One of the most important, and perhaps least appreciated, components of the 2009 stimulus package was a series of measures that increased federal aid to state and local governments.

This was done primarily through an increase in funding for Medicaid and a State Fiscal Stabilization Fund, to be used mostly for education. The impact was designed to stay largely invisible: The idea was to prevent states and localities from having to slash services and increase taxes in response to declining revenues.

The concept gained quite a bit of traction. One economist, James Galbraith of the University of Texas, even proposed bringing back a version of Richard Nixon’s general revenue sharing, which had redistributed federal income tax revenue to the states before Ronald Reagan ended the program. (Back in 2002, Galbraith suggested a version of revenue sharing with a “pass-through” that would target aid directly to city governments.)

Fast forward three-plus years, and the conversation has nearly reversed. The Budget Control Act — the (dis)incentive that Congress and the president came up with to hold their feet to the deficit-reducing fire — will mean substantial reductions in federal funding for services provided by state and local governments. Under the BCA, the outlook for cities, which even more than states are still trying to get their fiscal houses in order, is particularly grim.

The BCA requires sequestration, or automatic spending cuts, for military and nonmilitary spending unless Congress wards it off with deficit reduction measures of its own design.

In a letter released earlier this month, the U.S. Conference of Mayors warns that one-third of the non-defense discretionary spending cuts are for state and local programs, including significant reductions to education, housing and community development, health, environment and public safety. Non-exempt HUD programs, for example, are all scheduled for cuts of 8.2 percent.

This is particularly bad for at least three reasons. First, public sector job losses are already keeping unemployment high; even as the private sector has added jobs, between 2010 and 2011 nearly 300,000 state and local jobs were lost. Second, rather than contributing to growth, layoffs and other cuts at the state and local government level are dragging the economy down. Over the summer, researchers at the New York Federal Reserve pointed out that:

The strain on state and local government budgets has impacted the national economy more severely in this recovery than in previous years, with the sector subtracting 0.4 percent from real GDP growth in the first quarter of 2011.

Third, the fiscal stability of cities across the country remains perilous. A recent National League of Cities report finds that while finances are improving, cities are still struggling with declining revenues and increasing costs. Further cuts in aid could provoke another round of severe budget tightening.

In the short run, the cuts required by the Budget Control Act could choke off economic recovery by weakening the health of state and local governments even further. Worse, this weakening would be felt primarily by poorer households either through reduced services or through higher taxes and fees that tend to eat up more of their income than that of their wealthier counterparts.

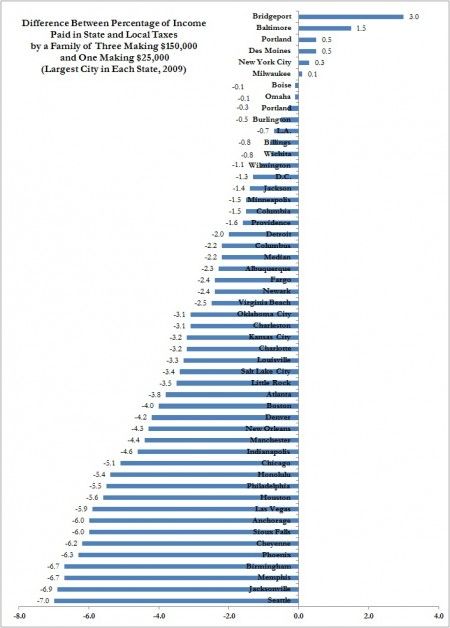

Indeed, one potential consequence of sequestration — or of any budget deal that reduces the federal government’s commitment to state and local governments — is increased taxes at the state and local level. The problem is that in most large cities, the burden of state and local taxes is severely regressive. As the chart to the lower right shows, in 2009 residents in only six cities paid taxes that were progressive (that is, the percentage of income that a household pays in taxes rises as income rises), while in some cities the least wealthy households paid as much as 7 percent more of their income in state and local taxes than their wealthier counterparts.

In other words, pushing the burden of funding service provision onto state and local governments means that poorer households will tend to finance more of these services proportional to their income. To be sure, state and local governments would cut services if sequestration occurs. But to the extent that they try to make up for lost federal funding with tax increases, poorer households will pay more as a proportion of their income.

Finally, sequestration’s cuts to military spending would also have substantial consequences for cities across the country.

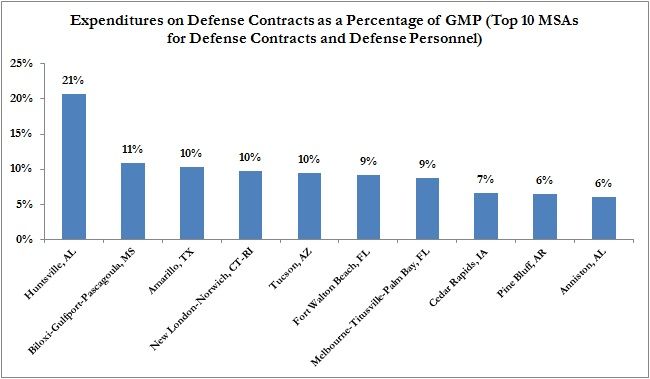

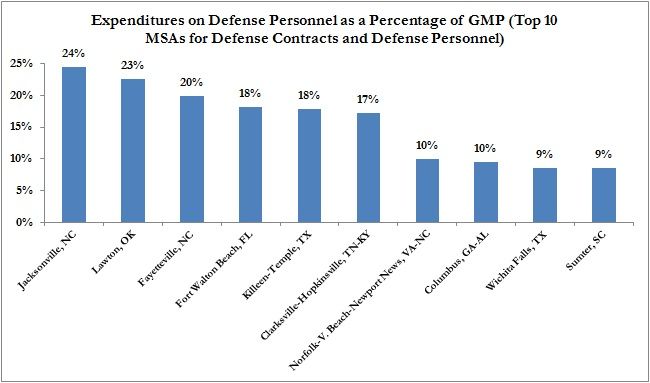

Growth in defense spending was one (but, yes, just one) of the driving factors behind the growth of cities in the South, West and Southwest. In fact, defense spending favored metropolitan over non-metropolitan areas in the South in the 1980s and 1990s. And research suggests that large-scale cuts to defense spending could result in lower income and higher inequality, poverty and unemployment in urban areas, particularly in the Southeast. The two tables below show that defense spending is particularly important for several, albeit smaller, cities for which military spending represents a significant share of gross metropolitan product.

Source: Adapted from Gauchat 2011

Nearly everyone agrees on the stupidity of the sequestration required by the Budget Control Act. But stupid does happen in Washington, and state and local governments are at risk.

_600_350_80_s_c1.jpg)