When it comes to foreign direct investment (FDI) in the United States, some communities are seeing it as a panacea, but others aren’t so sure. For the U.S., the notion of FDI — or the investment by other countries in U.S. entities — can sound a bit scary, especially when China is involved.

Much of the concern surrounding FDI has to do with not knowing what you’re going to get. When asked about recent investments in Toledo, Ohio, Rep. Marcy Kaptur, who represents the city in Congress, argues that all countries make for equal investment partners. She calls FDI by China “a game of chance.”

In a recent interview, Christina McFarland of the National League of Cities explains that “proper vetting” is the main way to address the concerns of local leaders. “Building business connections and relationships in advance,” she says, “will allow for “proper vetting practices to occur.”

But this vetting process seems to be left mostly to the federal government, with advice to local leaders lacking a bit in substance. In an NLC report last year, McFarland and her co-author put forth a local strategy for pursuing FDI, emphasizing that “performing due diligence when considering lead generating consultants.” But the report only suggests: “If the business is located within the U.S., be sure to check references.”

On the other hand, the foreword to a 2009 report by Deloitte, which acts as guide for Chinese investors, cautions that “while U.S. policy is largely welcoming of foreign investment, it is the product of an on-going trade-off between the desire to maintain an open investment environment and the need to address national security interests in a post-9/11 world.” The document serves to calm citizen nerves a bit, outlining a fairly complex due diligence evaluation process.

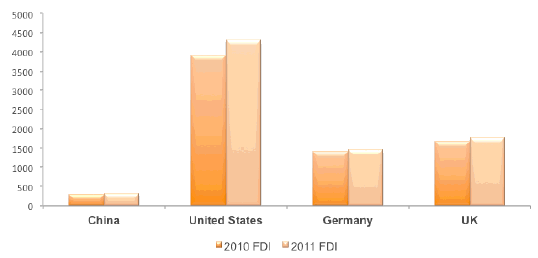

While the influx of FDI into U.S. communities increased by 50 percent between 2009 and 2010, the United Nations reported that U.S. FDI inflows had declined almost 40 percent for the first half of 2012. China saw only a 3 percent drop in the same period, usurping the U.S. as “the world’s top destination for foreign investment” for the first time since 2003. But while China is a destination for FDI, it is making relatively modest foreign direct investments worldwide.

FDI abroad (USD) by country. Credit: U.S. Department of Commerce

In the U.S., concern over FDI from China has been dominating headlines and raising concern. But how much is China actually investing in the U.S. market? A report by the National League of Cities ranks the top FDI countries in the United States by number of jobs created. The chart below lists the corresponding level of investment of the same countries in terms of income from FDI in the U.S., revealing that FDI does not necessarily correspond with job creation. Perhaps most interesting: China is not in the top 10.

Foreign Direct Investment, in billions of U.S. Dollars, by country. Credit: U.S. Department of Commerce

It seems that it is not necessarily the amount of FDI the U.S. is seeing from China that is raising concern, but the uncertainty that surrounds it.