New data from the Census Bureau’s American Community Survey digs into homeownership rates and median home values across the U.S. during and after the recession. As it turns out, they both continue to decline. Those rumors of a slow crawl to recovery? Not reflected by would-be homeowners or median home value.

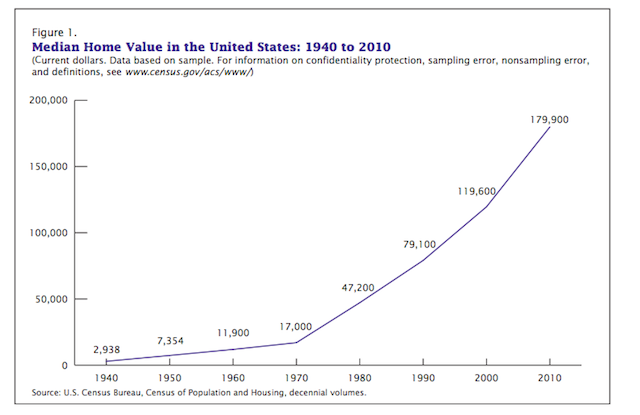

Let’s start with the latter. As shown in the graph below, the median home value in America has seen consistent growth since the 1940s, with a very healthy pace between 1970 and 2010:

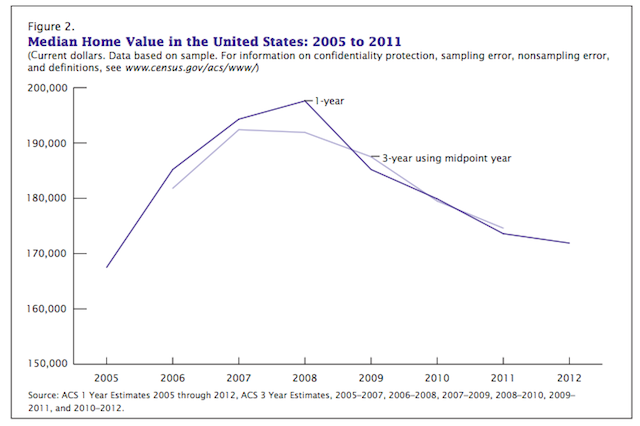

The peak monetary value of American homes came in 2008, according to the report. Then it started dropping. Between 2010 and 2012 it fell by $17,300, to $174,600, which implies that the recession didn’t just have an effect in the few years after the market crashed. It put a burden on homeowners last year, too, four years after the economic downturn began.

The highest home values in the country during that same period? Hawaii at $503,100 and the District of Columbia at $436,000. West Virginia ($98,300) and Mississippi (an even $100,000) were at the bottom of the barrel.

As for metro areas, no surprise here: The San Jose-Sunnyvale-Santa Clara region in California clocked in with the highest median home value at $624,800. San Francisco-Oakland-Fremont was on its heels, at $568,900. So, yeah, Valleywag is right: All the money’s in Silicon Valley. The Detroit area had the lowest median value, at $119,900.

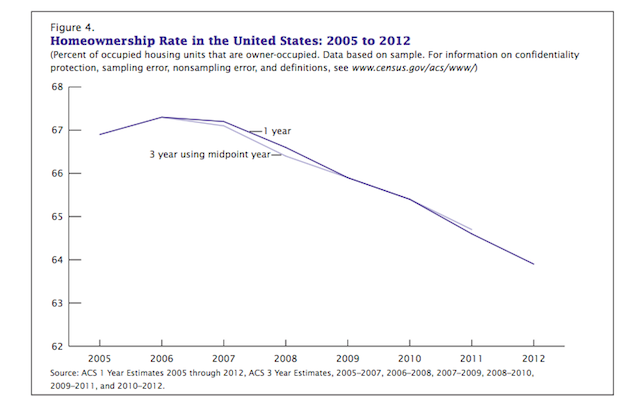

When the median home value shrank, so did the homeownership rate, defined here as “the percent of occupied housing units that are owned with a mortgage and those owned free and clear.”

Those old fuzzy home videos of Americans unpacking moving vans portrayed a very real thing: There was strong growth in the homeownership rate after World War II through 1960, when it started to slow. (Though it remained on the upward trend.) But after homeownership hit its high-water mark in 2006 at 66.41 percent, there was a precipitous decline through the end of last year. The lowest homeownership rate between 2010 and 2012 was in New York City, at 31.7 percent, with Miami and Boston not far behind. Renters, of course, reign supreme in cities.

The knee-jerk reaction here is to find some Big Lesson About America. (This is where an out-of-touch newspaper columnist complains that Millennials Aren’t Buying Homes Anymore. Which might be true! But still.) A clear-eyed observer says that the economy isn’t so hot — in both metro regions and small towns — and that is reflected in both the value of homes (not as much as it used to be) and the number of homeowners (not as many).

The Equity Factor is made possible with the support of the Surdna Foundation.

Bill Bradley is a writer and reporter living in Brooklyn. His work has appeared in Deadspin, GQ, and Vanity Fair, among others.