As I mentioned earlier this week in “Which Cities Should Be Most Worried About Pension Funds?,” pensions now exceed outstanding debt as the largest type of state and local government liability. Cities are facing the repercussions of kicking the can down the road by not sticking to payment schedules and maneuvering the actuarial science behind forecasting liabilities. Yet most politicians are reluctant to tackle this crisis. (In fact, Next City’s recent Forefront “This Woman Has a Solution to America’s Pension Problem,” profiles Rhode Island gubernatorial candidate Gina Raimondo, in large part, because when she was the state’s general treasurer, “she opted to take the lead on an incipient problem that many of her predecessors had happily ignored: a desperately underfunded pension system.”)

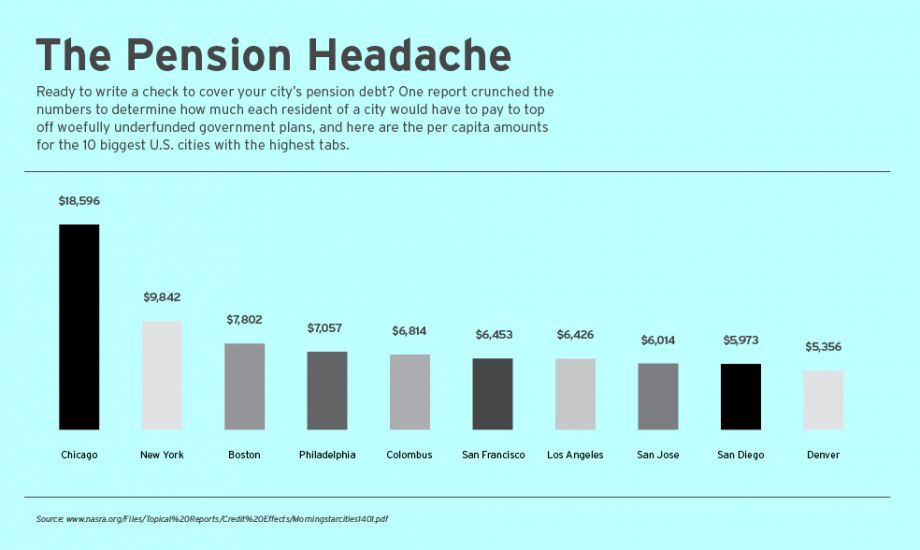

To further drill down into just how much money we’re talking about, I looked at a report from Morningstar Municipal Credit Research that calculates the burden of underfunded pensions in America’s 25 most populous cities. The study’s “median aggregate unfunded actuarial accrued liability (or UAAL) per capita” formula shows the amount residents would have to fork over to make their public pension funds sound. The number folds in municipal pension debts as well as those for state, county and other overlapping jurisdictions (such as school districts). Why is it crucial to take all of those into account? Well, Washington, D.C. is the only city among the 25 to be overfunded — because it benefits from not having overlapping jurisdictions. Charlotte and Memphis have the highest funding ratio because they are supported by strong state pension systems. Here’s a snapshot of what the pension crisis means for residents for 10 cities.

The Equity Factor is made possible with the support of the Surdna Foundation.

Alexis Stephens was Next City’s 2014-2015 equitable cities fellow. She’s written about housing, pop culture, global music subcultures, and more for publications like Shelterforce, Rolling Stone, SPIN, and MTV Iggy. She has a B.A. in urban studies from Barnard College and an M.S. in historic preservation from the University of Pennsylvania.