The Brookings Institution released its quarterly analysis of U.S. metropolitan economies today, and it looks like those in Texas, at least since the official end of the recession, are doing pretty well.

Florida, however, still needs some help.

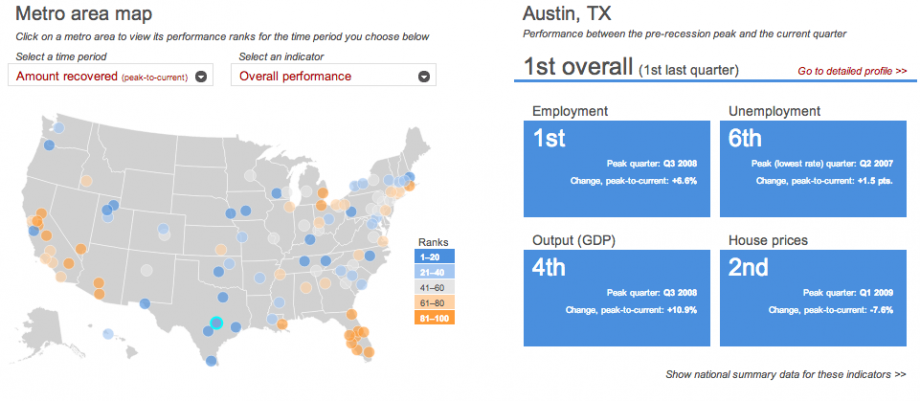

Measuring performance in job growth, employment rates, GDP output and housing prices, Brookings ranks the 100 largest metropolitan areas in the country on its “Metro Monitor,” the most prior edition having come out last December. In the third and fourth financial quarters of 2012, according to Brookings, 78 of these metros posted job gains.

Compared to its peak before the recession, Austin, Texas was the metro that saw the largest share of job growth, at 6.6 percent. The other five largest metro areas in the Lone Star State — Houston, Dallas-Fort Worth, San Antonio, El Paso and McAllen — were also among the top 10 that have added the most jobs.

Brookings credited the good numbers from Texas to a natural gas boom, and there’s no denying what the tech sector has done to keep places like Austin economically robust.

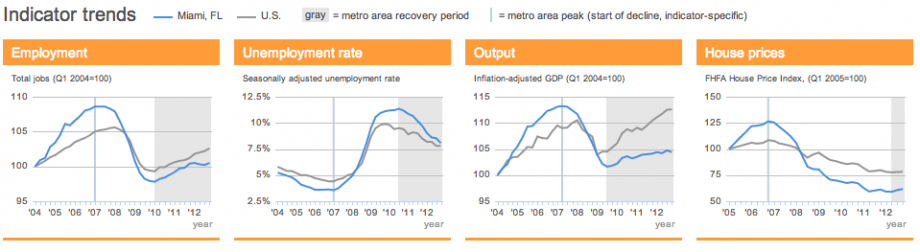

Over in Florida, however, the picture is less promising. Though their unemployment rates are down, metros like Miami, Tampa and Jacksonville have seen job growth that lags behind much of the rest of the country. Additionally, housing prices and GDPs have remained low.

How Miami has fared in the last decade. Credit: Brookings Institution

Central California — where cities such as Stockton and San Bernardino have filed for bankruptcy in the last year — is also home to a number of metros that have been slow getting on their feet. It’s no surprise that Bay Area cities are doing fine, but further inland metro areas like Modesto are dealing with low housing prices and largely stagnant employment rates. (Though Stockton saw a pretty sharp uptick in job numbers last year, another shot in the arm from the natural gas industry.)

While only a few metro areas have returned to employment rates that match or surpass their pre-recession peak (among the lucky few are Austin, Washington, D.C., Charleston, S.C. and San Jose, Calif.), many have been slowly moving in that direction since 2010. Texas metros may be moving faster than those in Florida or California, but most are following the same general upward trajectory.

You might notice that Northeast and West Coast metros are conspicuously absent from the top of these lists. But that’s because the recession didn’t hit as hard here as it did in other regions, so there’s less distance from which to bounce back.

To get stats on other metro areas, check out this interactive map.