, Tegucigalpa, to make his case to Congress. Accompanied by his father, a former governor of Colorado and past chairman of the Democratic National Committee, Romer traveled to the capital in January, and within weeks Congress had passed a constitutional amendment granting Lobo’s government the power to create Special Development Regions (“las Regiones Especiales de Desarrollo” or “REDs”) modeled on charter cities. The vote was 126 in favor; one opposed (with one abstention).

The Lobo administration wants to get the first RED up and running in the next year or two, before the next presidential elections. To get this done, the administration has empowered Coalianza, an agency created in March 2011 to manage the country’s public-private partnerships. Overseeing a handful of staff are three commissioners, including Sanchez and Carlos Pineda, a 41-year-old lawyer and the eldest member of what he calls “our de facto think tank” — a close-knit group of free market reformers who go back a decade together. “The international community was against us, unemployment was 42 percent,” and foreign direct investment — never more than $1 billion annually to begin with — had been almost halved, Pineda told me recently at Coalianza’s headquarters, an airy, unmarked villa on a gated street in Tegucigalpa.

Unlike a previous generation of instant cities such as Brasilia, or debt-fueled fantasies like Dubai, the REDs are deliberately being planned on the cheap. “How do we do things with no money down?” Pineda asked rhetorically. “How do we not max out the credit card?” One answer is to let others pay. To that end, the Constitutional statue passed last July enshrines the principles of free trade, low taxes and open immigration in the zones, in the hopes of making them more attractive to manufacturers than Mexico or China. On top of that, the REDs can establish — or outsource to foreign governments and companies as necessary — their own hospitals, schools, courts, judges and even police. They are public-privatized states-within-a-state, or rather pieces of states-within-a-state.

In practice, this means creating separate police for the REDs under the tutelage of foreign instructors or private security forces. Judicial nominees might come from outside Honduras (as they are in Hong Kong), and the final court of appeal might be the Supreme Court of Mauritius — an island nation ten thousand miles away.

Day-to-day governance is hardly less complicated — local governors will be watch-dogged by audit committees and report to a nine-member “Transparency Commission,” whose pro tem chairman is Paul Romer. From there, the REDs dissolve into a welter of overlapping and competing jurisdictions — municipal governments, unincorporated areas, even “opt-out” zones administered under Honduran law, not the RED’s.

“Whatever we do will establish the pattern that will last forever.”

All of which underscores the monumental planning challenge facing Coalianza. Each zone — or rather each site, of which a RED may have several — is 200 square kilometers, or more than twice the size of Manhattan. The buildout will begin in 50-hectare (123-acre) increments, that being the average size of your typical free trade zone. The land inside will technically be owned by the RED, which means the government must either acquire or grandfather in (and tax) whatever acreage it doesn’t already own. Romer’s ideal charter city occupies uninhabited land, “but there is no place in the country like that,” Pineda said. Still, he and his colleagues hoped to avoid what he called the “original sin of taking land by force.”

A dozen sites are under consideration to be the first RED. All lie along the coasts or near the borders of Guatemala, Nicaragua and El Salvador, as residents are expected to vote with their feet until elections are held. They hoped to make an announcement within the next 60 days, Pineda told me, but stressed that everything was still provisional — a “menu of options,” he said, that “should be treated as a draft.”

At dinner that evening at his favorite hole-in-the-wall baleada joint — baleadas being Honduras’ answer to the burrito — Sanchez, the president’s 30-something right-hand man, took this sentiment still further. Pineda’s ideas were his own, he claimed, not government policy; the renderings I’d seen weren’t official; announcements by competing groups — one calling itself the Free Cities Institute and another Future Cities Development Inc., a builder of cities for profit — were delusional; and the design of these cities was not only unsettled, but was ultimately unimportant. They were an urban Rorschach blot, in which each of the principals saw a provisional path to social transformation.

“It’s a tool for everyone to imagine their future,” is how Sanchez described the REDs. “You see what you want to see.”

Imagining the future is one thing; designing cities for as many as 10 million inhabitants (in a country of only 7.5 million) is an altogether different exercise — especially if you doubt that urban form and planning make any difference in their success.

“Do you know of the South Pacific cargo cults?” Romer asked me last October. He was referring to the tribes who had ritually restored World War II landing strips in hopes the U.S. Army would return, bringing C rations with them. For 70 years, they’d mistaken circumstance for causality. “I think architects may be running their own cargo cult,” he said. Their obsession with form had blinded them to the true importance of rules. Look at the Army: “It went from one of the most segregated institutions to the most integrated” gradually in the decades following the Vietnam War. “The buildings didn’t change.”

“It’s important that buildings don’t catch fire or fall down when there’s an earthquake,” he added, affirming the necessity of building codes. “Otherwise, I don’t think it matters all that much.”

Romer had made a similar point a few years earlier in a debate with Yale University economist Chris Blattman, who had compared charter cities to the infamous high-rise public housing projects of Chicago’s Cabrini-Green. Romer replied that high-rises had worked “remarkably well” in sheltering the poor of Hong Kong and Singapore. “The key difference between these cases lay not in the hardware or architecture but rather in the supporting rules, particularly those related to crime,” he wrote. Architectural historian Katharine G. Bristol made a similar case in her 1991 essay “The Pruitt-Igoe Myth” arguing modern architecture hadn’t failed the residents of infamous St. Louis projects —institutions had.

Still, plans must be made, not just for Honduras but for the potentially dozens of charter cities Romer hopes to inspire around the world. His guru in these matters is Shlomo “Solly” Angel, who teaches planning at NYU and Princeton and was his first recruit for the Urbanization Project. Angel saw the developing world’s urban explosion first-hand during a 30-year career as an advisor to the United Nations and the World Bank in Bangkok, Nairobi and across Latin America, including Honduras. Most recently, he’s turned to geographic information systems and satellite photography to document the astounding pace of urban expansion.

Angel’s working theory of instant urbanism can be reduced to two principles, each of which is controversial. The first is that outward expansion is inevitable and must be accommodated, and the second is that the mistake most planners make is to plan too much, not too little. “What I try to do is the opposite of what these other guys are trying to do,” he told me recently in his SoHo loft. “They’re trying to specify more and more and more. I’m saying: ‘What is the minimum amount that I could specify?’ And after that, I say I don’t care.”

The minimum, he believes, is a grid, Manhattan’s being the exemplar. In 1811, when the city was barely settled above Houston Street, a three-man commission produced the plan to grid the entire island up to what is now 155th Street, a grid that was later extended into the Bronx and Brooklyn. Thomas Jefferson had performed a similar feat in drafting the Land Ordinance of 1785, which eventually gridded three-quarters of the United States into townships.

Angel’s plans for cities such as Santo Domingo, Ecuador, called for extending their grids into hundreds of square kilometers of farmland. “We don’t have to specify everything” if we have a grid, he argued — not even streets. In Bangkok, he noted, developers negotiate directly with residents to acquire the right-of-way needed for the city’s filigree of residential streets. But in the absence of a grid, its few arterial roads lie miles apart, causing its infamous traffic jams.

Markets can do most things, he said, but we still must plan the public goods — including the location of the port, the airport and the arterial grid. “When you talk to economists, they somehow have convinced themselves that planning has no role — that the market can generate whatever it needs to generate,” he said. “Look: The market will not actually generate the public goods necessary to build cities.”

On this point he’s in agreement with another of Romer’s muses, a World Bank planner and consultant named Alain Bertaud. As a junior architect, Bertaud toiled on the construction of Chandigarh, the Punjabi capital designed by Le Corbusier. The experience seems to have soured him on his profession; he rails against planners’ “intellectual stagnation” on his website.

To Angel’s rules, he adds two of his own. First, any charter city should be “a very dense, mono-centric city,” he told me, to maximize accessibility to the factories that are its raison d’etre. In a country like Honduras, where horse-drawn carts are still common, sprawl and long commutes could inhibit economies of scale. Second, the authorities shouldn’t limit plot sizes anywhere in the city, in order to let residents lease as much or as little space as they can afford.

“One of the main problems with Chandigarh is that it was immediately surrounded by slums,” he said, “and then those slums were pushed further and further away.” Any city meant to attract the working poor must not only embrace informal settlements, but actually formalize them. “You have no way of knowing what tradeoffs they will want to make on housing when they come. The best solution is to let it float completely…I would demand a minimum amount of infrastructure, but not space.” As an aside, he added, “no urban planner would go for this.”

“Honduras was the original ‘banana republic,’ molded by United Fruit and its competitors in their own competing interests.”

Angel’s and Bertaud’s insistence that private interests can’t produce public goods would appear to contradict the desire of Romer and Coalianza to let investors pick up the tab for just about everything. Not only would this be a windfall for Honduras, but it would also be a triumph over economists such as Jeffrey Sachs (whose Millennium Villages Project has come under fire yet again) who argue the only thing that can save impoverished nations is a massive infusion of aid.

And what is a “public good,” exactly? Highways? Hospitals? Utilities? Schools? Charter schools, for-profit clinics, and infrastructure operators such as DP World (which runs 60 ports worldwide) all demonstrate how public goods can be privatized — including roads, the most prominent example being the lease of the Chicago Skyway to investors for $1.83 billion in 2004. The REDs thus also represent an opportunity to realize the fully privatized metropolis envisioned by the George Mason University economist Alex Tabarrok in The Voluntary City.

As Tabarrok explains it, the key is to “internalize the externalities,” i.e. compelling everyone to pay the costs of public goods. Companies might be enticed into planning and paving streets, for example, so long as they can charge congestion pricing. “Since they’re starting from the ground up, there’s a huge opportunity to do things differently,” Tabarrok told me. “There’s no reason why you can’t have private roads or private security firms.”

This thought has occurred to Patri Friedman — seasteader, grandson of the University of Chicago economist Milton Friedman and managing partner of Future Cities Development, Inc. In an interview last fall, Friedman described his firm as a “platform” for creating cities with “cutting-edge legal systems” and decentralized, privatized infrastructure. Although Friedman claimed to have signed a preliminary agreement with the Lobo government to develop a proprietary flavor of RED, Sanchez strenuously insists otherwise.

“Maybe having a corporation run the place is a pretty good idea,” Tabarrok said. “People will accept it — I don’t think people want democracy all that much. They’re not that concerned about democracy until their wealth has built up to a considerable degree. Not having a democracy is okay, especially when people can leave.”

Honduras created special development zones once before. More than a century ago, the United Fruit Company and its twin subsidiaries, the Tela Railroad Company and the Trujillo Railroad Company, ran vast banana plantations from private enclaves in Tela Nueva and La Lima known as the Zona Americana — the American Zones. These were your classic company towns, complete with golf courses, hospitals and schools — a few of which are still around.

“They’re some of the best in the country,” insisted Daniel Facussé, president of the Honduran Maquila Association, the trade group for the tax-free textile factories that employed 133,000 Hondurans prior to the financial chaos of the coup. He drew a straight line for me from the zonas to the REDs. “Yes, it’s true that all of them were made by the companies,” he said, “but they were physically set up in a small town. At the time, they also had their own rules and regulations.”

“There was also a change of culture,” he added with a note of admiration. “A culture of saying the company is not only responsible for the benefits of their workers, but also for the benefits of their families…[and for] society itself.”

To say the fruit companies played by their own rules would be an understatement. Honduras was the original “banana republic,” molded by United Fruit and its competitors in their own competing interests. Successive Honduran presidents ceded huge tracts of land for infrastructure that stopped at the plantations’ edges. (To this day, Tegucigalpa lacks a train station.) At one point, United Fruit’s fiercest competitor — and later, its controlling shareholder — sponsored a successful coup to overturn a rival’s concessions. The United States intervened seven times between the turn of the century and 1925; the fruit companies continued to back local military governments until the 1980s.

Opponents of President Porfirio Lobo’s government see similar parallels between the zonas and the REDs, with the latter a tool to finish the job started by the coup. When Manuel Zelaya was elected president in 2006, he appeared to be the latest in a long line of entrenched elites to hold office, dedicated to preserving the status quo. But by their standards he turned out to be a reformer, lowering school fees while increasing the minimum wage (which didn’t extend to the maquilas). He cut a deal with Venezuela for oil at below market prices in exchange for closer ties to its president, Hugo Chavez. He also hindered the privatization of the telecommunications industry, which eventually proved to be a massive success. And most alarming of all, in 2008 he called for a referendum to rewrite the constitution drafted under the generals.

Zelaya’s enemies (and by then there were many) labeled this a power grab. The first thing to be erased, they charged, would be his term limit. As a compromise, he pushed for a non-binding national referendum in June 2009, on what would turn out to be the day of the coup.

Explanations for his ouster tend to pivot on the referendum and his relationship with Chavez, although some activists insist the real reason was his tepid support for privatizing state-owned utilities. Dragging his feet on selling off the water, power and telecom industries brought him into direct conflict with the handful of families controlling large swaths of the economy, they say.

“Zelaya was stopping that stuff; they were looking for a pretext,” says Dana Frank, a professor of Latin American history at University of California, Santa Cruz who has lobbied on Capitol Hill to suspend all U.S. military and police aid to Honduras. (The 2013 Obama budget would more than double it.) “The real coup is the privatizations they have planned.”

As an example, Frank points to the law passed in March 2011 passing control of the national education system to the municipalities, which are now free to fund for-profit charters. Simultaneously, Zelaya’s predecessor will lead a program dramatically curtailing the pay of new hires in the public system. Unsurprisingly, the law’s passage prompted a nationwide teachers strike, which was met with teargas in Tegucigalpa and the threat of mass suspensions.

Land reform is another sticking point. Fallow banana plantations in the northeast were converted to palm oil cooperatives in the 1960s and 1970s, until a law passed in 1992 permitted wealthy landowners to buy the struggling co-ops. Today, one of the largest plantations belongs to Corporation Dinant, which in turn is controlled by Miguel Facussé, the father of Daniel Facussé and the uncle of former president Roberto Flores.

Following the coup, thousands of campesinos occupied Dinant farmland they claimed had been stolen from them, leading to clashes with soldiers, police and Dinant’s private security forces, resulting in the deaths and disappearances of dozens — including five campesinos acknowledged to have been killed by Dinant employees. In April, several thousand campesinos briefly occupied 30,000 acres of private farmland around the country before being dispersed — in some cases peacefully, in others with the use of force. Miguel Facusse described the occupation as horrorosa (appalling) to the newspaper El Tiempo.

“You see here the problems of impunity,” Antonio Maldonado told me in Tegucigalpa. Maldonado was appointed as the United Nations’ human rights advisor to Honduras in 2010 and has been frustrated in the role ever since. “We don’t know of one important case which has been duly investigated” — not one, he emphasized. The problem wasn’t a lack of resources, no matter what the government claimed, nor could it be solved by outsiders setting a good example. (“You can bring in the best trainers in the world and keep the same behaviors,” he said.) The problem, simply put, was institutional rot (“Prosecutors, judges and police officers don’t do their work!”), and it was slowly corroding democracy in Honduras. He described the REDs’ vow of judicial integrity as a “promise that is impossible to keep.”

This corrosion is visible in the annual Latinobarómetro poll. Less than half of Hondurans presently believe democracy is preferable to any other type of government, while more than a quarter admit an authoritarian regime is occasionally preferable. Proportionately more Hondurans felt this way than residents of any other nation in Latin America. “The danger is the hollowing out of the rule of law,” said Kevin Casas-Zamora, a Latin America expert at the Brookings Institution and a former vice president of Costa Rica. “People are just willing to put up with the encroachment on their civil liberties for the sake of fighting crime. They’re terrified.”

In Why Nations Fail, James Robinson and his co-author, MIT economist Daron Acemoglu, stress the difference between “inclusive” and “extractive” economic institutions. Inclusive institutions such as property rights, contracts, education and competitive markets embody rules designed to maximize opportunities for everyone; extractive institutions such as monopolies and conglomerates consolidate wealth in the hands of a few, squelching growth and innovation.

This dichotomy explains the development gap between Sierra Leone and South Korea —the same gap Romer is trying to close in Honduras through the REDs. But telling President Lobo and Congress which rules to adopt will never work, the authors argue. Failing states “get it wrong not by mistake or ignorance, but on purpose.”

The reason we can’t simply transplant inclusive rules from one state to another has to do with a second set of institutions — political ones — and whether they manage to balance power between elites, the people and the state. Successful nations do this well, begetting the economic rules Romer cherishes. Failing states produce dictatorships, kleptocracies and banana republics — or in Honduras’ case, all of the above.

It’s clear that Romer envisions charter cities as a new kind of inclusive institution, engineered to cram centuries of socioeconomic evolution into decades. What’s less clear is whether Honduras’ entrenched elites are invested in reforming themselves. Is it true that “the politicians recognized they themselves were the biggest obstacle,” as Mauro De Lorenzo, the deputy director at the Urbanization Project, told me in Tegucigalpa? Can an extractive regime spin off inclusive institutions? Robinson is firm in his answer: no. Close observers of the region agree. “They control the game,” said Casas-Zamora, “and they will find a way to benefit from this.”

“It’s a fallacy, in some sense, to think the markets are the enemy of the poor.”

If Romer has any qualms about his partners, he isn’t saying — he declined multiple requests for interviews — but Peter Henry leapt to his defense. “It’s a fallacy, in some sense, to think the markets are the enemy of the poor,” Henry told me, dismissing the charge that charter cities amount to neoliberal neocolonialism. “If you look at the last 35 years of human history,” he said, “there is overwhelming evidence that markets are helping people out of poverty.”

For mayors across the developing world who are already swamped by the leading edge of the world’s final, epic migration — Solly Angel predicts urban populations will double in 40 years while the built environment triples in size — there may not be time to create a better option. Regardless whether the REDs work as Romer intended, they may still prove to be the template for privatizing urbanization. The size of the market dwarfs even Henry’s optimistic projections — a recent study by Booz & Company estimates the cost of building, running and maintaining the world’s cities at an astounding $350 trillion over the next 30 years. A land rush is underway in more ways than one.

“The success or failure of the Urbanization Project doesn’t hinge on the success or failure of the Honduras experiment,” said Henry, who is already looking ahead to the opening of NYU Shanghai in 2013. “The story in emerging markets is cities.” With twin campuses in both the Middle East and China, perhaps no business school is better positioned to lead the charge than Stern, with Romer in the vanguard chartering new ones. If the REDs are really a tool for imagining an urban future, then the one thing everyone involved wants to see — or fears — are dollar signs.

Our features are made possible with generous support from The Ford Foundation.

Greg Lindsay is a contributing writer for Fast Company and co-author (with John D. Kasarda) of the international bestseller Aerotropolis: The Way We’ll Live Next.

His writing has appeared in The New York Times, The Wall Street Journal, Bloomberg BusinessWeek, The Financial Times, McKinsey Quarterly, World Policy Journal, Time, Wired, New York, Travel + Leisure, Condé Nast Traveler and Departures. He was previously a contributing writer for Fortune and an editor-at-large for Advertising Age. Greg is a two-time Jeopardy! champion (and the only human to go undefeated against IBM’s Watson).

Eleanor loves animals: You name it, she’s probably drawn it. Eleanor’s unique graphic perspective aims to simplify lines and playfully arrange form to capture the essence of each animal she draws. She’s well known for her graphic take on our feathered, furry and fuzzy friends, and her illustration career has grown from its rock poster roots with jobs for clients such as Keds, Giro, Urban Outfitters and Wilco.

20th Anniversary Solutions of the Year magazine