In Forefront this week, Tanveer Ali looks at the growing popularity of the idea that urban entrepreneurship can help drive economic recovery in floundering U.S. cities.

While it’s not exactly news that successful businesses can attract other businesses to an area (and thereby foster economic development), never before have so many resources been available to small-business owners. This is due mainly to the foundations, venture capitalists and various government bodies that have realized the payoff in investing in local startups.

One lifeline for inner-city entrepreneurs comes in the form of community development financial institutions, or CDFIs, which act as credit lenders in low-income areas around the country. Funding for the 800-plus CDFIs in the U.S. comes from Department of the Treasury, which today announced that it will award over $186 million to 210 CDFIs nationwide in the 2012 fiscal year.

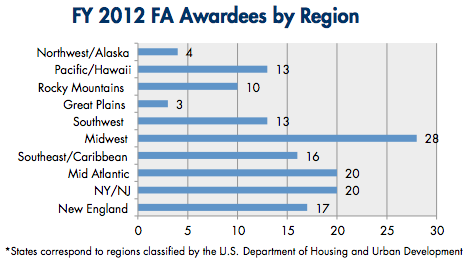

A breakdown of where CDFI awardees are located. Credit: Department of the Treasury

Most of the money will go toward affordable housing programs, however a good $43 million will be reserved for aiding small businesses. The awardees are located in communities stretching from Alaska to Florida, though most can be found in Native American reservations, the Mississippi Delta, the Gulf Coast, Appalachia and rural settlements along the Mexican border called “colonias.” And while a significant portion of the award money will serve rural communities, over two-thirds of the funding has been allocated for “major” and “minor” urban areas (we’ll assume most metropolitan areas fall within one of these two categories).

“This year’s awardees will continue to provide vital financial services in low-income areas that are typically overlooked by traditional lenders, bettering the lives of Americans nationwide,” said Donna J. Gambrell, director of the Treasury’s Community Development Financial Institutions Fund (CDFI Fund), to a group of community lenders gathered at a Milwaukee restaurant. The restaurant, called Antigua, a recipient of the 2012 CDFI program, has created 19 new jobs, according to the Treasury’s press release.

The Treasury’s CDFI Fund technically expired at the end of 2011, however it continues to operate and has already allocated $3.6 billion in tax credits for 2012. CDFIs enjoy the support of President Obama, whose fiscal year 2013 budget proposal includes $221 million to continue funding them.