Philadelphia Mayor Michael Nutter and City Council President Darrell Clarke have been feuding over how to pay for an emergency funding plan for public schools so they can open on time. Nutter wants to borrow $50 million against an extension of the city’s sales tax hike, while Clarke wants to buy unused school buildings and resell them to developers.

While there is some concern about whether the properties could really fetch $200 million, as the Office of Property Assessment estimates, Clarke’s idea is certainly more progressive from the standpoint of distributional politics. And there’s reason to believe that the concept of getting more city-owned real estate back on the tax rolls could extend to other types of properties, municipal surface parking lots in particular.

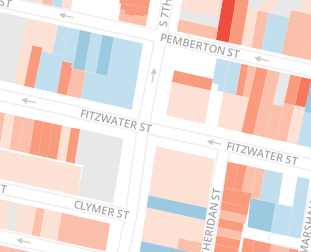

To see how this would benefit the city budget, consider the case of a municipal lot in the Bella Vista neighborhood. Casey Thomas’ interactive property assessment map at AxisPhilly (now defunct but we have screenshots) allows us to take a deeper look at the opportunity cost to the city of wasting this land on surface parking.

Here’s the parcel, colored in gray at the southwest corner of Fitzwater and 7th streets:

The post-assessment land value for this lot is $95,400, up from $65,000 before the reassessment. It contributes $0 in property taxes because it’s owned by a government entity, the Philadelphia Parking Authority.

Isaiah Thompson reported on what looks like a systematic underassessment of vacant land, so the actual market price this parcel would fetch in an auction would likely be higher. If the city could pay the Parking Authority the official assessed value and then auction it for something closer to the real market price, it would make a profit.

But that’s not even the main reason to sell the lot. The real return would come from converting it into a new mixed-use building. Take a look at what some similarly sized parcels nearby return to the city in property tax revenue.

Right across 7th Street, on the southeast corner of the intersection, are seven three-story rowhouses and a private parking lot. The land value for this group of parcels adds up to $206,895, despite being just a bit larger than the municipal lot by one or two rowhouses’ worth of space.* But with $3 million worth of improvements, the southeast corner contributes $42,636 in property tax revenue to the city budget each year.

The northeast corner, which has five three-story rowhouses, yields a bit less in property tax revenue for the city even though it has a higher combined land value of $398,958. This is because Philadelphia taxes improvements more than land, and the value of the improvements is just $1,365,542 — about half as much as the southeast corner.

(Since assessment data is not available for 729 and 727 S. 7th St., I assigned these properties the same values as the lowest-value property on the block. Unless they are drastically different that the similar rowhouses on the block, I estimate that the northeast corner contributes about $31, 464 in property tax revenue.)

The pitiful fiscal return from the northwest corner of this intersection really drives home the point that surface parking lots are a low-value land use that should be discouraged even when they are privately-owned.

The Fitzwater Cafe building is a short one-story building set far back from the sidewalk, and sits on a lot about the same size as the municipal parking lot and the other clusters of properties I looked at. The majority of the lot is used for off-street surface parking.

The land value for the northwest corner is $145,100. But the small Fitzwater Cafe building is worth just $162,500, and so it contributes only $4,122 in property taxes. That means the northwest corner generates almost 12 times less in property tax revenue than the southeast corner, and eight times less than the northeast corner:

This chart should really be the starting point for any discussion of city fiscal issues.

It’s a big global economy out there, and Philadelphia doesn’t have a whole lot of control over the macro trends that affect its economy and budget. But one thing local government definitely has a lot of control over is how well the land inside city limits is used. We’re seeing that Philly could do more to boost the fiscal oomph on each and every block.

So what is the policy agenda that follows from this chart?

One takeaway is that if the city bought this PPA surface parking lot for $95,400 and sold it to a developer who builds seven three-story rowhouses on it, it would take between two and four years’ worth of property tax receipts for the investment to pay off. After that, the city would get a higher revenue yield from that land in the long run.

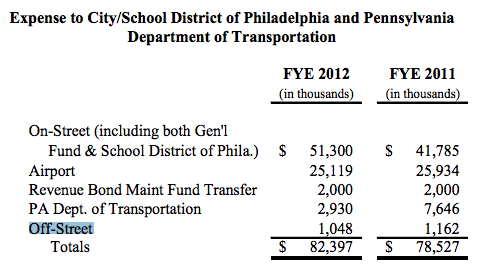

The lowest-hanging fruit would be to sell off city-owned surface parking lots. According to the most recent Philadelphia Parking Authority financial statement from 2012, PPA manages more than 50 parking lots just like this.

All of these lots would be better off on the tax rolls. They contribute far less than the city could get in the long run by turning them into new housing or mixed-use buildings. Of the $82.4 million that PPA remitted to the city, the school district and the Pennsylvania Department of Transportation in 2012, only about $1.05 million came from the entire off-street parking system, which includes parking garages:

If PPA lost the revenue stream from these neighborhood surface lots, it could make it up from major sources of revenue like on-street parking, or even better, airport parking.

And that’s just city-owned land. What about private properties like the Fitzwater Cafe building, which deliver very little property tax yield for the amount of land they use?

The best option would be to tax the land value at a higher rate than improvements. If every property at this intersection paid a higher tax rate on land value rather than the improvements, then landowners on the northwest and southwest corners would pay property tax bills closer to what those on the northeast and southeast corners pay, and the northeast and southeast landowners would pay less.

There would be a higher cost to wasting so much space, and those landowners would likely redevelop their properties into buildings that produce more revenue. Some would sell their properties to new owners interested in redeveloping, and others would simply pay more for the privilege of wasting land in pricey areas on low-yield uses like surface parking.

The argument isn’t that this tax shift would be a cure-all for the budget, or that it would eliminate all surface parking from Philadelphia. Many surface lots would surely remain, but their owners would pay more of the taxes for municipal services, and the tax burden would be reduced for people who choose to use their land for higher-value improvements, especially mixed-use apartment buildings. At the margin, Philadelphia would see more infill construction, more economically productive blocks and reduced car dependence.

That’s probably why shifting the city’s property tax burden onto land value enjoys support from the Philadelphia realtors, and is included as a goal in the Philadelphia 2035 plan.

* This seems to be a good example of Thompson’s observation that vacant land has been under-assessed, since it’s not clear why these roughly identical land parcels would be assessed at such wildly different values. They are similar in size, and both are in the same school catchment area. Why did assessors think one was so much less valuable than the other?

Jonathan Geeting is a freelance writer based in Philadelphia, where he writes about land use and public space politics. His work appears at Next City, This Old City and Keystone Politics.